Your basket is currently empty!

How Kobe Bryant, LeBron James, and James Harden Turned Small Bets into Millions And How You Can Too!

A Wealth-Building Playbook for Everyday Investors

You don’t need millions to start building wealth you just need to think like those who already have it.

When Kobe Bryant, LeBron James, and James Harden made their early investments, they weren’t following Wall Street or chasing trends. They were thinking long-term, spotting value before anyone else saw it, and believing in innovation.

The difference between a celebrity investor and an everyday one isn’t access. It’s mindset, patience, and timing. This report breaks down exactly how they did it and how you can follow the same blueprint using simple, realistic investing steps.

Key Takeaways

- Great investors see opportunity where others see risk.

- Small, consistent bets often outperform flashy, short-term plays.

- The secret is to invest early in the right story not the hype.

- You can mirror these celebrity moves through public stocks, ETFs, or your own business ideas.

- Wealth grows through ownership, patience, and reinvestment.

Kobe Bryant The $6M Bet That Became $400M

In 2013, Kobe Bryant quietly invested $6 million into a small sports drink company called BodyArmor. Most people ignored it. The market was already dominated by Gatorade, and the idea of another hydration brand seemed like a losing game.

But Kobe wasn’t looking for instant profit. He understood a bigger shift consumers were choosing healthier, functional drinks over sugary ones. He believed the future of fitness would center around natural ingredients and athlete-backed credibility.

Seven years later, in 2021, Coca-Cola acquired BodyArmor for $5.6 billion, turning Kobe’s $6 million into more than $400 million.

Lesson for You:

Spot emerging consumer trends. Don’t chase hype study behavior. Kobe didn’t follow headlines, he watched habits. People were changing how they fueled their bodies, and he invested in that shift.

Action Step:

