Your basket is currently empty!

September 2025 has been a dramatic month for equity markets, with a select group of stocks attracting outsized attention thanks to their impressive rallies, transformative business shifts, and momentum in technology leadership. The following ten companies represent the most popular and widely traded assets on Wall Street, spanning sectors from artificial intelligence and data analytics to commodities, energy, health, and travel. Here’s what investors and traders need to know about each.

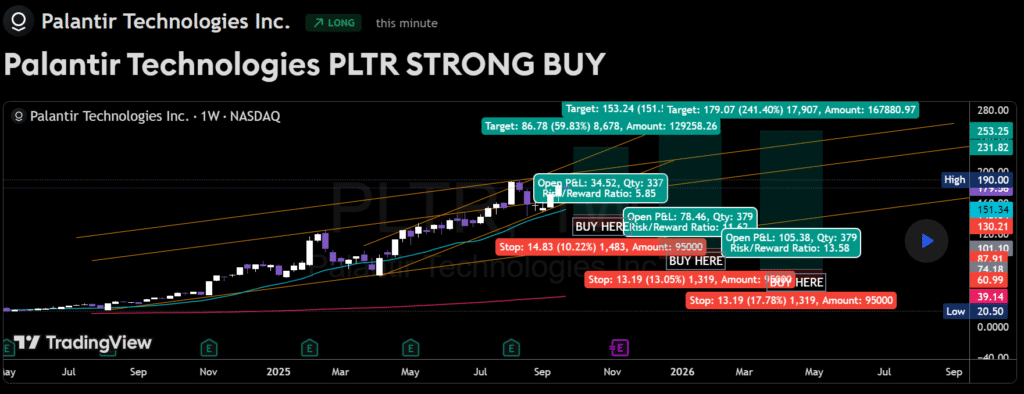

Palantir Technologies (PLTR) – Data Analytics & AI

Palantir stands at the forefront of artificial intelligence for both the U.S. government and commercial clients. Its platforms including Gotham, Foundry, Apollo, and the Artificial Intelligence Platform are rapidly reshaping enterprise deployment of AI and big data. PLTR has gained over 145% since April, riding institutional demand as well as retail enthusiasm for generative AI innovation tickeron+1

- Latest Results: Palantir posted 48% revenue growth year-over-year, outpacing the industry and surprising analysts with strong margins.marketbeat

- Key Drivers: Secured major government contracts, launched AIPCon 8, and expanded into commercial verticals.

- Risks: Valuation concerns remain high, with the forward P/E exceeding peers, and analysts divided between bullish long-term adoption and short-term overpricing.capital+1

- Technical Note: The stock recently broke above its 50-day moving average, and MACD has just turned positive momentum may favor a new upward leg.tickeron

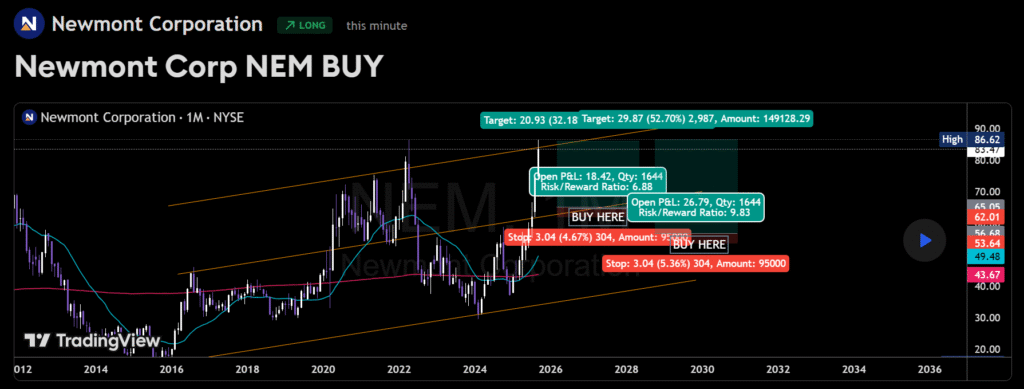

Newmont Corp. (NEM) – Gold & Mining Leadership

Newmont has rallied on surging gold prices and persistent market demand for safe haven assets. As the largest gold producer in the world, its scale and cost efficiency make it a favorite during macro uncertainty bankrate

- Latest Results: Strong quarterly gold output, improving cash flow, and industry-leading environmental practices.

