Your cart is currently empty!

Category: Money Blog Series

5 Powerful Ways to Make Money Working With Real Estate Agents in Dubai

Dubai’s real estate market is a goldmine — not just for agents, but also for entrepreneurs who know how to support them.

If you’re thinking outside the box, there are smart ways to build income streams by helping estate agents grow their business, close deals faster, and look more professional.

Here are five creative ways you can make money working with real estate agents in Dubai:

1. Launch a Luxury Car Rental Subscription for Agents

First impressions matter — especially in Dubai’s competitive real estate market.

Set up a luxury car rental promotion bundle, offering estate agents the option to rent a high-end vehicle on a weekly rotation. A fresh, impressive car every week helps agents build trust and authority with clients.

Package this as a monthly subscription service, and you’ll create a consistent, scalable business model.

2. Start a Marketing Agency for Estate Agents

Estate agents are constantly searching for new leads — and most of them need help with marketing.

Create a specialized marketing agency that focuses on real estate. Offer services like targeted ads, SEO, social media growth, and organic lead generation.

By becoming the go-to marketer for Dubai’s real estate agents, you can secure recurring clients and build a profitable agency.

3. Set Up an Affiliate Partnership with a Tailor Shop

In real estate, appearance is everything. Agents need sharp suits to close big deals.

Partner with a tailor shop and create an affiliate referral system. Share your unique referral link with estate agents, business partners, and colleagues.

Every time someone orders a tailored suit through your link, you earn a commission — all while helping agents look their best.

4. Refer Business Clients to Estate Agents and Earn Big Bonuses

Russia’s Crypto Sandbox: Bank of Russia’s New Exchange for Elite Investors

Russia’s Crypto Stance to Date

Since 2021, Russia has maintained a blanket ban on using cryptocurrencies as a means of payment, even as it has quietly permitted mining and certain cross-border settlements under tightly controlled conditions. In January 2021, Russia’s first comprehensive crypto law came into force, outlawing domestic payments in Bitcoin and other tokens while allowing mining under license and enabling Russian entities to use digital assets for foreign trade purposes — notably to circumvent Western sanctions on the ruble-financed economy ReutersInterfax. The upshot: crypto trading has largely been driven offshore or conducted in legal limbo, with no state-sanctioned domestic venue for buyers and sellers.

The New Proposal: A State‐Backed Exchange for “Super-Qualified” Investors

On April 23, 2025, Finance Minister Anton Siluanov announced that the Ministry of Finance and the Bank of Russia will jointly launch a cryptocurrency exchange—but exclusively for so-called “super-qualified” or “highly qualified” investors, under a three-year Experimental Legal Regime (ELR) outside Russia’s ordinary banking system CointelegraphBitcoin Magazine. Siluanov emphasized that this pilot is designed to legalize crypto assets domestically, “bringing crypto operations out of the shadows,” while still upholding the ban on crypto as a payment method for the broader population Interfax.

The Experimental Legal Regime (ELR)

Rather than integrating crypto trading into existing financial infrastructure, Russia will treat this exchange as a sandbox pilot:

-

Duration: 3 years under the ELR, after which regulators will assess outcomes.

-

Scope: Transactions permitted only within the ELR framework—no retail participation.

-

Legal Isolation: Activities will be ring-fenced from the domestic payment system, avoiding conflict with Russia’s crypto payment ban.

This approach mirrors other jurisdictions’ sandboxes, allowing regulators to test market mechanics, risk controls, and compliance processes before broader roll-out CointelegraphInterfax.

Who Qualifies? Wealth and Income Thresholds

To gain access, investors must meet stringent asset or income requirements. Early proposals (still under parliamentary discussion) set the bar at:

-

≥ 100 million ₽ (≈ $1.2 million) in securities and/or bank deposits,

-

or ≥ 50 million ₽ (≈ $600 000) in annual income.

These thresholds, floated by the Central Bank in March, are not yet final. Osman Kabaloev, Deputy Director of the Finance Ministry’s Financial Policy Department, stressed that “these indicators may be adjusted in one direction or another” amid ongoing debates with lawmakers Bitcoin MagazineInterfax.

