Your basket is currently empty!

Artificial intelligence is no longer science fiction. It is the engine driving everything from self-driving cars to medical breakthroughs, from automated trading to voice assistants in your pocket. For investors, AI represents one of the biggest wealth-building opportunities of the 21st century. But where should you start? Which companies are truly positioned to dominate the AI revolution, and how can everyday investors get exposure without betting the farm on a single stock?

This blog breaks down the AI investment landscape into clear categories big tech leaders, software innovators, hardware giants, robotics applications, and ETFs so you can make informed decisions about where to put your money.

Big Tech Leaders Driving AI

When you think of artificial intelligence, you probably picture Silicon Valley giants. That’s for good reason the largest tech companies in the world are investing billions to ensure they lead the AI arms race.

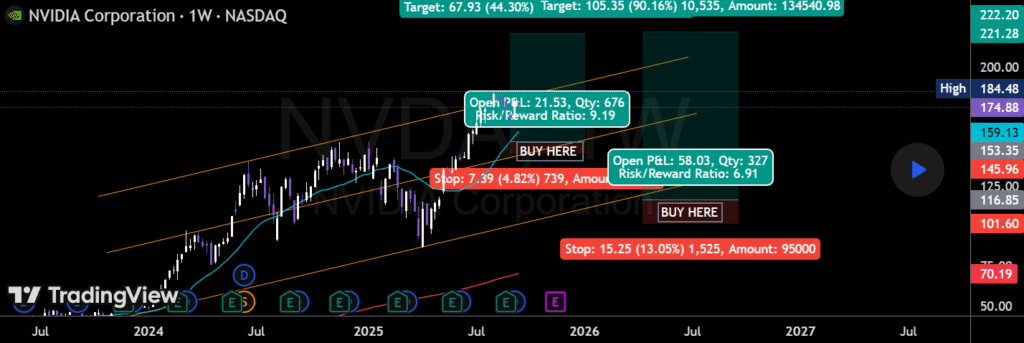

NVIDIA (NVDA) is the undisputed king of AI hardware. Its GPUs power most machine learning models, including the systems behind ChatGPT and other generative AI tools. Investors have already seen explosive gains, but demand for AI chips shows no signs of slowing.

Microsoft (MSFT) has partnered with OpenAI, integrating AI into products like Office, Bing, and its Azure cloud platform. This is a classic “picks and shovels” play, because Microsoft makes money whenever other businesses use its cloud services to run AI models.

Alphabet (GOOGL), parent of Google, owns DeepMind and Bard, two of the most advanced AI research arms in the world. With its dominant search business under threat from AI chatbots, Google has doubled down, pushing AI into advertising, cloud services, and enterprise tools.

Amazon (AMZN), through AWS, is a hidden giant in AI. Its cloud division provides everything from custom AI chips to scalable machine learning platforms, which are used by start-ups and Fortune 500s alike.

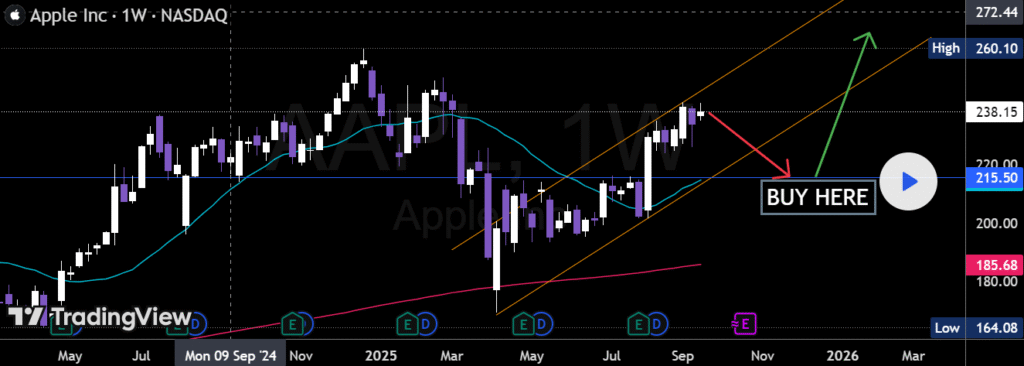

Apple (AAPL) often moves quietly but powerfully. Its push into AI will focus on integrating intelligence into consumer devices from the iPhone to Vision Pro making AI seamless in everyday life.

AI Software and Platforms

Not every winner in the AI space builds chips or sells cloud services. Some build the tools and platforms that businesses rely on.

