Your basket is currently empty!

Artificial Intelligence (AI) is no longer just a buzzword it’s rapidly reshaping how we live, work, and consume energy. While many investors chase headline names like NVIDIA, Microsoft, or Meta, the world’s largest private equity firms are focusing on something more fundamental: the infrastructure that makes AI possible.

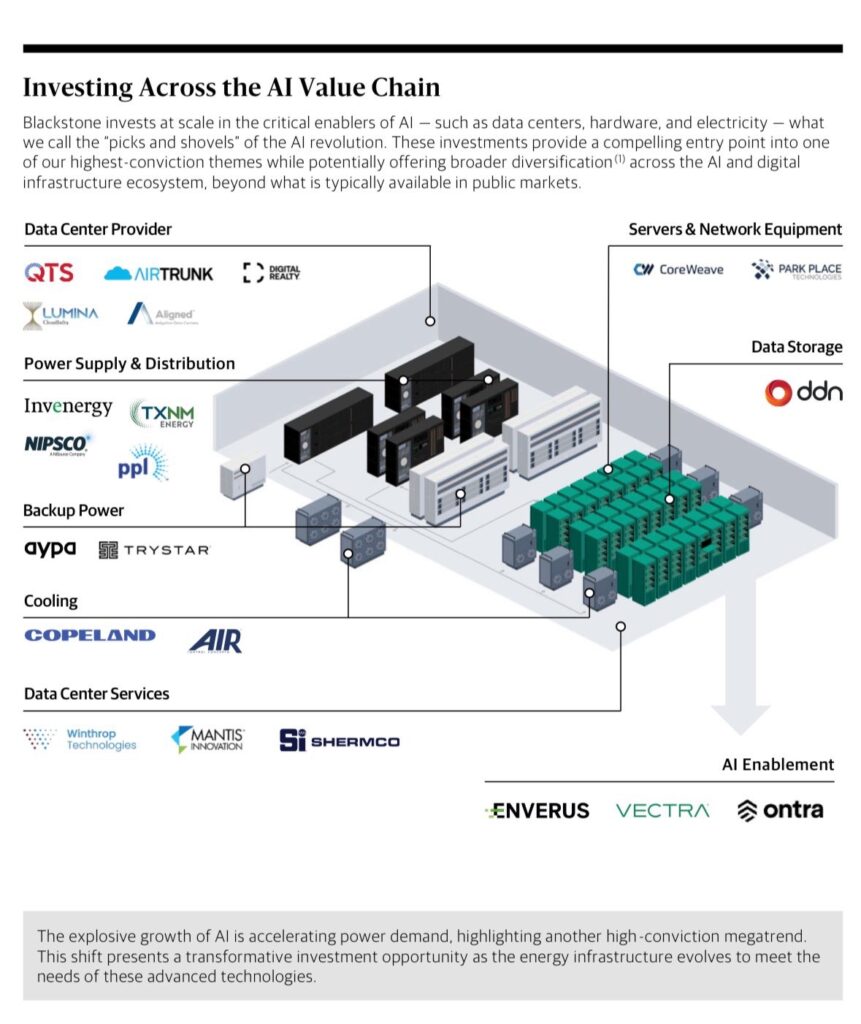

Blackstone, the world’s biggest alternative asset manager, has gone so far as to map out its investments across what it calls the AI Value Chain everything from data centers and power supply to network equipment and software enablement. These are not speculative bets on the next chatbot. These are multi-billion-dollar positions in the companies that provide the power, cooling, storage, and servers required to keep AI running 24/7.

Data Centers: The Real Estate of the AI Boom

The first piece of this puzzle is the physical space where AI workloads run. Blackstone owns QTS Realty Trust, one of the largest data center operators in the world, along with stakes in AirTrunk and Aligned. These data centers are the digital land on which AI models are trained and deployed. Hyperscalers like Microsoft, Google, and Amazon are leasing entire campuses, securing capacity years in advance, and pushing demand to record highs.