Building the Platform: Exchanges and Instruments

Several major Russian venues are already positioning themselves:

-

Moscow Exchange: Vladimir Krekoten, MD for Sales & BizDev, says the bourse is at “maximum level of readiness” to launch crypto-linked derivatives in 2025, potentially layering futures and options on top of spot trading capacity Bitcoin Magazine.

-

SPB Exchange: The St. Petersburg-based venue has signaled its support for diversified crypto products tied to token values, aiming to broaden investor offerings once the ELR regime is formalized Bitcoin Magazine.

-

New Entrants: Regulators are weighing the entry of niche crypto platforms—subject to strict licensing—alongside existing infrastructure, to foster competition within the pilot Interfax.

Why Now? Sanctions, Budget Diversification, and Market Development

Several forces are converging to push this pilot forward:

-

Sanctions Workarounds

Russia’s attempts to use crypto for foreign trade have intensified after SWIFT restrictions 📉; Bitcoin and other tokens offer a quasi-sovereign settlement layer beyond Western banking rails Reuters. -

Reducing Hydrocarbon Dependence

With oil and gas revenues slated to drop from ~40% of budget receipts to ~23% by 2027, authorities see digital assets as a non-oil lever to broaden state finances and grow capital market activity Reuters. -

Taming the Gray Market

By providing a regulated domestic venue for wealthy Russians—and by insisting on full KYC/AML compliance—officials hope to channel offshore crypto flows back into sanctioned Russian frameworks CointelegraphFXStreet.

Potential Impacts: From High-Stakes Trading to Broader Adoption

1. High-Rolling Investors

Qualified individuals gain direct access to Bitcoin, Ethereum, and other tokens with on-chain transparency, enabling portfolio diversification and sophisticated hedging strategies via futures and options.

2. Maturation of Russia’s Capital Markets

Introducing crypto derivatives and digital asset custody services under state oversight could spawn a local ecosystem of institutional managers, custodians, and blockchain-native fintech startups.

3. Regulatory Precedent

Should the ELR prove effective, Russia may consider expanding access to “qualified” investors beyond the super-qualified tier, or even easing its broader crypto payment ban over time.

4. Sanctions Efficacy and International Response

A state-sponsored exchange could complicate Western efforts to monitor and sanction illicit flows. Expect heightened scrutiny from the U.S. Treasury, FATF, and EU regulators, potentially accelerating AML/CFT adjustments.

Risks and Open Questions

-

Concentration Risk: Allowing only a tiny pool of whales could lead to illiquid markets and price manipulation.

-

Legal Uncertainty: Parliament’s ongoing debate over eligibility criteria may delay or dilute the pilot’s scope Interfax.

-

Market Skepticism: As Igor Danilenko of Renaissance Capital warns, crypto assets can resemble “pyramid schemes” without real collateral, challenging long-term investor confidence Bitcoin Magazine.

-

Technology & Security: Building a robust, hack-proof platform at scale remains a non-trivial engineering feat.

Looking Ahead

If the pilot launches in late 2025 and meets its goals over the next three years, we could see:

-

Wider Access: A tiered “qualified investor” model for seasoned traders and asset managers.

-

New Products: Introduction of tokenized securities, stablecoin-pegged instruments, and on-chain ETFs.

-

Payment Reforms: Gradual re-evaluation of the crypto payment ban as regulators grow comfortable with controlled use cases.

In the broader geopolitical chessboard, Russia’s experiment is emblematic of a global trend: state-backed sandboxes that seek to corral crypto innovation under sovereign oversight. The outcome will determine whether Russia remains on the periphery of digital finance or emerges as a pioneer in regulated crypto markets.

-

Top Hedge Funds in 2025 & Should You Start One? vs. Trading at a Prop Firm

📊 Introduction

As we step into 2025, hedge funds continue to dominate headlines — not just for their record-breaking profits but for the opportunity they represent. From Citadel’s billions in returns to D.E. Shaw’s double-digit gains, many traders dream of managing their own fund. Yet, the alternative — trading at a prop firm — has become a booming gateway for ambitious traders thanks to low overhead and access to firm capital.

In this comprehensive guide, we dive deep into:

The top-performing hedge funds The pros and cons of starting your own fund vs prop firm trading And a powerful edge: the software tools both professionals and independent traders are using in 2025 — including the standout AF Software Suite.

