Your basket is currently empty!

Introduction

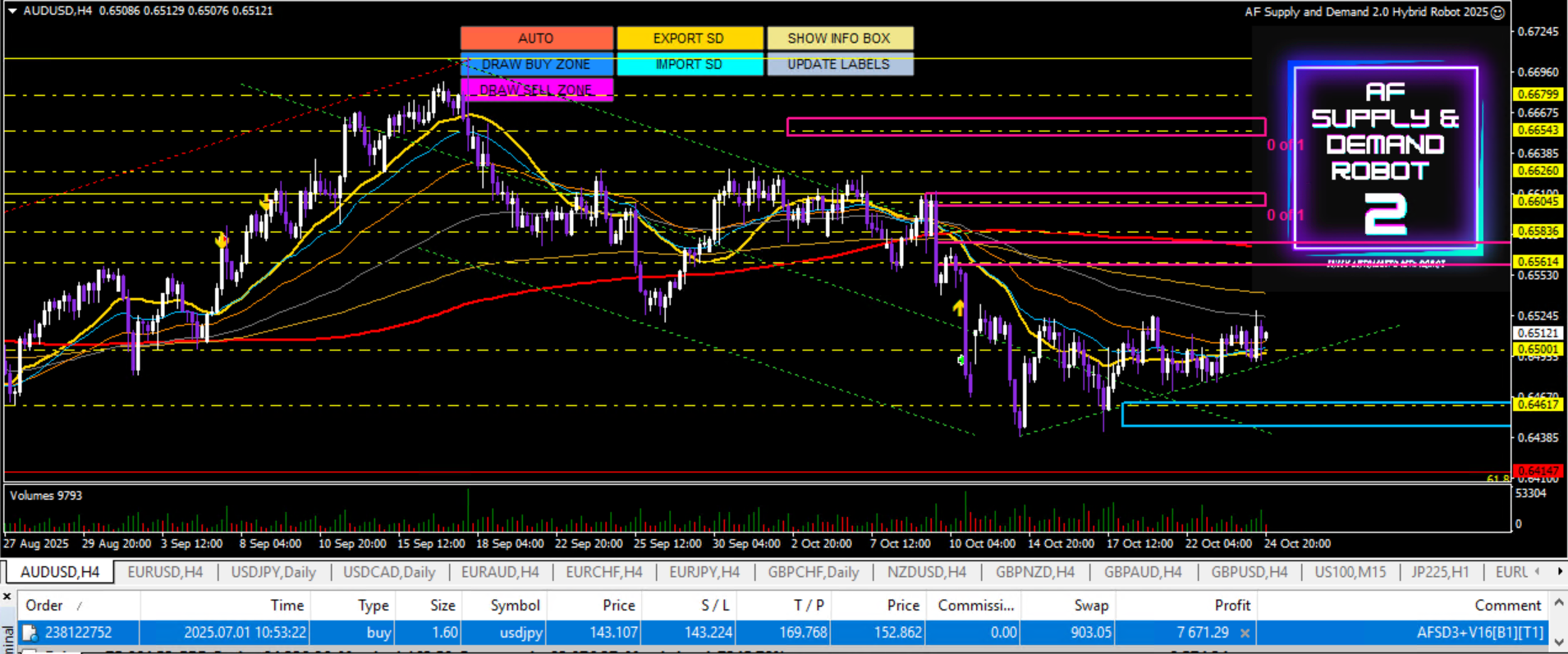

Welcome to my weekly market outlook powered by the AFSD2! If you’re focusing on supply and demand zone trading for major pairs like AUDUSD, EURUSD, USDJPY, USDCAD, EURAUD, EURCHF, EURJPY, GBPCHF, NZDUSD, GBPNZD, GBPAUD, and GBPUSD this is your all-in-one resource.

This week’s landscape is set for explosive moves, with multiple central bank decisions and red folder news releases shaking up volatility. Get ready for zone-to-zone analysis, smart anticipation of liquidity grabs, and S&D tactics primed for every session.

Macro & Fundamental Drivers This Week

- Central Bank Spotlight: Watch for rate decisions and statements from the Federal Reserve, Bank of Canada, and Bank of Japan these will define the market tone across USD, CAD, and JPY pairs.

- Inflation & GDP Releases: Major CPI prints from Australia and the Eurozone, plus growth numbers from the USA and CAD. Expect sharp, directional moves during these events.

- Volatility Cues: Red folder events, especially clustered on Wednesday and Thursday, will create prime conditions for S&D reversals and breakouts.

Pair-by-Pair S&D Fundamental Commentary

AUDUSD

- Key Drivers: Aussie Q3 CPI and RBA measures Wednesday; expect big intra-session spikes during Asia. Watch for USD side whipsaws post-Fed.

- Supply/Demand Zones: Anticipate AUD demand near former swing lows if CPI disappoints; demand into 0.64617–0.6339 is likely to be retested with dovish risk.

