Automated Weekly Forex Market Outlook 14th April 2025

Welcome to this week’s detailed market outlook from ConnectMyCurrency.com, your trusted source for in-depth analysis combining fundamental events, technical insights, and advanced automated trading strategies.

Fundamental Market Events

1. Global Tariff War and Economic Turbulence

The escalating trade tensions between the United States and China, characterized by a 125% U.S. tariff on Chinese imports and China’s 84% retaliatory tariffs, continue to dominate the market sentiment. Analysts express growing concerns about an impending global recession due to disrupted supply chains and soaring inflationary pressures. Gold and other safe-haven assets have surged to record highs, highlighting investors’ flight to safety.

2. Central Bank Monetary Policies

This week, traders will closely monitor central bank decisions, particularly from the European Central Bank (ECB) on April 17. Expectations suggest a hold on interest rates amidst uncertainties triggered by trade wars and rising inflation. Meanwhile, the Bank of England postponed its long-dated gilt auction, reflecting significant volatility and uncertainty in UK markets.

3. Significant Economic Indicators

UK CPI (April 16): A critical gauge of inflation that could impact future Bank of England policy decisions.

US Retail Sales and Housing Data: Indicators expected to reflect consumer confidence and the health of the U.S. economy amidst economic uncertainties.

Technical Market Analysis

EUR/USD Outlook

EUR/USD continues to test multi-month highs around the 1.1500 area. However, with the RSI indicator firmly in overbought territory, traders should anticipate a corrective pullback towards key support around 1.1350.

GBP/USD Outlook

GBP/USD is currently struggling below the 21-day Exponential Moving Average, suggesting further bearish pressure toward critical support at 1.2700. Traders should watch price action closely around these support levels.

USD/JPY Outlook

The USD/JPY pair shows signs of bullish accumulation, with the Chaikin Money Flow indicating potential upward momentum. Traders should consider long positions if the pair clearly breaks the psychological 110.00 resistance level.

Introducing the AF Supply and Demand Robot

At ConnectMyCurrency.com, we understand that traders value efficiency, precision, and consistent profitability, especially in volatile market conditions. That’s why we developed the AF Supply and Demand Robot, a sophisticated automated trading system specifically designed to capitalize on supply and demand zones across multiple currency pairs.

Why Use the AF Supply and Demand Robot?

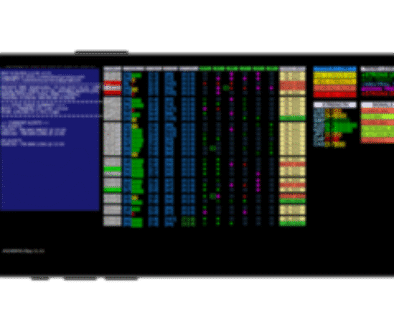

Advanced Zone Detection: Automatically identifies institutional-level supply and demand zones on all major timeframes, including M15, H1, H4, and Daily.

Risk Management: Employs robust, adaptive risk management techniques to ensure minimal drawdowns and maximum profitability, particularly effective during volatile market events.

Automation and Efficiency: Eliminates emotional trading by consistently executing trades based purely on market structure, significantly enhancing trade accuracy and execution speed.

How the AF Supply and Demand Robot Navigates Current Market Conditions

Given the ongoing tariff turmoil and market volatility, the AF Supply and Demand Robot is specifically optimized to:

Capitalize on swift market reversals resulting from geopolitical news and economic data releases.

Utilize volatility filters to enhance its decision-making, avoiding risky trades during excessive volatility spikes.

Adapt dynamically to changing market conditions, seamlessly shifting between conservative and aggressive strategies based on real-time market sentiment.

Key Trading Opportunities this Week with AF Supply and Demand Robot

Comprehensive Weekly Event Calendar

April 14: Market reacts to delayed UK gilt auction.

April 16: UK CPI data.

April 17: ECB interest rate decision.

April 18-20: US retail sales and housing data releases.

Final Trading Insights

This week’s market conditions emphasize the importance of a disciplined trading approach combined with advanced automated tools. Leveraging the AF Supply and Demand Robot allows traders to effectively navigate uncertain environments, reduce emotional interference, and enhance overall profitability.

Stay informed, disciplined, and profitable with ConnectMyCurrency.com.