🚀 Top Hedge Funds by AUM (Assets Under Management) in 2025

Rank Firm AUM (USD billions)

1 Bridgewater Associates $89.6

2 Man Group $77.5

3 Elliott Investment Management $69.7

4 Millennium Management $67.9

5 Citadel LLC $63.4

These firms manage billions, attract elite talent, and utilize cutting-edge strategies — powered by advanced analytics, automation, and proprietary tools.

💰 2024 Hedge Fund Returns & Profits

D.E. Shaw Oculus Fund: +36% return Citadel Wellington Fund: +15.1% Millennium Management: +15% Schonfeld Advisors: +19.7% Industry-Wide Return: +15.7% average

With over $93.7 billion in total net profits, the hedge fund industry cemented its dominance — but is it right for you?

💼 Hedge Fund vs Prop Firm: Strategic Comparison

🛠️ Software Used by Hedge Funds

Hedge funds typically utilize high-end platforms that combine execution, analytics, and risk management, including:

Bloomberg Terminal Eze EMS / OMS FactSet Charles River IMS Palantir Foundry (for big data hedge funds) Python/R/Matlab for algorithmic modeling

These platforms offer deep data access, but come with steep learning curves and subscription costs in the thousands per month.

⚙️ Software Tools for Prop Traders & Retail Hedge Fund Founders

While traditional hedge funds lean on institutional software, independent traders are turning to modern, intuitive tools like the AF Software Suite — a powerhouse for short-term, swing, and algorithmic traders alike.

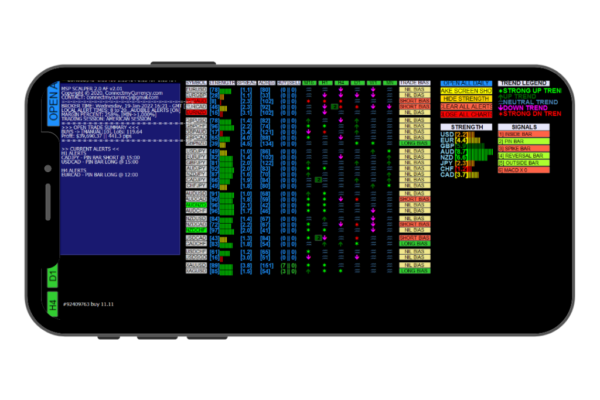

🔹 AF Blitz Scalper Trade Copier and Mentorship

Type: Real-time scalping interface Best For: Fast-paced prop traders and scalpers Features: Instant execution signals Entry/exit timing optimization Benefits: Eliminates hesitation Boosts accuracy in high-volatility conditions Works with any prop firm that supports any platform including the popular C Trader, MetaTrader, NinjaTrader, or TradingView platforms.