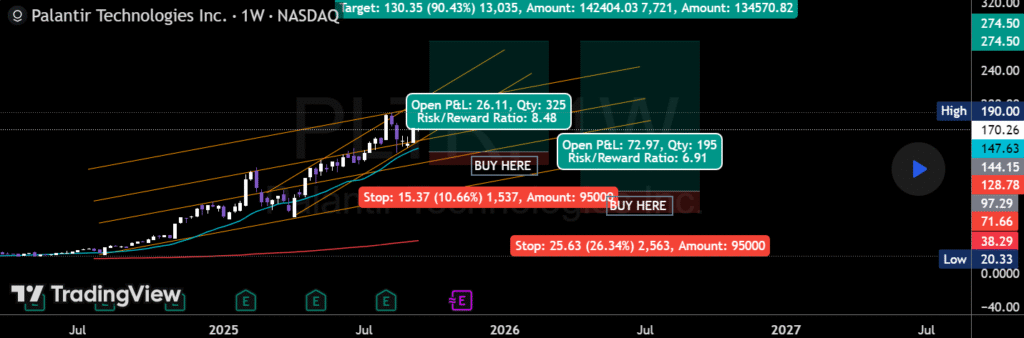

Palantir Technologies (PLTR) has become synonymous with data-driven decision-making. Governments and corporations pay heavily for its AI-driven analytics, making Palantir a long-term institutional play.

C3.ai (AI) is a pure-play AI software provider, building customizable enterprise solutions across energy, healthcare, and manufacturing. Its volatility is high, but so is its growth potential.

UiPath (PATH) focuses on automation and robotics for digital workflows, helping businesses replace repetitive human tasks with software bots. As companies look to cut costs, this type of AI-driven efficiency becomes more attractive.

Snowflake (SNOW) has positioned itself as the backbone for AI applications. By managing and streamlining data across platforms, Snowflake is enabling companies to build smarter AI systems.

Semiconductor and Hardware Plays

AI cannot exist without the chips and infrastructure that power it. While NVIDIA dominates headlines, there are other key players worth noting.

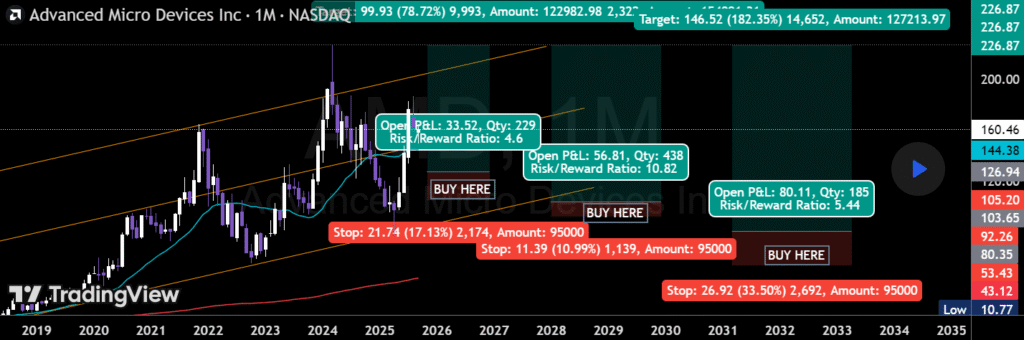

AMD (AMD) is racing to close the gap with NVIDIA, launching competitive AI-focused GPUs. Its success depends on whether it can chip away at NVIDIA’s massive lead.

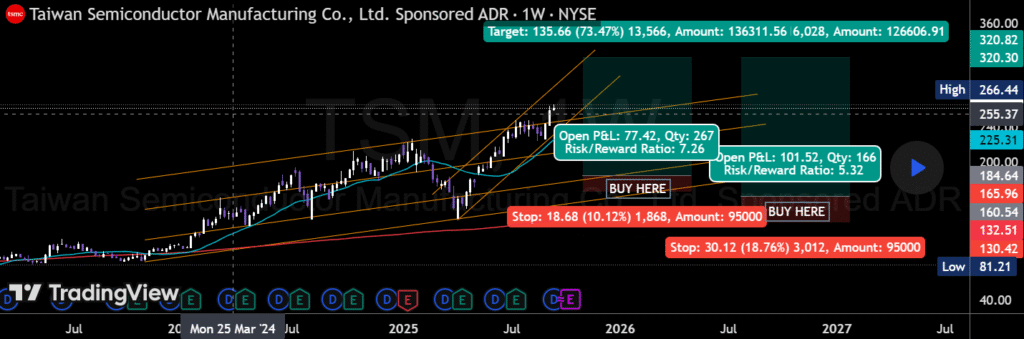

TSMC (TSM) manufactures chips for virtually every tech giant, including Apple and NVIDIA. As the world’s largest semiconductor foundry, it is the quiet backbone of AI hardware.

