Your basket is currently empty!

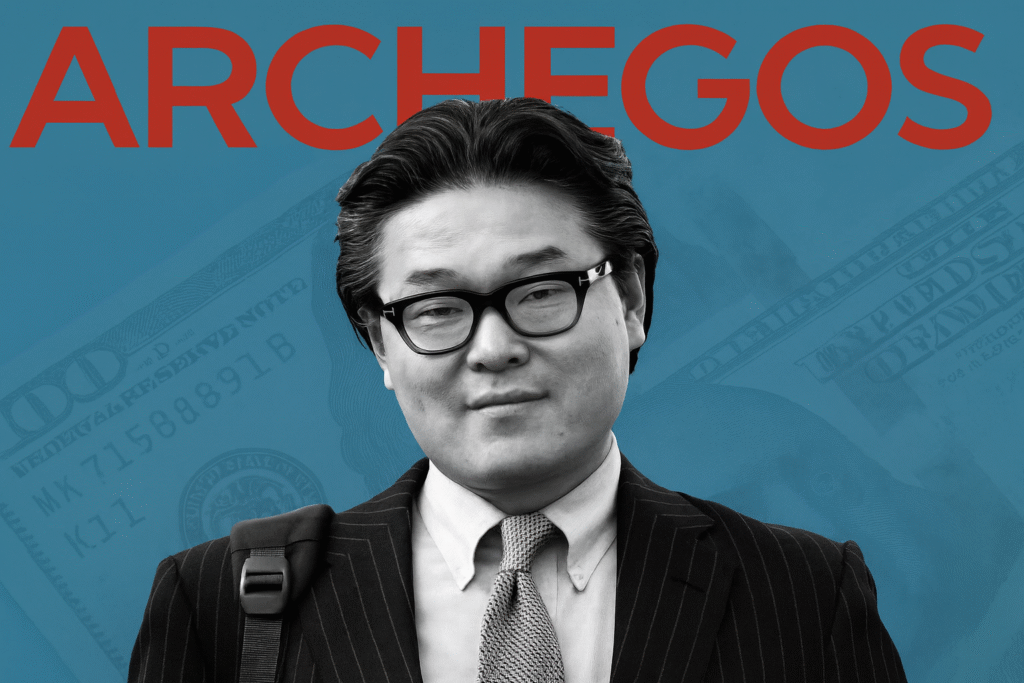

In the world of finance, fortunes can rise and fall overnight. But few collapses have ever been as shocking or as instructive as the downfall of Bill Hwang, the billionaire founder of Archegos Capital Management. In just 48 hours, Hwang managed to lose more than $20 billion, sending shockwaves through Wall Street and exposing the hidden leverage that had quietly built up behind the scenes.

This wasn’t just another bad trade. It was a spectacular implosion that revealed how even the most sophisticated investors can be undone by overconfidence, secrecy, and the relentless mathematics of leverage.

Who Was Bill Hwang?

Before his collapse, Bill Hwang was something of an enigma in the investment world. A former protégé of hedge fund legend Julian Robertson at Tiger Management, Hwang was considered part of the elite “Tiger Cub” network a group of traders who went on to run some of the most successful hedge funds in history.

After Tiger Management closed, Hwang founded Tiger Asia Management, a hedge fund focused on Asian equities. However, in 2012, he was charged by the U.S. Securities and Exchange Commission (SEC) for insider trading and wire fraud. Hwang paid a $44 million fine and agreed to return money to investors.

Instead of fading into obscurity, he re-emerged under a new entity Archegos Capital Management a family office that didn’t manage outside capital and therefore wasn’t subject to the same regulatory scrutiny as hedge funds.

This technical distinction allowed Hwang to operate in the shadows. It was this secrecy that would later prove catastrophic.

The Rise of Archegos: Hidden Leverage and Synthetic Bets

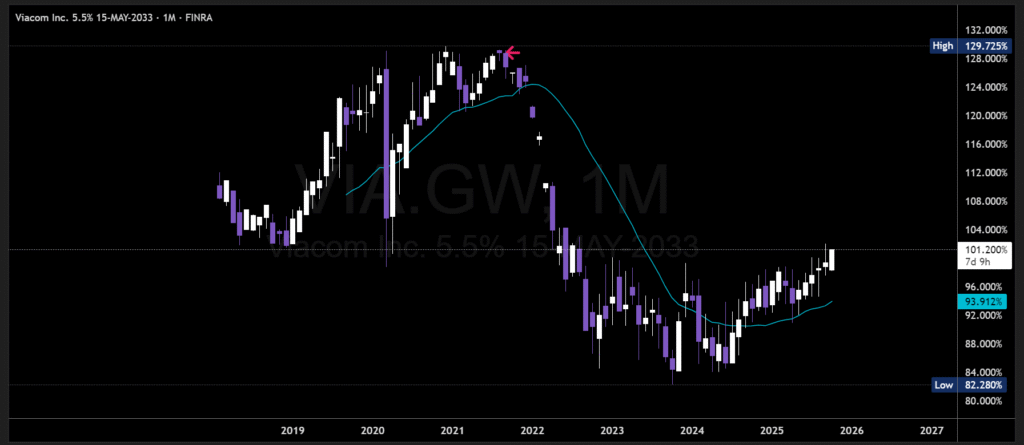

Archegos wasn’t a traditional hedge fund it didn’t directly buy billions in stocks. Instead, it used total return swaps, a financial derivative that allowed it to take massive positions without publicly disclosing ownership.