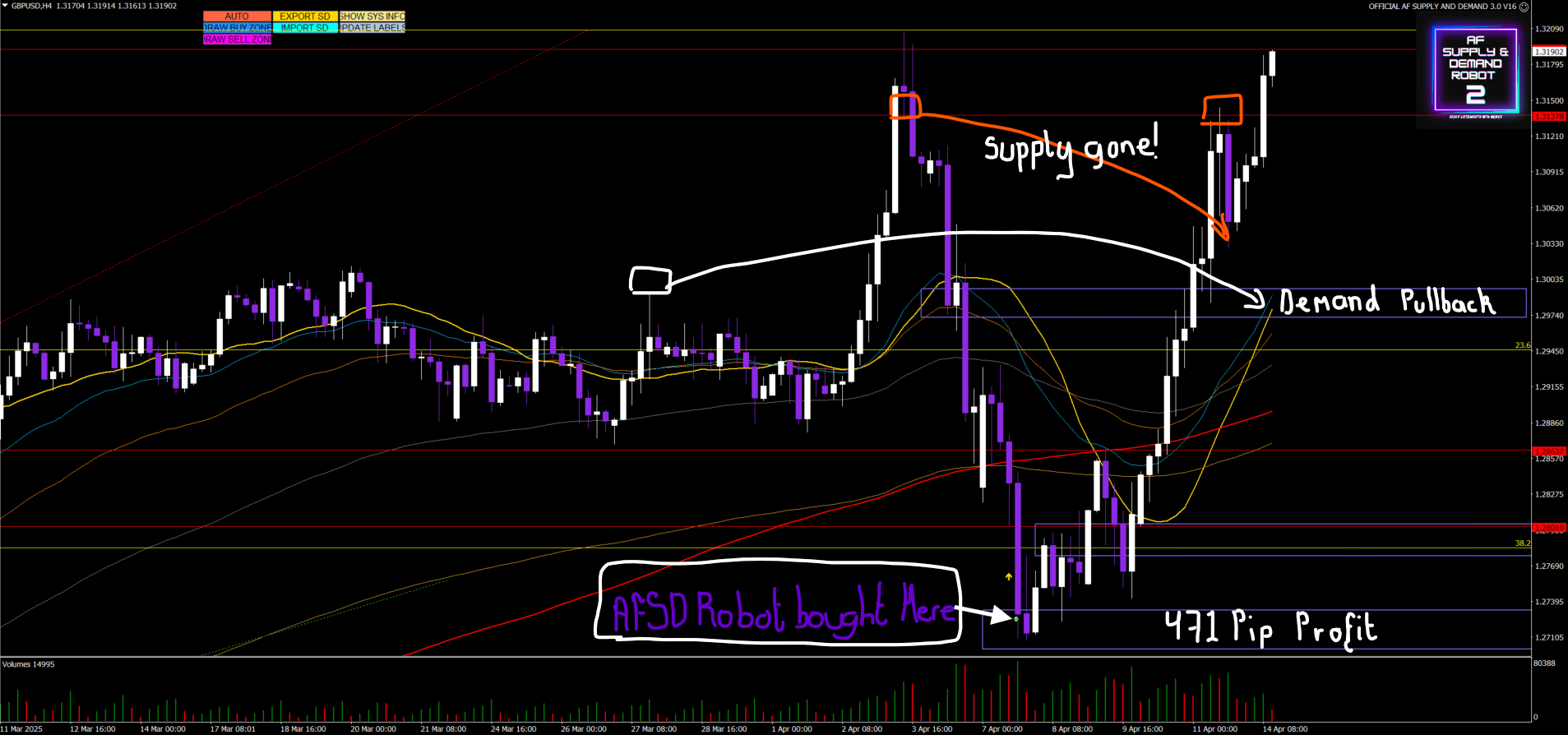

🔹 AF Supply and Demand 3.0 Software

Type: Market structure analysis tool Best For: Swing traders, hedge fund quants Features: Visual mapping of supply and demand zones Customizable alerts Works across Forex, indices, crypto, and equities Benefits: Enhances trade confidence Detects institutional-level order flow Used in strategy development for both manual and automated systems

🔹 MSP ( Signal Software Pro)

Type: Advanced pattern price action recognition and market context tool Best For: Professional strategists, data-backed hedge funds Features: Detects distinct price action signals Layered market structure forecasting Supports backtesting & live strategy adjustment Benefits: Aligns entries with institutional strategies Reduces false signals Ideal for hybrid discretionary-quant trading setups

🔚 Conclusion: Choose Your Weapon

Whether you’re building a billion-dollar fund or mastering a prop trading account, your edge in 2025 is in strategy + software.

Start a hedge fund if you’re ready to raise capital, manage clients, and scale big. Trade at a prop firm if you’re focused on skill, low overhead, and short-term performance. Use the right tools — and the AF Software Suite is one of the best in the game for independent traders aiming to compete with the pros.

Hedge Fund Investment Strategies

Hedge funds are among the most powerful and enigmatic entities in global finance. Yet, when investors or analysts try to pin down what exactly hedge funds do, the answer isn’t always clear-cut. That’s because hedge fund strategies are as diverse as the markets they operate in.

They’re often labeled “speculators,” “gunslingers,” or “macroeconomic players,” but in reality, hedge funds pursue a broad range of strategies. They operate with the goal of making profits for themselves and their investors—whether the market goes up or down.

Introduction to Hedge Fund Strategy Complexity

Unlike traditional mutual funds, hedge funds are not bound by strict investment rules. This freedom allows them to adopt strategies based on arbitrage, macroeconomic assumptions, or specific pricing inefficiencies. As a result, classifying them into one-size-fits-all categories is almost impossible.

Each hedge fund typically outlines its approach in a prospectus, but even then, there’s room for creativity. Some funds mix several strategies, adapting as markets shift. Others are hyper-focused. This makes hedge fund investing both exciting and unpredictable.

