Your basket is currently empty!

Estimated Reading Time: 5–6 minutes

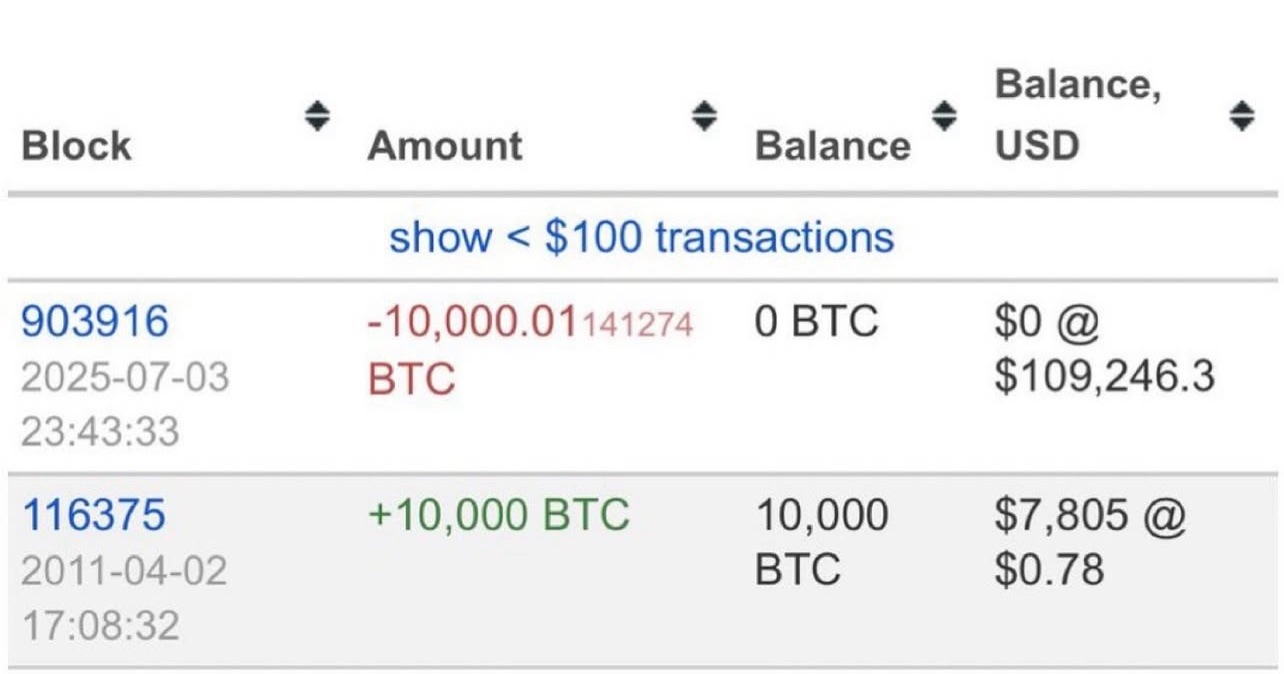

In 2011, Bitcoin was an obscure digital experiment that only a handful of developers and technology enthusiasts paid attention to. At the time, one Bitcoin was worth less than a dollar. Most people dismissed it as an internet curiosity. But for one anonymous investor, it was something worth betting on. They invested approximately $7,800 to acquire 10,000 BTC.

Fourteen years later, that decision has become one of the most astonishing success stories in the history of investing. As of July 2025, the wallet containing those coins was moved for the first time. At a recent price of $109,246 per Bitcoin, the balance was worth about $1.1 billion.

This story is not only about massive profits. It is a powerful example of conviction, discipline, and the extraordinary potential of emerging technology when combined with patience.

A Timeline of This Extraordinary Journey

April 2, 2011

The investor purchased 10,000 BTC for a total of about $7,805, when the price per coin was $0.78.

2011 to 2025

The wallet remained inactive through every Bitcoin boom and bust, including the surge to $1,000 in 2013, the $19,000 rally in 2017, and the all-time highs above $100,000 in the early 2020s.

July 3, 2025

After 14 years of total silence, the investor finally moved the entire balance. The transaction was recorded on the blockchain, attracting immediate global attention.

Why Did This Investment Succeed?

Vision was essential. In 2011, there was no institutional adoption, no regulated futures, and no mainstream understanding of cryptocurrency. Most people saw Bitcoin as a novelty or a scam. This investor saw a revolutionary technology.

Equally important was discipline. Every time Bitcoin experienced a major rally, there was a strong temptation to sell. Most people would have liquidated at a fraction of the eventual gains. The wallet stayed untouched through multiple cycles of volatility.

Time compounded the returns in a way that seems almost impossible. A single decade turned a speculative wager into a billion-dollar fortune.

The Psychology of Not Selling

Perhaps the most fascinating part of this story is how the investor resisted cashing out. Keeping such a position requires an unusual combination of emotional detachment and conviction.

Many investors panic when they see volatility. Others become greedy and try to time the market. But this evidence shows that doing nothing can be the most powerful strategy of all. By ignoring both fear and hype, the investor allowed Bitcoin’s long-term trajectory to unfold.

Applying This Mindset to Modern Trading

This week, I traded Bitcoin myself using my own strategies and tools. Even though I am not holding ten thousand coins for over a decade, I was able to capture several profitable moves in a single session.

I rely on the AF Supply and Demand 3.5 P.R.O automated trading software to help me identify key price levels and execute trades with precision. This tool is built for traders who want to combine professional-grade analysis with automation.

Here is a short video of my live BTC trading session using this system:

Whether you trade Bitcoin, indices, or other major assets, the AF Supply and Demand 3.5 P.R.O can help you spot institutional-level supply and demand zones and take advantage of market inefficiencies.

If you are interested in learning more about this software or seeing real examples of how it works in live markets, visit the official page or explore the videos and tutorials available.

Broader Lessons for Investors

This story demonstrates how technological revolutions often look unimportant in their early days. New ideas rarely arrive fully formed. They evolve, get tested, fail, recover, and slowly build momentum. The greatest returns are typically reserved for those who can spot potential before it is obvious.

The transparent nature of blockchain also makes this event unique. Anyone can look up the transaction details. Unlike traditional finance, where ownership is hidden behind layers of institutions, Bitcoin allows the public to see these historic moves in real time.

Takeaways for Today’s Market Participants

Think long-term. Bitcoin’s rise did not happen overnight. It unfolded over years of uncertainty and controversy.

Recognize the power of modest initial bets. Even relatively small amounts of money can produce life-changing gains if the underlying asset grows exponentially.

Stay informed about new technologies. Today’s underappreciated ideas could be tomorrow’s breakthroughs.

Focus on discipline. Emotional control is often more important than perfect timing.

Will There Be Another Moment Like This?

No one knows with certainty. But history suggests that the most transformative innovations are usually underestimated in their earliest stages. In 2011, Bitcoin was an obscure project discussed in internet forums. By 2025, it became the foundation of one of the most extraordinary investment outcomes ever recorded.

The next opportunity may already exist, quietly building momentum while the majority of people overlook it.

Main Takeaways

A $7,800 investment in Bitcoin became worth approximately $1.1 billion through a combination of early conviction, extreme patience, and unwavering discipline.

Blockchain transparency allows anyone to witness these events and learn from them.

Long-term thinking, emotional control, and openness to innovation remain the cornerstones of extraordinary success.

If you would like to see how professional trading tools can help you in the modern market, explore the AF Supply and Demand 3.5 P.R.O software and consider watching my recent trading video to see it in action.

0 responses to “The Bitcoin Time Capsule: How One Normal Wallet Grew 140,000% in 14 Years”