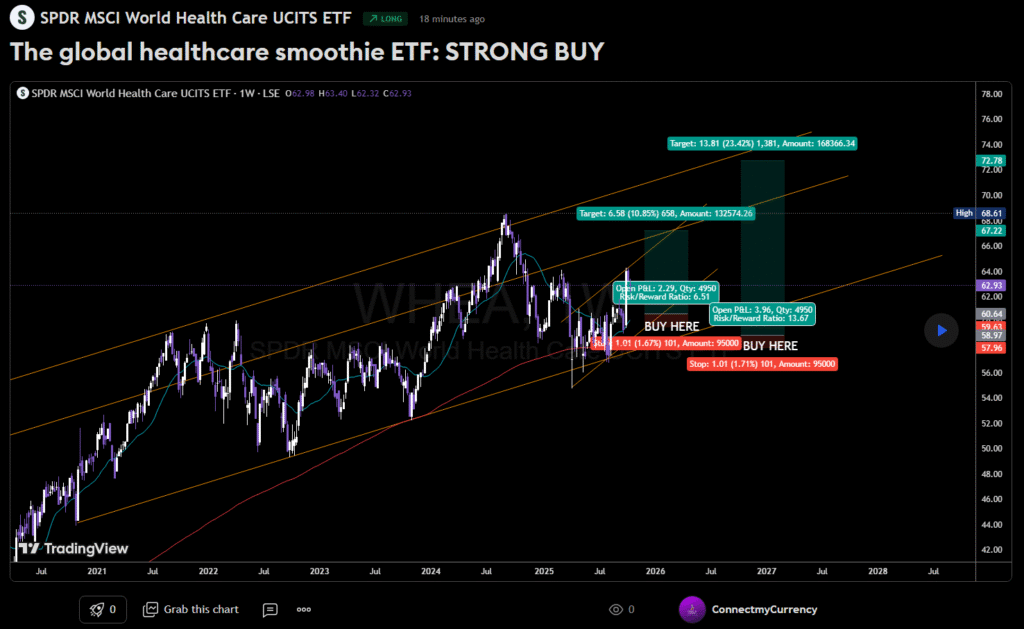

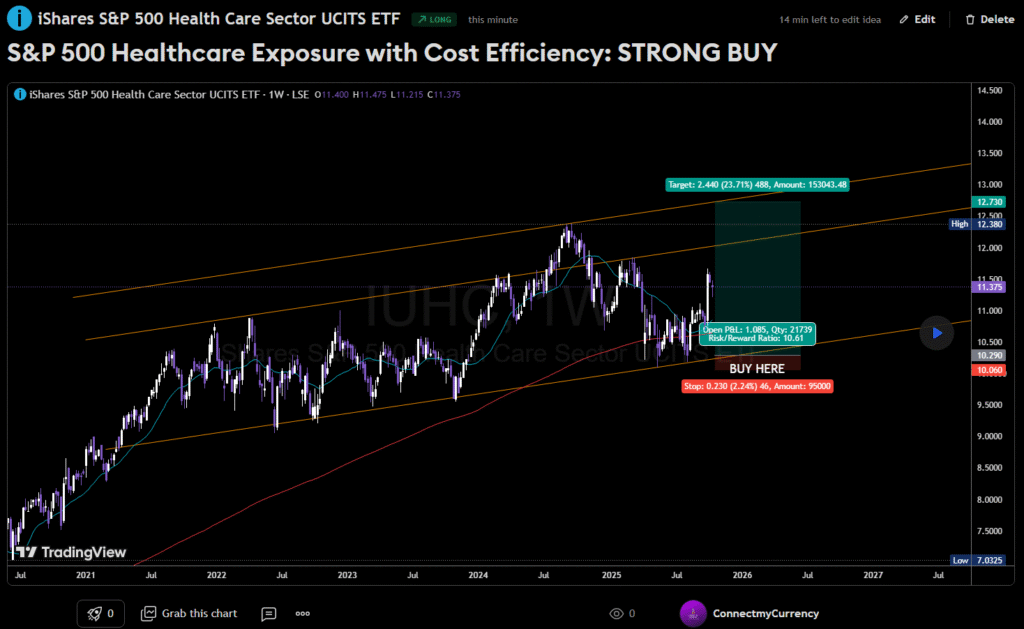

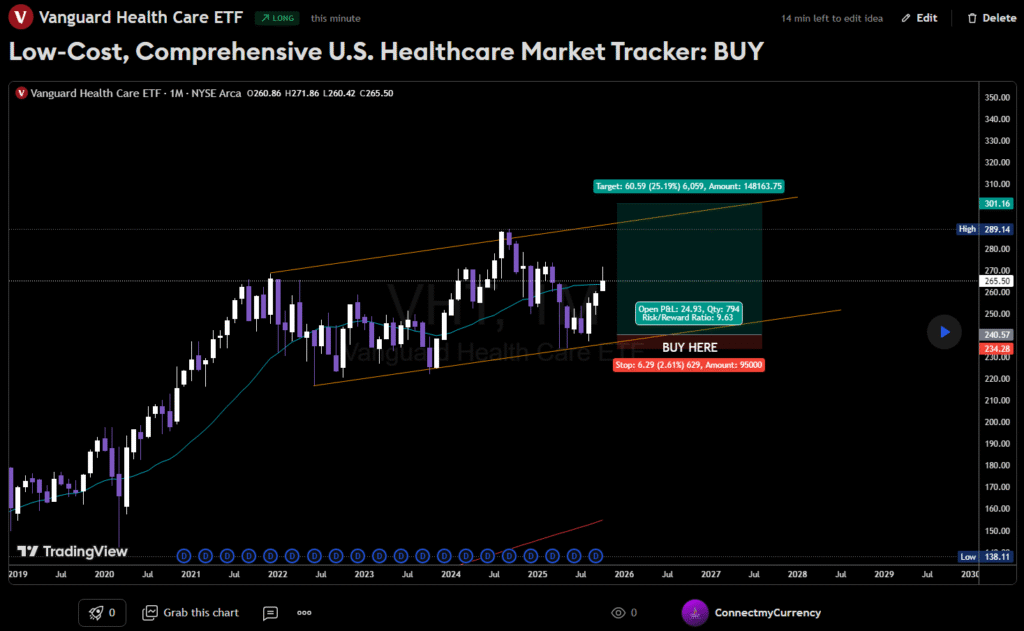

You can do this through stocks or ETFs that represent real-world change. Look at:

- Health & Wellness ETFs

- Clean Energy funds

- Tech-enabled healthcare stocks

Start small but consistent. Kobe’s investment wasn’t about money. It was about vision.

LeBron James Turning $1M into $30M with Beats by Dre

In 2008, LeBron James made a $1 million investment in Beats by Dre, a new headphone company with little market share. Most analysts dismissed it as another short-lived celebrity brand.

LeBron saw something else the fusion of music, identity, and lifestyle. He understood that the product wasn’t just about sound quality; it was about culture. He started wearing Beats before games, turning them into a global symbol of cool.

In 2014, Apple bought Beats for $3 billion, and LeBron’s stake became worth over $30 million.