- Key Drivers: Elevated gold spot prices, potential for asset divestitures to improve profitability.

- Risks: Exposed to cyclical commodity swings and regulatory challenges in global markets.

Seagate Technology (STX) – Data Storage Expansion

Seagate has soared due to overwhelming demand for high-capacity data storage, driven by cloud computing and AI-related infrastructure growth. The company’s strategic investments in next-gen drives have paid dividends.bankrate

- Latest Results: Record shipment volumes and sequential margin improvement.

- Key Drivers: Cloud and data center client expansion, innovation in high-density storage.

- Risks: Sector competition from Western Digital and cyclical pricing pressures.

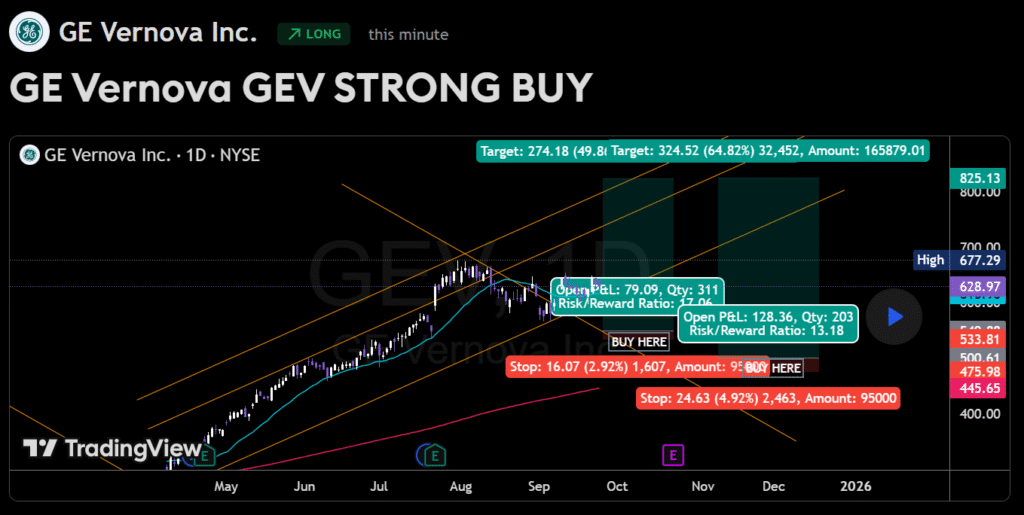

GE Vernova (GEV) – Renewable Industrial Giant

A spinoff from General Electric, GE Vernova focuses on renewables and low-carbon technology. Increased investor interest centers on its role in the global energy transition and ability to scale green infrastructure.bankrate

- Latest Results: Growth in wind and grid segments, international expansion contracts.

- Key Drivers: U.S. and European policy tailwinds, capital recycling via spinoff structure.

- Risks: Capital intensity and execution risk in new green segments.

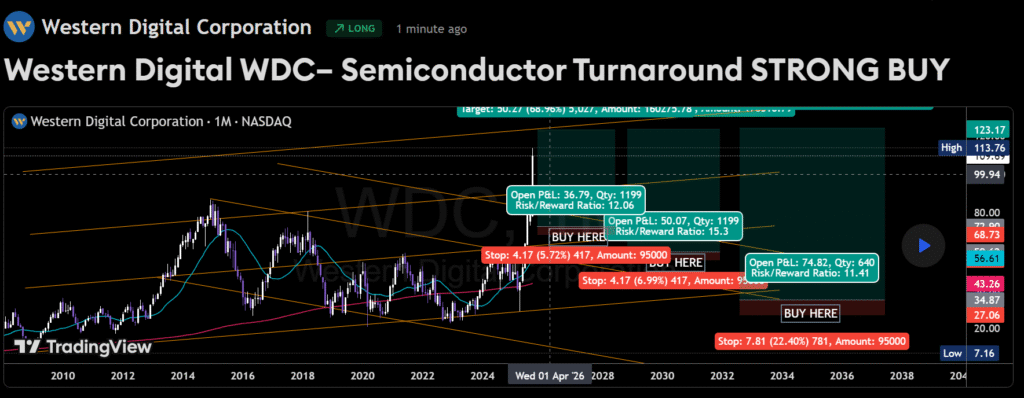

Western Digital (WDC) – Semiconductor Turnaround

Western Digital joins Seagate as a beneficiary of the AI and cloud revolution. Its turnaround story is driven by renewed demand for memory chips and improved operational discipline.bankrate

- Latest Results: Rebounded after quarters of losses, now reporting net profit.