What Drives Hedge Fund Investment Decisions?

At their core, hedge funds are designed to:

Maximize profits Manage or exploit risk Capitalize on market inefficiencies

These goals can lead hedge funds to:

Take views on macroeconomic policies or interest rate movements Use arbitrage opportunities in pricing mismatches Hedge against downturns using derivatives

Core Strategy Types in Hedge Funds

There are three primary categories of strategies in hedge fund literature:

1. Arbitrage-Based Funds

These funds profit by exploiting price discrepancies in similar or related financial instruments—think convertible bonds, equity arbitrage, or merger arbitrage. The assumption is that price gaps will eventually converge.

2. Macro Funds

Macro hedge funds bet on large-scale economic trends—like interest rate changes, geopolitical shifts, or currency fluctuations. They use economic models and policy changes to anticipate price movements.

3. “All Else” Category

This includes more specific or unconventional strategies. They may focus on sectors, regions, or use unique data-driven models. The diversity within this group shows how creative hedge funds can be.

Examples of Instruments Used by Hedge Funds

Hedge funds use a wide array of instruments, but they often fall into these categories:

Spot or Cash Instruments – Stocks, bonds, currency Futures, Forwards, and Swaps – Contracts based on future pricing Options and Contingent Claims – Rights or conditions based on future actions

Each instrument carries unique risks and return profiles.

How Hedge Funds Choose Instruments

While some hedge funds stick to instruments mentioned in their official documents, many select tools based on market conditions. Just because a fund hasn’t used swaps in the past doesn’t mean it won’t in the future.

Selection is based on:

Ease of execution Regulatory or contractual freedom How well the instrument fits the strategy

Understanding Arbitrage and Macro Funds

Arbitrage Funds:

These funds look for price mismatches. For example, if two stocks in a merger are trading at different prices than expected, an arbitrageur might long one and short the other.

Macro Funds:

These are broader in scope. A macro fund might believe a country will raise interest rates and take a position in that country’s bonds or currency.

Risk and Return in Hedge Fund Strategy

Risk is never ignored in hedge fund investing.

Hedge funds examine:

Historical prices Volatility forecasts Market depth and liquidity

They may tolerate short-term losses for long-term gains—or vice versa—depending on their model.

Case Example: Trading Government Bonds

Imagine a hedge fund expects the Russian government to cut interest rates. They might buy Russian government bonds ahead of the announcement, betting prices will rise.

However, even if the trade seems obvious, the risk could include:

Currency devaluation Political instability Inaccurate forecasts

This example shows how a seemingly simple trade can carry multiple risk layers.

Derivatives and Hedging Tactics

Hedge funds use:

Futures contracts to lock in prices Options to bet on market moves with limited risk Swaps to manage interest rate or currency exposure

These tools help reduce losses and amplify gains when used wisely.

Common Misconceptions About Hedge Funds

Myth: Hedge funds are only for the ultra-rich.

Truth: Many hedge funds now allow lower minimums and serve a range of investors.

Myth: Hedge funds always take huge risks.

Truth: While some are aggressive, many hedge cautiously and even outperform safer mutual funds.

Classification Challenges in Hedge Fund Analysis

Hedge funds constantly evolve. A fund might start as macro-focused but shift toward arbitrage in response to market dynamics. This fluidity makes classification difficult—and it’s why reading each fund’s strategy and track record is essential.

FAQs

Q1: What’s the main goal of a hedge fund strategy?

To generate absolute returns, regardless of market conditions.

Q2: Are hedge funds always risky?

Not necessarily. Many hedge their positions to limit losses, not just to speculate.

Q3: What does “macro fund” mean?

A macro fund bases its strategy on global economic and political trends.

Q4: Can individual investors use hedge fund strategies?

Yes. Many of the tactics (like using ETFs or options) are available on public platforms.

Q5: Why do hedge funds use so many different instruments?

Because each instrument helps them fine-tune their exposure to risk and reward.

Q6: How do hedge funds hedge?

By using derivatives like futures or options to offset potential losses.

Final Thoughts: The Art and Science Behind Hedge Fund Strategies

Hedge fund investing is as much art as it is science. The best funds blend data, intuition, and discipline to craft strategies that deliver performance. As investors, understanding these strategies helps us demystify what happens behind the scenes—and make smarter decisions about where to allocate capital.