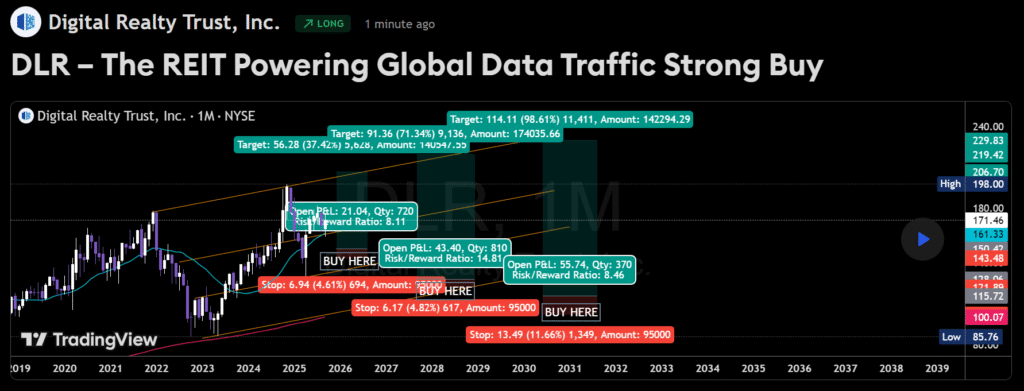

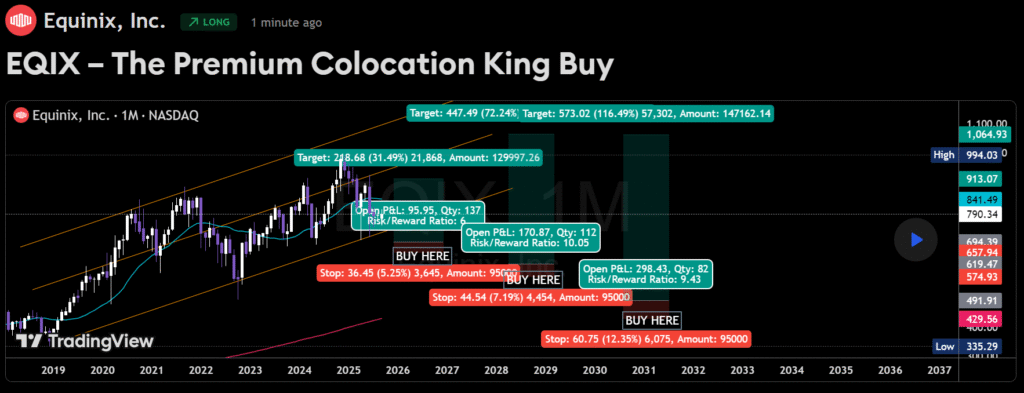

For individual investors, this theme can be captured through publicly traded data center REITs such as Digital Realty (DLR) and Equinix (EQIX). Both have global footprints and are expanding aggressively to meet the surge in high-power, high-density demand created by AI training clusters.