- Key Drivers: AI server deployment and cross-licensing agreements.

- Risks: Price volatility in NAND/flash memory, supply chain constraints.

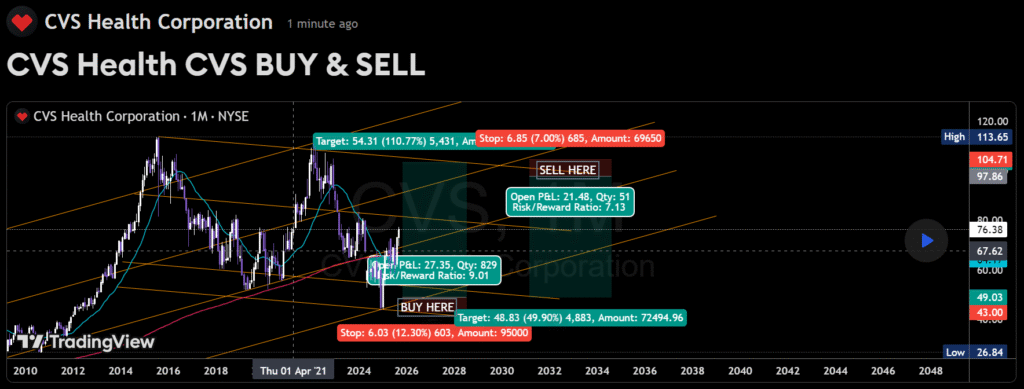

CVS Health (CVS) – Retail Healthcare Transformation

CVS Health is expanding aggressively into retail healthcare, acquiring clinics and expanding insurance lines. This integrated model appeals to cost-conscious consumers and positions CVS favorably in the ongoing healthcare shakeup.

- Latest Results: Earnings beat on pharmacy and insurance strength.

- Key Drivers: Vertical integration, digital healthcare expansion.

- Risks: Regulatory changes, competitive pressure from digital-first entrants.

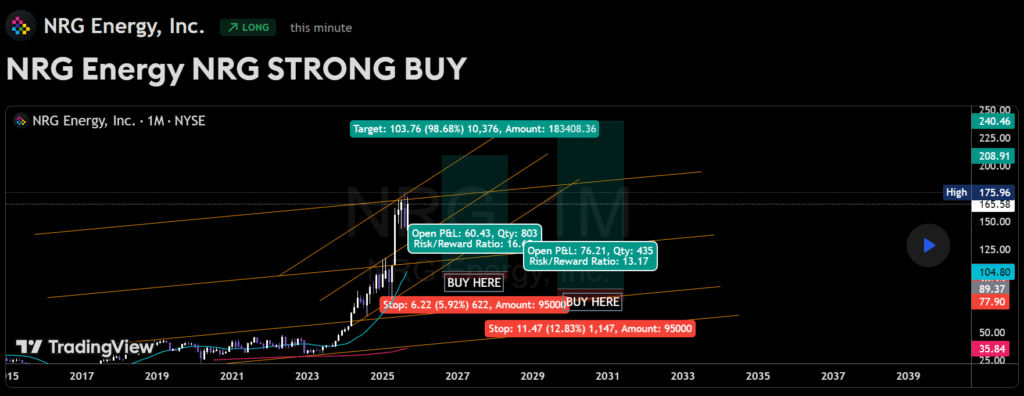

NRG Energy (NRG) – Utilities with Clean Energy Momentum

NRG Energy is at the center of the U.S. utility renaissance, benefitting from the transition to renewables and rising electricity prices. Its diversified asset portfolio provides stability during market volatility.finance.yahoo+1

- Latest Results: Increased renewables onboarding and higher margins.