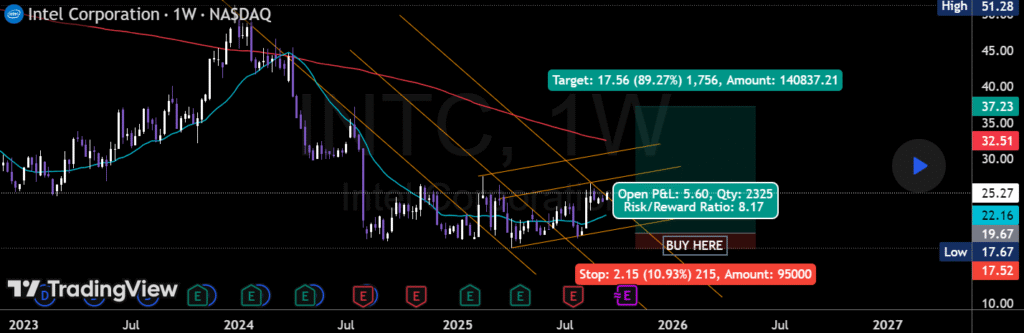

Intel (INTC), though struggling in recent years, is heavily investing in AI accelerators. If its turnaround is successful, Intel could re-emerge as a leader in the space.

AI-Driven Applications and Robotics

Artificial intelligence is not limited to chips and platforms. It is also transforming industries directly.

Tesla (TSLA) is best known for electric cars, but its future depends on AI. From self-driving vehicles to its Optimus humanoid robot, Tesla is an AI-first company disguised as an automaker.

Adobe (ADBE) has embraced generative AI with tools like Firefly, which create text, images, and video. With a huge creative customer base, Adobe has the potential to monetize AI quickly.

ServiceNow (NOW) uses AI to automate workflows across enterprises, from HR systems to IT support. It’s a software business that becomes more valuable the more companies lean on automation.

AI ETFs for Diversification

If you want exposure to AI but don’t want to pick individual winners, ETFs (exchange-traded funds) are a safer option. These funds bundle multiple AI-related stocks together, giving you diversified exposure.

- Global X Robotics & Artificial Intelligence ETF (BOTZ) focuses on robotics and automation.

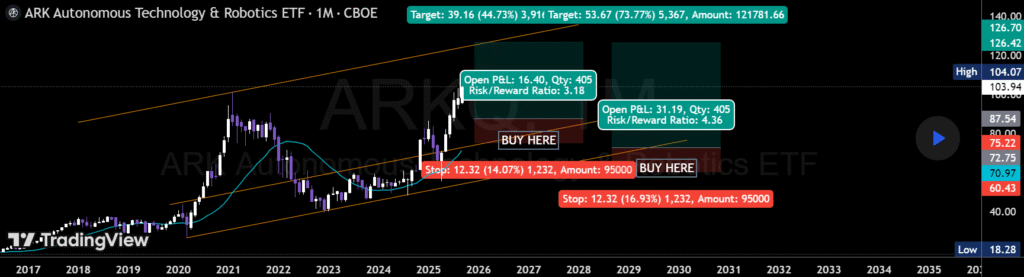

- ARK Autonomous Technology & Robotics ETF (ARKQ), led by Cathie Wood, bets on futuristic AI and robotics companies.

- iShares Robotics and Artificial Intelligence ETF (IRBO) offers global exposure across developed and emerging markets.

- WisdomTree Artificial Intelligence UCITS ETF (WTAI) is popular in Europe for diversified AI exposure.

Risks and Rewards

AI investing is exciting, but it comes with risk. Many companies are still unprofitable. Valuations are high, and hype can drive bubbles. Regulatory crackdowns could slow progress, and competition between the U.S. and China could create volatility.

That said, the potential upside is enormous. Just as the internet created trillion-dollar companies in the 2000s, AI will create the next generation of market leaders. The key for investors is diversification and patience — spreading bets across categories while holding for the long term.

The Bigger Picture

Artificial intelligence will not just transform industries; it will transform wealth. Those who invest early in the infrastructure, platforms, and applications of AI stand to benefit most. Whether through big tech stocks, specialized software providers, hardware plays, or diversified ETFs, the opportunity is clear: AI is not a passing trend, it is the future.

For investors willing to study the space, manage risks, and think long-term, AI stocks may be the closest thing to “buying the internet” in the 1990s.

0 responses to “The Future Is Automated: How to Invest in AI Stocks Before the Next Wave of Growth”