Your cart is currently empty!

Tag: Stock trading robot

Hermès heir awarding 51-year-old gardener Billion Dollar fortune

This story keeps getting crazier. Last year the heir to Hermès shocked the world by deciding to adopt his gardener to gift them his $11BN fortune. But last week he claimed the money… vanished. Why did he leave it to his gardener? Where did the money go? Here’s what I found:

Puech is a fifth-generation descendant of Thierry Hermès, who founded the luxury fashion house in 1837. It all started as a small, Paris workshop that made horse harnesses. But today, the company is valued at $220 BILLION.

Over time, Hermès evolved and diversified into fashion. Iconic products like the Hermès scarf established the family name as a luxury status symbol.

Fast forward 187 years and 5 generations, Puech plans to pass his estate of $11B to his gardener. All anyone knows about the mystery gardener is that they come from a modest Moroccan family. And this isn’t the first time Puech has made large gifts to them.

He’s already gifted properties in Marrakesh, Morocco, and Montreux, Switzerland – worth a combined $5.9 million. But not everyone is a fan of his generosity…

Initially, Puech planned to donate his entire $11B fortune to the Isocrates Foundation: A small charity for journalism. But then he changed his mind. As you can imagine, he annoyed a number of people with that decision. Including his family…

In 2011 Hermes faced a hostile takeover attempt by LVMH. The family created a private holding to stop this attempt – but one family member didn’t join the holding: Puech. Now he plans to gift his wealth to his gardener, he’s defying the tradition of keeping wealth.

To facilitate the transfer of his wealth, Puech was planning to adopt his 51-year-old gardener to pass on his $13 billion estate. But just last week, the money seems to have vanished. Where did it go?

Puech claims he has no idea. He’s accused his wealth manager, Eric Freymond of “gigantic fraud” in the disappearance of the $13 BILLION in Hermès shares that he was planning to leave his gardener. But the courts didn’t agree with him.

They found that Puech willingly gave Freymond access to his bank accounts, and let him manage his money. And although it’s not certain where the money went, there’s one thing for sure. It’s not likely to go to his gardener anymore.

But I can’t help but think “What if it did go to the gardener?” Put yourself in their shoes. Your life is changed forever – now what..? Puech thought he was doing them a favor, but would he really be helping him? Will the money destroy the gardener’s life and his family?

This story in particular reminds me of a quote: “Wealth is as potent as any sword. When mastered it can bring the world to its knees. When not, it can bring the owner to his knees.”

With wealth, there are repercussions of inheriting that level of power overnight. And it makes you think twice about: how much is a “gift” – and at what level does gifting power actually become a curse?

Building Your Own “Legacy”