Lesson for You:

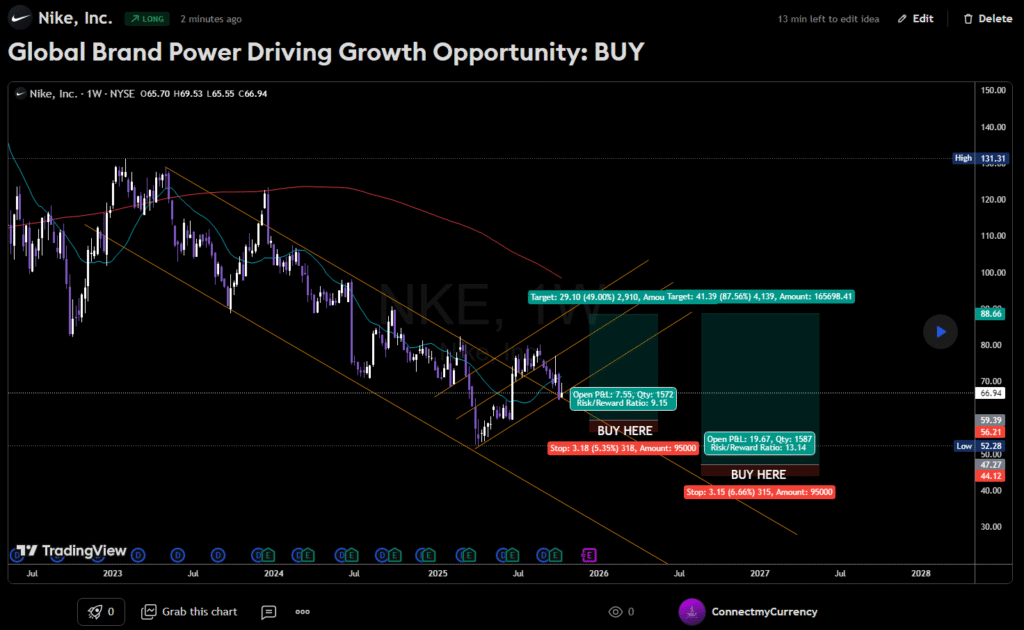

Invest in stories that people emotionally connect with. LeBron didn’t just buy into a product; he bought into a movement. When a brand aligns with culture, it scales far beyond its original niche.

Action Step:

