Your basket is currently empty!

Water is one of the world’s most critical resources and yet it remains one of the most overlooked asset classes. While tech and AI dominate headlines, a quieter revolution is underway in water infrastructure, utilities, and water-management companies. Billionaires and institutional investors are increasing their exposure to this sector because they see steady growth, regulatory tailwinds, and essential demand that never goes away.

Below are some of the top water stocks and ETFs that reflect this trend. I’ll explain why each is worth attention, and you can drop your charts under each stock to spot buy points.

Top Water Stocks Gaining Interest

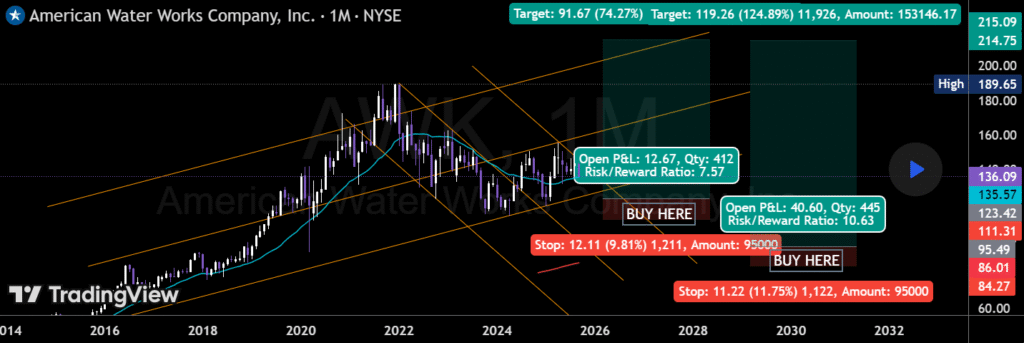

American Water Works (AWK)

American Water Works is a utility focused purely on water and wastewater services across many U.S. regions. It holds appeal because its revenue comes from essential services. When demand for clean water remains constant, AWK delivers cash flow that is both resilient and predictable.

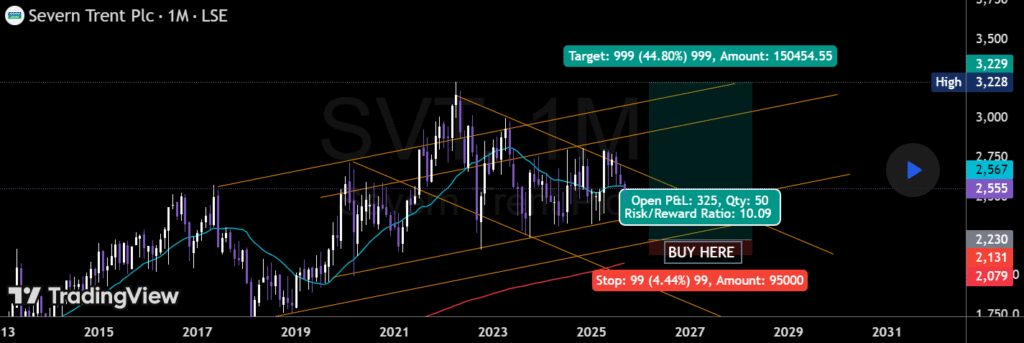

Severn Trent PLC

Severn Trent provides drinking water and wastewater services in the UK. For investors who value regulated revenues, Severn Trent stands out. Its government oversight ensures rates adjustments yield returns, and its infrastructure needs are driving maintenance and upgrade spending now.

United Utilities

This utility company also operates in the UK and serves a large population with water and waste services. Rising concerns over environmental compliance, aging pipes, and water quality make United Utilities an attractive pick. It offers both dividend stability and long-term growth prospects.

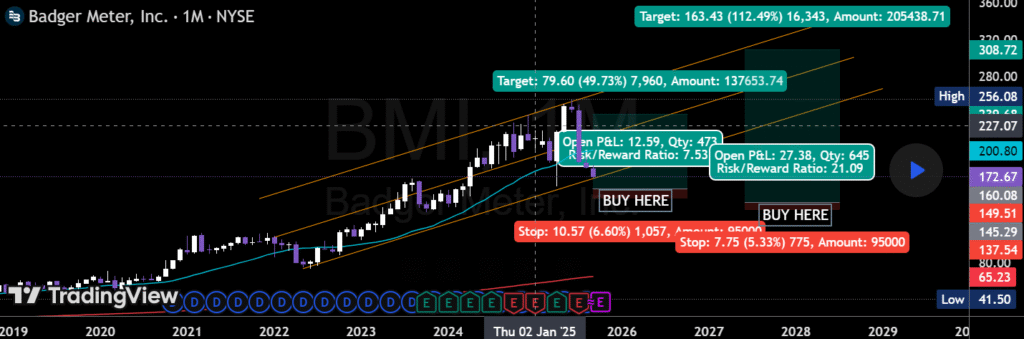

Badger Meter (BMI)

Badger Meter supplies meters, flow monitoring tools, and instrumentation. As governments push for smarter usage tracking, leak prevention, and efficiency, companies like BMI gain demand. Their products play a hidden but crucial part in conserving water.