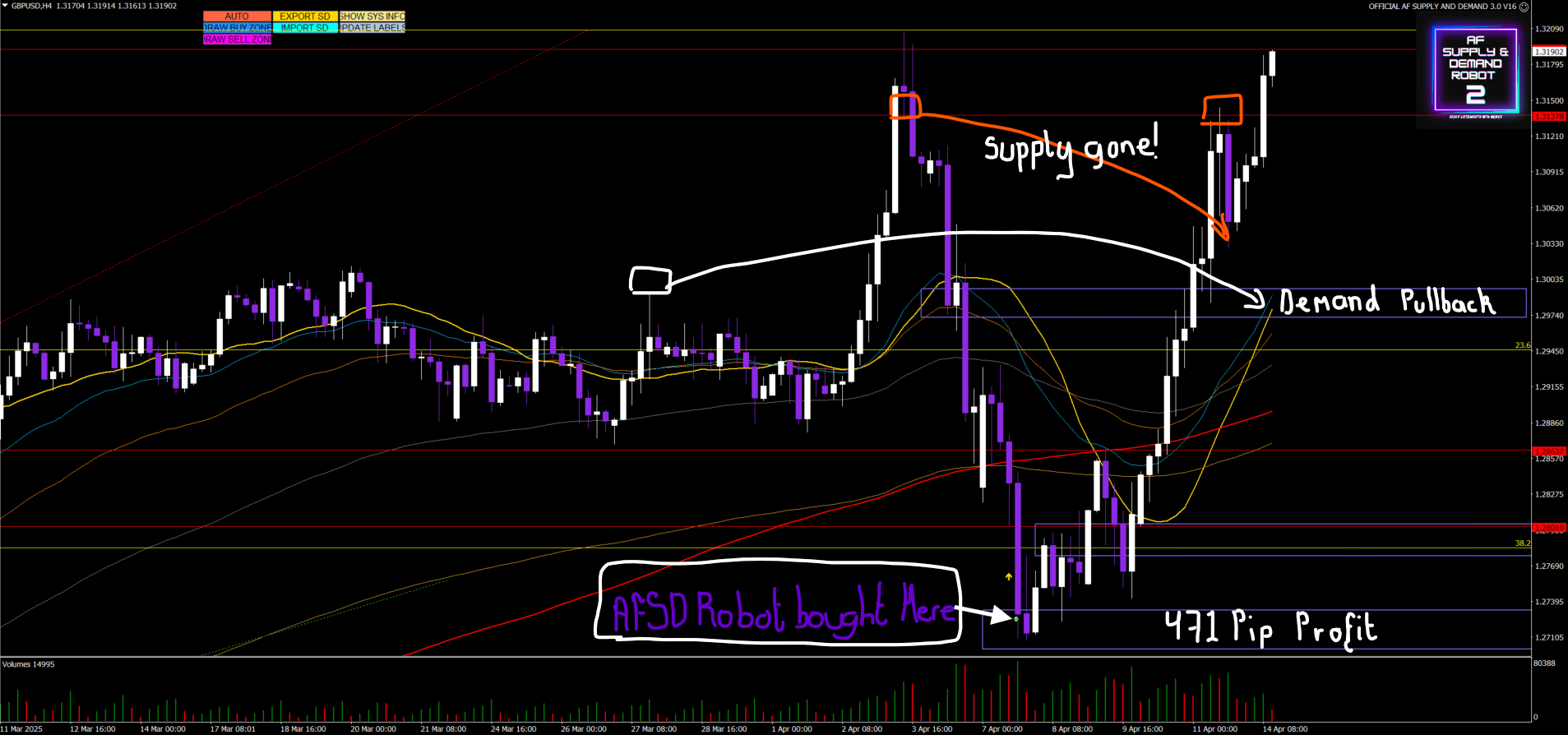

Being inspired by stories and taking consistent action are two different things. Here at Connect My Currency we inspire our traders through consistent actionable growth strategies using automated and hybrid trading solutions.

Find out more about what we do Click Here

And also feel feee to share this post if you found it helpful.

See you soon

Ewan @CMC

From Death To £400 Million: The Bookstore Rebirth

In recent years, the U.K. bookstore industry has experienced a remarkable resurgence. After a challenging period marked by the rise of e-books and competition from online giants, physical bookstores have bounced back, with many now reporting significant revenue growth. This revival has not only invigorated the industry but also rekindled the joy of browsing books in-store—a pleasure that many readers had sorely missed.

A Comeback Story

The decline of physical bookstores was a well-documented narrative throughout the 2010s. The rapid adoption of e-books and the dominance of online retailers led many to predict the demise of brick-and-mortar bookstores. However, recent trends have proven these predictions wrong. Bookstores in the U.K. are not just surviving—they are thriving.

One of the key factors driving this resurgence is a renewed interest in physical books. Despite the convenience of digital formats, many readers have returned to printed books, appreciating their tactile nature and the joy of owning a physical collection. This shift has been reflected in sales figures, with physical book sales outpacing e-book sales in recent years. According to a report by the Publishers Association, physical book sales in the U.K. increased by 5% in 2023, reaching a value of £3.7 billion.

Independent Bookstores: The Heart of the Revival

Independent bookstores, once seen as an endangered species, have played a central role in the industry’s revival. Far from being overshadowed by larger chains and online retailers, independent bookstores have carved out a niche by offering personalized services, curated selections, and a community-oriented experience.