Power and Cooling: Feeding the AI Machine

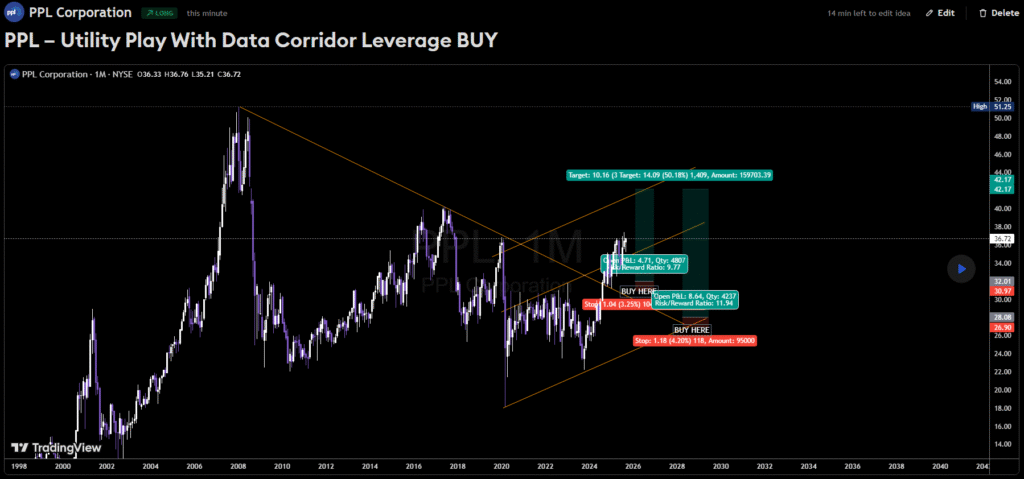

AI workloads are extraordinarily energy-intensive. Training a single large model can consume millions of kilowatt-hours, and each query requires far more power than a traditional web search. Blackstone is positioning itself ahead of this trend with ownership in utilities and renewable developers such as Invenergy, TXNM Energy, NIPSCO, and PPL Corporation. These assets will be crucial as electricity demand from data centers is expected to grow more than 160% by 2030 in the U.S. alone.

Just as important as power generation is keeping those server farms online and cool. Companies like Aypa Power and Copeland provide battery backup systems and advanced cooling solutions, ensuring that AI clusters run without interruption. Cooling alone can account for up to 40% of a data center’s energy costs, so efficiency here is a major profit driver.

Public investors can follow this play by adding regulated utilities like PPL, which benefit from rising rate bases, or even renewable leaders like NextEra Energy (NEE) for a cleaner growth profile. For cooling exposure, manufacturers like Trane Technologies and Johnson Controls are key players in data-center thermal management.

Servers, Storage, and Networks: The Silicon Backbone

While power and space are critical, AI workloads also require highly specialized servers, networking equipment, and storage systems. Blackstone’s portfolio includes CoreWeave, a fast-growing cloud provider optimized for GPU workloads and backed by NVIDIA, as well as DDN, a leader in data storage solutions for AI.

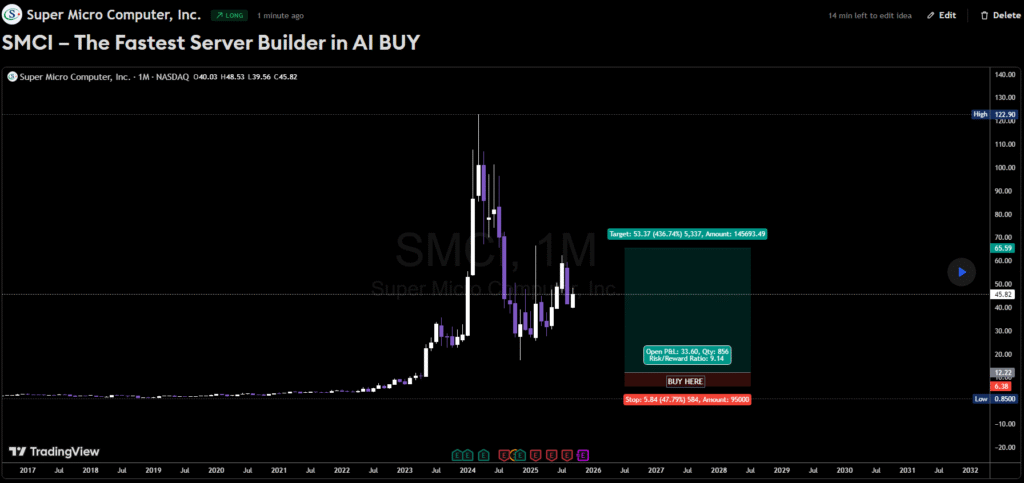

For public market investors, companies such as Super Micro Computer (SMCI) whose share price has soared as demand for AI servers explodes and Arista Networks (ANET), a dominant provider of high-speed switches, are excellent ways to gain exposure to this “backbone” of AI infrastructure.