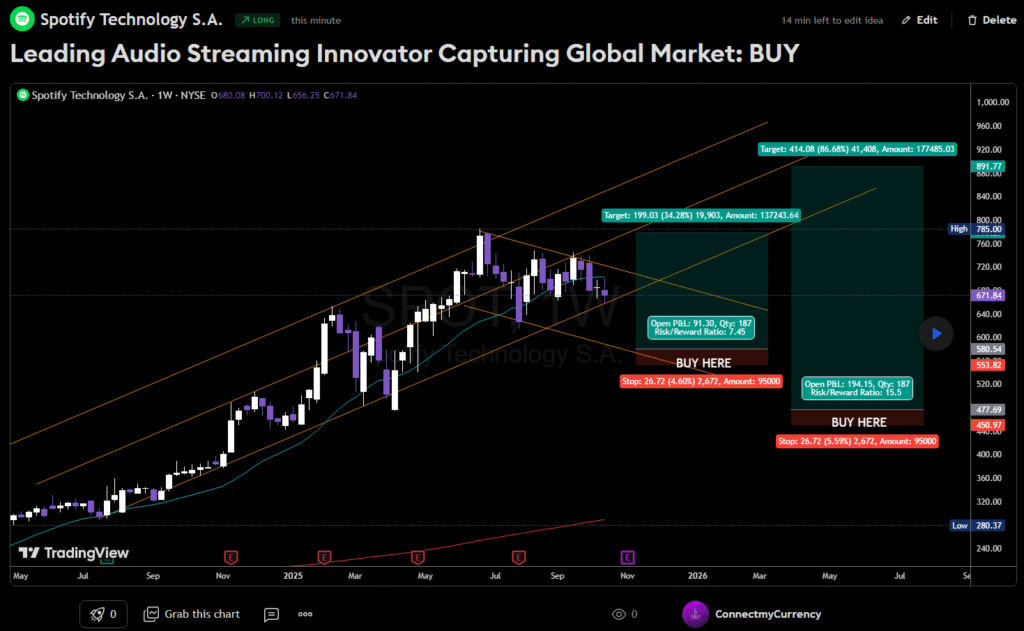

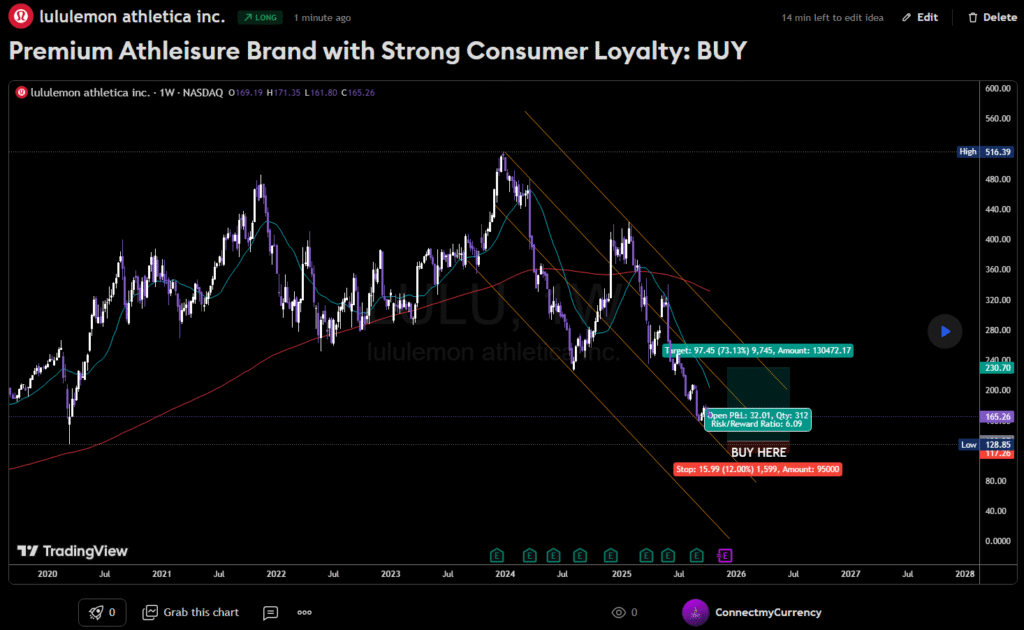

Find publicly traded companies that lead cultural shifts think Nike, Apple, Spotify, or Lululemon. These companies build brands around emotion, not just products.

And remember: sometimes your biggest leverage isn’t money. It’s attention, timing, and belief.

James Harden Turning $500K into $200M

In 2014, James Harden followed Kobe’s advice and invested $500,000 into BodyArmor.

At that time, it was still a risky bet. But he trusted Kobe’s vision, and more importantly, the company’s growth story.

By 2021, when Coca-Cola acquired BodyArmor, Harden’s stake ballooned into a payout worth over $200 million.

Lesson for You:

Leverage trusted insights. Harden didn’t just follow hype he listened to someone who had done the research. Surround yourself with experienced mentors and learn from their conviction.

Action Step:

For everyday investors, this means studying credible voices and using tools like stock screeners and trend analysis platforms. Follow data, not noise.

If you’re interested in early-stage investing, platforms like Seedrs or Crowdcube offer equity in real companies for small amounts. The next BodyArmor could be hidden there.

How You Can Do the Same as an Everyday Investor

Here’s the truth: you don’t need to be a celebrity to make celebrity-style returns. You just need to follow ownership-based investing principles.

- Look for real value, not viral attention.

Study trends that reflect lifestyle changes sustainability, wellness, AI, automation, or health tech. - Start small but consistent.

Even £50 a month into ETFs or innovative companies compounds massively over time. - Invest in what you understand.

Kobe knew fitness. LeBron knew culture. Harden knew trust. Invest in your circle of competence. - Play long-term games.

Most people quit too early. The biggest gains come from holding the right assets through time.

Automation and Systems for Smart Investors

Modern investors can replicate celebrity-level insight using AI, data analytics, and automated tools.