The numbers tell a compelling story. The Booksellers Association reported that the number of independent bookstores in the U.K. has grown for the sixth consecutive year, reaching 1,072 stores in 2023. This growth is not just in quantity but in financial performance as well. Many of these stores are reporting millions in annual revenue, driven by loyal customer bases and a resurgence of local shopping trends.

Waterstones: A Success Story

Waterstones, the U.K.’s largest bookstore chain, exemplifies the industry’s broader success. After years of restructuring and adapting to market changes, Waterstones has emerged stronger than ever. The chain reported a revenue of £400 million in 2023, with significant contributions from both in-store sales and a robust online presence.

Waterstones’ success has been attributed to several factors. The chain has focused on creating a welcoming and comfortable environment in its stores, encouraging customers to linger and explore. Additionally, Waterstones has emphasized local autonomy, allowing individual store managers to curate their selections based on local tastes and preferences. This strategy has resonated with customers, driving both foot traffic and sales.

Adapting to a New Landscape

The COVID-19 pandemic posed significant challenges to the retail sector, and bookstores were no exception. However, many bookstores adapted quickly, enhancing their online presence and offering delivery services. These adaptations not only sustained them during lockdowns but also positioned them well for the post-pandemic market.

As restrictions eased, there was a noticeable increase in foot traffic, with customers eager to return to the in-store experience. This was particularly evident during key retail periods such as the 2023 holiday season, where sales exceeded expectations. The industry’s ability to adapt and innovate during challenging times has been a critical factor in its ongoing success.

Challenges and the Road Ahead

Despite the positive trends, challenges remain. Competition from online giants like Amazon continues to be a significant hurdle for bookstores, particularly in terms of pricing and convenience. However, many bookstores have differentiated themselves by offering unique experiences that online retailers cannot replicate.

Looking ahead, the outlook for U.K. bookstores is optimistic. The combination of a strong cultural shift towards supporting local businesses, the enduring appeal of physical books, and the innovative approaches taken by both independent stores and large chains suggests that the industry is on track to continue making millions in revenue.

The Bottom Line

The resurgence of U.K. bookstores is a testament to the resilience of the industry and the enduring appeal of physical books. From independent bookstores to large chains like Waterstones, the sector is once again thriving, with many stores reporting millions in revenue. This comeback is not just a financial success but a cultural one, reflecting the deep connection between readers and the physical act of browsing and buying books.

As the industry continues to evolve and adapt, U.K. bookstores are well-positioned to remain a vital part of the retail landscape, bringing the joy of reading to millions and proving that the bookshop is far from a thing of the past.

Figures at a Glance:

- Physical Book Sales: £3.7 billion in 2023, a 5% increase from the previous year.

- Independent Bookstores: 1,072 stores in 2023, marking six consecutive years of growth.

- Waterstones Revenue: £400 million in 2023, reflecting strong in-store and online sales.

These figures highlight the robust health of the U.K. bookstore industry and underscore the broader trend of readers returning to physical books and in-store shopping experiences.

Forrest Mars: The $96 Billion Dollar Candy King

When you think of candy, it’s hard not to think of M&M’s, Snickers, or the Mars Bar. These aren’t just sweets—they’re global icons. And behind these beloved treats is a man whose name might not be as famous as his creations but whose impact on the world of confectionery is monumental: Forrest Mars Sr.

From revolutionizing candy production to building a multi-billion-dollar empire, Forrest Mars’s journey is as rich and layered as the chocolate he became famous for. Let’s delve into the life of the man who turned candy-making into a science and a business empire, and whose influence is still felt around the world today.

Early Life: A Rocky Road to Success

Forrest Edward Mars was born on March 21, 1904, in Wadena, Minnesota, to Frank Mars and Ethel Mars. His father, Frank, had founded what would become the Mars Company, starting with small-scale candy production. But life wasn’t sweet for young Forrest. His parents divorced when he was young, and his relationship with his father was often tense, marked by differing views on how to run the business.