- Scenario: Hawkish Fed+soft AU CPI = sharp drop; CPI beat + USD pullback = relief rally.

EURUSD

- Key Drivers: German/Eurozone CPI, GDP on Thursday/Friday; Fed and PCE; supply zone likely above 1.16, demand 1.15–1.14.

- Volatility: Strongest during European/US overlap post-data.

- Scenario: Sticky EZ inflation + soft US GDP could trigger squeeze to upper resistance, but any PCE/GDP miss and hawkish Fed = downside follow-through.

USDJPY

- Key Drivers: BoJ rate decision Thursday, US rate/Fed; persistent yen weakness but watch for BoJ surprises.

- Key Levels: 151–152 supply is sticky (BoJ intervention risk), 147.887 demand.

- Scenario: BoJ dovish = resumption of USDJPY uptrend, but any mention of tightening/intervention = flash crash risk.

USDCAD

- Key Drivers: BoC statement; oil price volatility, GDP later.

- Zones: 1.40566 upper supply; 1.39223 demand.

- Scenario: Dovish BoC = rally to 1.39; hawkish = sharp fade. Oil rebound could also spark CAD squeezes.

EURAUD

- Key Drivers: Divergence between EU and AU inflation data; Eurozone CPI/GDP vs AU CPI.

- Zones: Monitor 1.76750 demand supply at 1.80781

- Scenario: AU CPI surprise = sharp leg lower; otherwise, euro resilience to continue.

EURCHF

- Key Drivers: Eurozone data, SNB rhetoric (no major event), CHF as risk-hedge.

- Zones: 0.92918 supply.

- Scenario: Strong EZ data = test higher; Swiss franc may bid on risk-off moves post-central bank volatility.

EURJPY

- Key Drivers: BoJ and Eurozone CPI/GDP; risk-sensitive play.

- Zones: Demand 173.210

- Scenario: BoJ dovish = new highs; intervention chatter = sudden drop.

GBPCHF

- Key Drivers: GBP trades on global risk and cross-asset flows; CHF spike risk during risk-off.

- Zones: 1.08973 supply

- Scenario: GBP can whipsaw with US+EZ prints and risk tone.

NZDUSD

- Key Drivers: No RBNZ, but will move on AUD risk and global USD flows; ANZ Business Confidence for soft NZ event.

- Zones: 0.56928 demand; supply 0.58008

- Scenario: Sell rallies on USD strength; watch for relief on risk-on mood or strong AU data.

GBPNZD

- Key Drivers: Brexit macro flows, NZD risk from global events.

- Zones: 2.34467 supply; 2.29248 demand.

- Scenario: Vol sensitive; expect wicks both ways on global risk, Australian/NZD data.

GBPAUD

- Key Drivers: UK cross-asset, AU CPI risk. Watch for a squeeze if both UK and AU beat.

- Zones: 2.08482 supply; 2.03016 demand.

- Scenario: Flat/neutral unless outstanding CPC CPI or risk move.

GBPUSD

- Scenario: Fed-driven dovish Fed and weak GDP/PCE = rally to resistance; strong US = liquidity runs lower.

- Key Drivers: USD core event flow, UK mortgage/credit, risk tone. Strong dollar events dominate price discovery.

- Zones: 1.34710 supply

The Offer Tools That Make Investing Easier

While this guide is educational, you can explore systems that help automate your journey:

- AF Supply and Demand 2: identifies institutional trading zones for precise investing.

- AF Blitz Series : structured automation and mentorship for consistent trade execution.

Each of these tools is designed to support rather than replace your judgment.

AF Supply and Demand Robot Comparison

£297

✦

Video lectures

✦

1x Robot Lifetime Access

✦

Downloadable resources

✦

1x Swing Trading Pack for 1 Month

This is an easy to use robot which requires members to update the Supply and Demand Zones twice a week with a 1x charting package for H4 Timeframes only and given in my community hub.

£797

✦

Video Lectures

✦

1x Robot One Year Access

✦

Downloadable resources

✦

7x Allstar Trading Packs: 1 Month Access

This is the same thing as AF Supply and Demand 2.0 Hybrid but now you have access to 7x charting packages which range from M15 Timeframes to Monthly which have to be uploaded once a week.

£497

✦

Video Lectures

✦

1x Robot Lifetime Access

✦

Exclusive Community Access

✦

Unlimited: Trades Every Asset

This is the complete all in bundle which trades Supply and Demand through automatic zone detection accross ANY Asset and ANY Timeframe! No uploads required!

Trading risk disclosure: Trading stocks, options, and derivatives involves substantial risk of loss and is not suitable for all investors. Past performance does not guarantee future results. This material is for educational purposes only and is not personalized investment advice. The author may hold positions in the securities discussed.

0 responses to “AFSD2 in Action: Rapidly Identify Supply & Demand Zones for Winning Trades This Week!”