AI Enablement: Securing and Optimizing the Future

Finally, Blackstone isn’t just betting on hardware it is also buying into software companies that enable AI adoption. Investments like Vectra AI (cybersecurity), Enverus (energy analytics), and Ontra (contract automation) show that Blackstone expects demand for security, data intelligence, and workflow automation to accelerate as AI becomes more deeply integrated into enterprise operations.

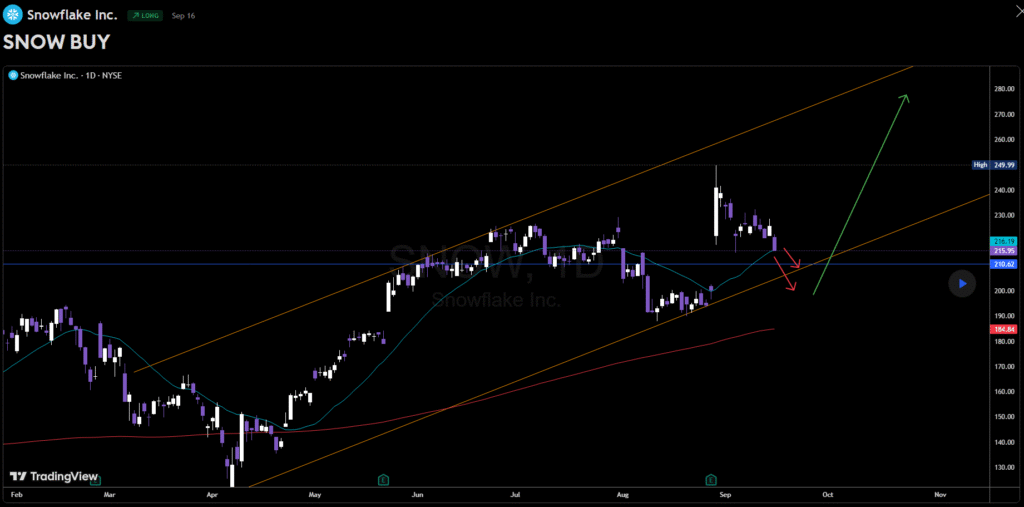

This part of the theme can be mirrored by owning cybersecurity leaders like Palo Alto Networks (PANW) or CrowdStrike (CRWD), as well as data infrastructure companies like Snowflake (SNOW). These firms help enterprises protect, manage, and extract value from the data that powers AI systems.

Why Following Blackstone’s Playbook Makes Sense

What’s striking about Blackstone’s approach is how early they are moving. By securing data centers, utilities, and infrastructure assets now, they are positioning themselves ahead of the demand wave that will hit as AI scales from today’s pilot projects to widespread deployment. Unlike speculative bets on individual AI software companies, these investments focus on cash-flow-generating businesses that will be needed regardless of which AI model “wins.”

For retail investors, this approach offers a way to build a more diversified AI portfolio. Instead of chasing the same few overvalued names, you can own the infrastructure layer the “picks and shovels” through listed REITs, utilities, equipment makers, and cybersecurity companies. This provides exposure to long-term growth drivers while keeping risk and valuation more manageable.

Building Your Own AI Infrastructure Portfolio

The easiest way to mirror this strategy is to combine a few key holdings: a data center REIT like DLR or EQIX as the core, a regulated utility such as PPL for steady cash flow, and a growth name like SMCI or ANET to capture the upside of AI hardware demand. Layering on cybersecurity exposure with PANW or CRWD gives you protection against one of AI’s biggest risks: cyberattacks.

This diversified mix reflects exactly what Blackstone is doing at scale owning the enablers of AI, not just the front-end applications. And because many of these companies are publicly traded, you can build your own version of an AI infrastructure portfolio right from a standard brokerage account.

0 responses to “Data Centers: The Real Estate of the AI Boom | How to Invest in AI Infrastructure”