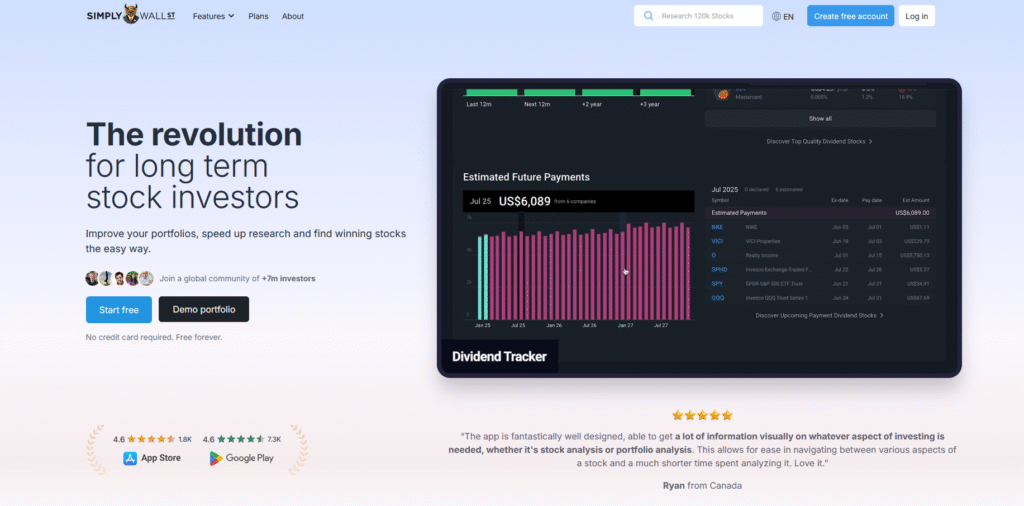

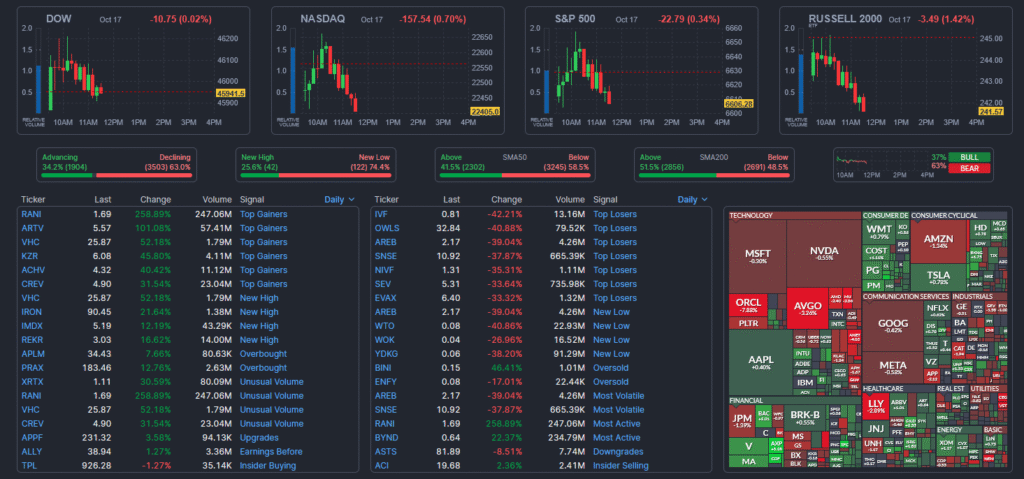

- Use platforms like Simply Wall St or Finviz to analyze companies visually.

- Set alerts for industries with rising demand (e.g. Forex, clean energy, fintech, biotech) with MSP 2.5 Software.

- Automate contributions through robo-advisors such as Wealthify, Nutmeg, or Vanguard.

This removes emotion from your process the same principle Kobe applied when he held BodyArmor quietly for years.

Evaluation Methodology

This report draws from:

- Verified financial data on BodyArmor and Beats by Dre acquisitions.

- Interviews and case analyses published on Forbes, and Investopedia.

- Lessons applied from real-world investment psychology and consumer behavior studies.

Wrapping Up

You don’t need to wear a jersey to win like an athlete.

What Kobe, LeBron, and Harden really mastered wasn’t product picking it was pattern recognition. They saw how the world was changing, and they acted before everyone else did.

You can do the same. Focus on ownership, patience, and alignment with real trends. Start small. Stay consistent. And remember, your wealth grows in silence, then multiplies in time.

Extra Reading

The Zero Property in Trading: Why Even Skilled Traders Fail The Billionaire Divorce, Nintendo’s $100B Empire, and Why Stablecoins Terrify Banks

Which of these celebrity investments inspired you the most?

Leave a comment and share what kind of company you’d invest in next.

Trading Risk Disclosure

Trading foreign exchange, stocks, options, or futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.

0 responses to “How Kobe Bryant, LeBron James, and James Harden Turned Small Bets into Millions And How You Can Too!”