- Key Drivers: Clean energy government incentives and restructuring gains.

- Risks: Sensitivity to commodity markets, regulatory headwinds in some regions.

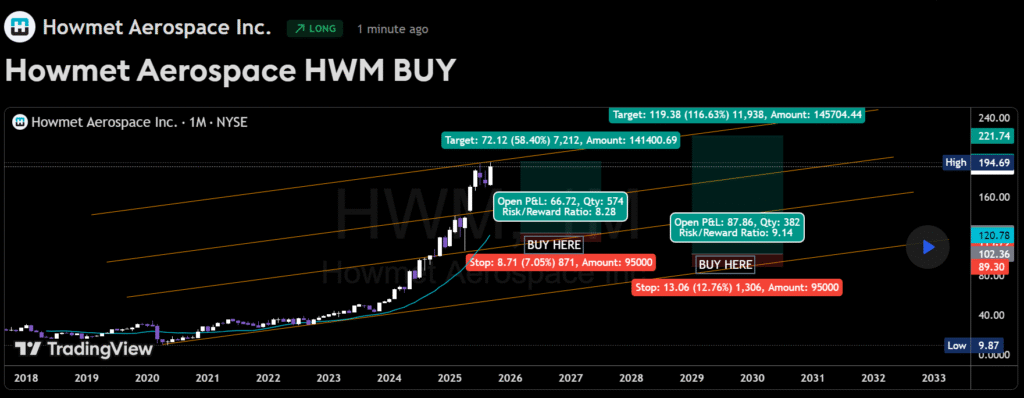

Howmet Aerospace (HWM) – Aerospace & Defense Revival

Howmet Aerospace’s advanced materials for aircraft and defense platforms have led to dramatic growth in 2025 as travel trends rebound and defense spending increases.

- Latest Results: Orders surge for commercial and military aviation.

- Key Drivers: Airline fleet restocking and steady defense contracts.

- Risks: Lumpy contract visibility, sensitivity to global economic swings.

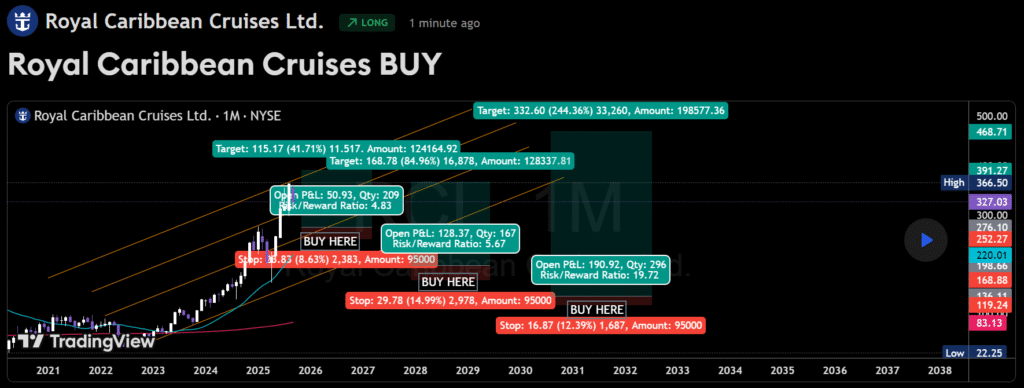

Royal Caribbean Cruises (RCL) – Travel Sector Rebound

Royal Caribbean is a top beneficiary of the post-pandemic travel boom. Record bookings in cruises and leisure travel have driven exceptional earnings results and bullish sentiment.

- Latest Results: Best-ever summer quarter, double-digit profit margins.

- Key Drivers: Pent-up demand for leisure, capacity expansion.

- Risks: Fuel price volatility, geopolitical/health risks impacting travel.

Wrapping Up

This cohort of high-momentum stocks embodies the leading trends of late 2025: AI transformation, energy transition, retail healthcare integration, and post-pandemic travel resurgence. Each asset carries its own fundamental and technical story, so supplement these insights with your buy signal charts to create actionable trade setups tailored to your strategies.

0 responses to “The Hottest Stocks of September 2025: Full Analysis and Insights”