Here’s how it worked: instead of buying shares of companies like ViacomCBS, Discovery, Tencent Music, or GSX Techedu, Hwang entered into contracts with major investment banks Credit Suisse, Nomura, Morgan Stanley, Deutsche Bank, and others. These swaps gave Archegos exposure to the stock’s performance, but the banks technically owned the shares.

This meant Archegos could borrow extraordinary amounts of money up to five times its capital to amplify its bets.

By early 2021, Hwang had quietly accumulated over $100 billion in exposure through these swaps. The banks, enticed by his business and past track record, kept extending credit.

The Collapse: When Margin Calls Come for Everyone

In March 2021, everything unraveled.

ViacomCBS, one of Archegos’s largest positions, announced a new share sale that spooked investors. The stock dropped sharply. Because Hwang was so heavily leveraged, even a small decline in one stock created a domino effect across his portfolio.

The banks demanded more collateral margin calls to cover the losses. But Hwang couldn’t pay.

Within hours, banks began liquidating Archegos’s positions. Billions of dollars’ worth of stock hit the market almost simultaneously, causing massive price collapses.

By the end of that week, Archegos had been completely wiped out. Hwang’s personal fortune estimated at over $20 billion just days earlier was gone.

Credit Suisse alone lost $5.5 billion, one of the largest single losses in the bank’s history. Nomura lost $2.9 billion. The total fallout across Wall Street exceeded $10 billion in damages.

How Did This Happen?

The Archegos disaster exposed deep flaws in both financial regulation and risk management:

- Hidden Leverage: Because Archegos used swaps instead of owning shares directly, regulators and even the banks themselves couldn’t see how concentrated its positions were.

- Bank Complacency: Major institutions competed for Hwang’s business, ignoring red flags to secure lucrative trading fees.

- Overconfidence: Hwang’s personal faith and belief in “God’s favor” were said to fuel his confidence in the market’s direction. He reportedly referred to his trades as being guided by divine intuition.

At its core, the collapse was a story of unchecked optimism and systemic blindness proof that no amount of wealth or experience makes a trader immune to risk.

The Aftermath: Trials, Regulations, and Lessons

In 2022, Bill Hwang was arrested and charged with racketeering, securities fraud, and market manipulation. Prosecutors argued that he deliberately misled banks about his holdings to obtain more credit.

His trial began in 2024, with testimony revealing a culture of excessive risk-taking and deception. The case has become a landmark in financial law, sparking renewed calls for greater oversight of family offices and derivative exposures.

For Wall Street, Archegos was a warning shot. It proved that leverage hidden behind complex instruments could still trigger global fallout just as it did in 2008.

Lessons for Traders: What You Can Learn from Hwang’s Mistake

- Leverage amplifies everything especially losses. Even the best strategies fail when overexposed.

- Transparency matters. If you can’t clearly measure your risk, you don’t control it.

- Diversify your exposure. Concentration in a few correlated assets magnifies volatility.

- Risk management isn’t optional. It’s the single most important factor separating survival from ruin.

- Stay humble. Confidence can build wealth, but hubris destroys it overnight.

How Modern Traders Can Avoid the Same Fate

Retail traders now have access to technology that didn’t exist in Hwang’s time AI-driven risk tools, signal platforms, and automated trading that help reduce human error.

Our MSP 1.0 FX Signal Software is designed for exactly this reason. It uses algorithmic data and AI logic to:

- Detect high-probability trade setups automatically

- Limit overleveraging by enforcing consistent position sizing

- Remove emotional bias from execution decisions

In essence, it gives you an AI-powered captain an always-on trading assistant that eliminates the same blind spots that led to Archegos’s downfall.

Whether you’re managing £10,000 or £1,000,000, the principles are the same: protect capital first, compound second, and never let a single mistake turn your entire system to zero.

Final Thought: The Thin Line Between Genius and Disaster

Bill Hwang’s story isn’t just about loss it’s about human nature. It shows how intelligence, experience, and faith can coexist with denial, greed, and overconfidence.

Every trader, no matter how skilled, lives on the edge of chaos. The key is to stay grounded, measured, and protected.

Because in trading, as Hwang proved, you’re never more than one margin call away from losing it all.

extra reading:

Find out exactly How Trader Jeff Yass Amassed a $500 Billion Fortune From Playing Poker!

0 responses to “The Biggest Trading Loss Ever: How Bill Hwang Lost $20 Billion in 48 Hours”