Despite the turmoil at home, Forrest was academically gifted. He attended the prestigious Yale University, where he studied industrial engineering. This technical background would later prove invaluable as he expanded his business operations. But after graduation, his ideas clashed with his father’s more traditional approach, leading Forrest to leave the family business and seek his fortune elsewhere.

A New Frontier: Building a Candy Empire in Europe

In the 1930s, Forrest Mars took a bold step by moving to the United Kingdom, where he founded Food Manufacturers Ltd. His first major success came with the creation of the Mars Bar in 1932. Unlike the American Milky Way bar—created by his father—the Mars Bar was specifically tailored to European tastes, with a denser nougat and a sweeter chocolate coating. It became an instant hit, cementing Forrest’s reputation as an innovator.

But Forrest’s true stroke of genius came during the Spanish Civil War in the late 1930s. While observing soldiers eating small chocolate pellets coated in a hard shell (which prevented them from melting in the heat), he saw an opportunity. Partnering with Bruce Murrie, the son of a Hershey executive, he developed M&M’s. Launched in 1941, M&M’s were an immediate success, especially among U.S. soldiers during World War II, who loved their durability and portability.

M&M’s would go on to become a global phenomenon, with annual sales today exceeding $1 billion. The brand’s slogan, “Melts in your mouth, not in your hand,” became as iconic as the candy itself.

Expanding the Empire: From Candy to Global Conglomerate

Forrest Mars was not a man to rest on his laurels. After reconciling with his father and taking over the Mars Company in the 1960s, he transformed the family business into a global conglomerate. His business strategy was aggressive: he expanded the product line to include what are now some of the world’s best-known brands.

In 1967, Mars introduced Twix, a caramel and biscuit bar that quickly became a favorite in both Europe and the United States. In 1974, Mars took Skittles from a small UK product to an international sensation. And then there’s Snickers, which today generates over $2 billion in annual sales, making it the world’s best-selling candy bar.

Forrest also diversified Mars, Inc. beyond candy. Recognizing the growing demand for pet food, he acquired companies like Pedigree and Whiskas, making Mars a dominant player in that industry as well. Today, Mars, Inc. owns more than 50 brands and generates annual revenues exceeding $45 billion, making it one of the largest privately-held companies in the world.

The Man Behind the Candy: A Perfectionist and Innovator

Forrest Mars was known as a demanding leader with an almost obsessive focus on quality. He famously coined the “Five Principles of Mars”—Quality, Responsibility, Mutuality, Efficiency, and Freedom—which still guide the company today. He believed in controlling every aspect of production to ensure the highest quality, from sourcing raw materials to the final product on the shelf.

This perfectionism extended to his employees as well. Forrest was known for his strict management style, expecting nothing short of excellence from everyone who worked for him. While this made him a polarizing figure—some admired his relentless drive, while others found him difficult to work with—it was undeniably effective.

A Lasting Legacy: The Billion-Dollar Candy King

Forrest Mars passed away on July 1, 1999, at the age of 95, leaving behind a candy empire that remains a giant in the industry. Mars, Inc. continues to be a family-owned business, with his descendants still involved in its operations. Under Forrest’s leadership, the company grew from a small, regional candy maker into a global powerhouse, with products enjoyed by billions of people around the world.

Today, the Mars family is one of the richest in the world, with a net worth estimated at over $100 billion. But beyond the staggering financial success, Forrest Mars’s true legacy lies in the brands he built—brands that have become woven into the fabric of everyday life.

Whether you’re enjoying a Snickers bar, sharing a bag of M&M’s, or treating your pet to a Pedigree snack, you’re experiencing the lasting influence of a man who turned candy into a global business empire. Forrest Mars didn’t just make candy—he made history, one sweet innovation at a time.

Building Your Own “Legacy”

Being inspired by stories and taking consistent action are two different things. Here at Connect My Currency we inspire our traders through consistent actionable growth strategies using automated and hybrid trading solutions.

Find out more about what we do Click Here

And also feel feee to share this post if you found it helpful.

See you soon

Ewan @CMC