Mueller Water Products (MWP)

Mueller makes hydrants, valves, fire hydrants, and related components. These are essential parts of water infrastructure. With many regions facing infrastructure gaps, the kind of hardware Mueller provides is being budgeted into public spending.

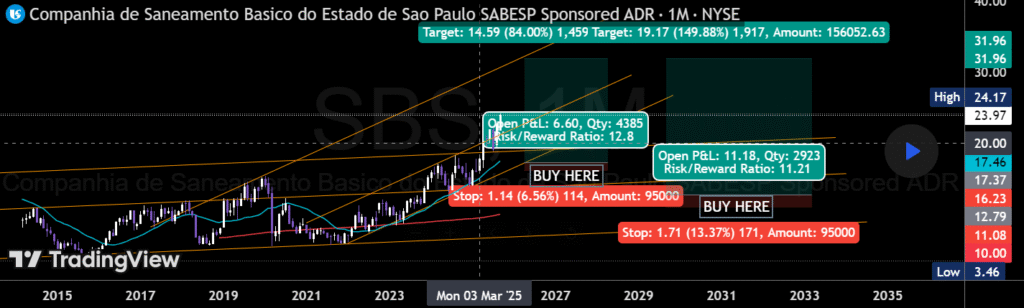

SABESP (Companhia de Saneamento Básico do Estado de São Paulo) (SBS)

SABESP is a major water and sewage services provider in Brazil. Emerging markets have urgent need for clean water and sanitation, and growing urban populations make companies like SABESP essential. Economies with rising middle class demand long-term infrastructure investment.

ETFs That Spread the Risk

If picking single stocks feels risky or you want broader exposure, these ETFs combine multiple players in water infrastructure, tech, and utilities:

- Invesco Water Resources ETF

The Invesco Water Resources ETF (PHO) invests in a selection of US companies focused on water conservation and purification. It holds about 38 stocks and charges a 0.59% expense ratio, with leading positions in Ferguson, Xylem, and Ecolab. Annual returns have averaged about 9% since its launch in 2005.

- First Trust Water ETF

The First Trust Water ETF (FIW) is designed to reflect the performance of US-listed water industry companies, including utilities and equipment suppliers. It typically owns 37 to 40 holdings, charges a 0.51% expense ratio, manages around $2 billion in assets, and includes names like Ferguson, IDEXX Laboratories, and Xylem.

- Invesco S&P Global Water Index ETF

The Invesco S&P Global Water Index ETF (CGW) targets a global basket of water sector leaders, investing mainly in industrials and utilities. Its portfolio usually has 50 to 60 companies with a typical expense ratio of about 0.5 to 0.6 percent. Major holdings are Xylem, American Water Works, and SABESP, with the majority of assets in the US and sizable positions in the UK and Brazil.

Each of these allows you to gain exposure across different segments of the water industry utilities, hardware/parts, global names reducing single company risk while riding the broader rise.

What Billionaires Look For in Water Investments

Those putting serious money into water are watching for several key signals:

- Infrastructure spending at both federal and local levels

- Regulatory support for water quality, leak mitigation, and sustainability

- Companies with monopoly or regional utility status because they have pricing power

- Products and technologies that support smarter water use (meters, sensors, flow control)

- ESG mandates and climate pressure that push clean water access into focus

How You Can Position Yourself

- Select 2-3 stocks from above that match your risk tolerance (utilities for stability, hardware for growth).

- Use your charts to identify buy points look for support levels, pullbacks on weakness, or news-driven dips.

- Consider adding one of the water ETFs to diversify.

- Keep track of regulation, especially environmental laws, infrastructure bills, and government contracts that’s where the catalysts often come from.

- Reinvest dividends or income to compound over time water rarely grows fast overnight but it builds value steadily.

Wrapping Up

Water might be low-glamour compared to AI or crypto, but it’s becoming essential for any smart, resilient portfolio. When billionaires move into water stocks, you should pay attention. The flows might not be as flashy as a tech IPO, but the payoff can be far more stable and far more certain.

0 responses to “The Silent Surge: Why Billionaires Are Rushing Into Water Stocks”