Whether you’re a beginner or an advanced investor, learning how hedge funds work gives you a powerful edge in the market.

6 Months to a New You: The Transformative Power of Consistency

What if everything you’ve ever dreamed of—better health, more money, stronger relationships, a thriving career—was only six months away? It might sound too good to be true, but here’s the catch: it is possible, if you commit to consistency.

This isn’t about working harder. It’s about showing up every day with small, repeatable actions that lead to big, lasting change.

Let’s break down how six months of consistent effort can be the single most transformative decision you make.

The Hidden Power of Daily Habits

The Compound Effect of Small Actions

Imagine investing just 1% more effort every day. Over six months, those tiny efforts stack up to create exponential growth. This idea, known as the compound effect, shows how even the smallest habits—like drinking more water, walking 10 minutes a day, or reading a few pages—can lead to profound changes.

Real-Life Examples of Life-Changing Habits

Waking up 30 minutes earlier to journal or plan your day Saving $5 daily instead of impulse buying coffee Replacing 30 minutes of screen time with reading or meditation

None of these sound hard—but done daily, they change your mindset, routines, and ultimately your outcomes.

Why Six Months Is the Magic Window

Psychology Behind the 6-Month Rule

Psychologists often talk about how it takes 21 days to build a habit and 90 days to make it a lifestyle. So what happens in six months? That’s when the new you becomes the default you.

By six months, your habits are automatic, your environment supports your goals, and your mindset is no longer questioning the process.

Habit Formation and Behavioral Science

The brain thrives on patterns. Repetition and reward strengthen neural pathways. Six months gives your brain time to fully adapt and automate positive behaviors.

What Can Really Change in Six Months?

Health & Fitness Transformations

Lose 20-30 pounds through daily walks and mindful eating Build muscle and energy with three workouts a week Improve sleep and mental health with better routines

Financial Improvements

Pay off thousands in debt by tracking expenses and sticking to a budget Build a $1,000 emergency fund Launch a side hustle that becomes a steady income stream

Career or Business Growth

Start a blog, podcast, or YouTube channel Upskill through daily learning on platforms like Coursera or LinkedIn Learning Network consistently and land job interviews

Mental Health and Mindset Shifts

Develop confidence through affirmations and goal setting Reduce anxiety with meditation and therapy Reframe limiting beliefs that hold you back.

The Role of Consistency in Achieving Success

Consistency vs Motivation

Motivation is fleeting. One day you have it, the next you don’t. But consistency? That’s the system you fall back on. It’s the decision to keep going, even when the feeling fades.

Building Discipline and Structure

Consistency breeds discipline. Discipline gives structure. Structure gives freedom.

How to Stay Consistent When Motivation Fades

Systems Over Willpower

Willpower is finite, but systems are sustainable. Create checklists, routines, and rituals that guide your day.

Tracking Progress and Rewarding Yourself

Use a habit tracker, journal, or app like “Habitica” or “Streaks.” Celebrate small wins: a new book finished, a week of workouts completed, or $100 saved.

Step-by-Step Plan to Transform Your Life in 6 Months

Month 1: Foundation & Clarity

Start with clarity. Ask yourself:

What do I want to change? Why does this matter to me? Who do I want to become?

Create SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) and break them down into weekly actions. Begin tracking your habits with a simple journal or an app like Habitica, Streaks, or Notion.

Focus areas:

Sleep schedule Hydration 30 minutes of daily movement 1% daily progress

Month 2: Build Routines That Stick

Consistency comes from systems. Set up routines for morning and night that reinforce your goals. Automate positive behaviors—like meal prepping on Sundays or scheduling workouts ahead of time.

Daily practices to include:

10 minutes of journaling Reading 10 pages of a book Weekly goal review Limiting distractions (e.g., social media detox)

Month 3: Keep Momentum with Midpoint Motivation

This is where people usually quit—but not you. Revisit your goals and assess progress. Make adjustments if necessary. Double down on what’s working.

Pro tip: Create a “done list” of accomplishments to keep yourself motivated. It’s a game changer for tracking progress.

Month 4: Double Down on Discipline

Now that your habits are formed, it’s time to refine your discipline. Cut out activities that drain energy and protect your focus like it’s gold.

Strategies:

Time-blocking your calendar Saying “no” to distractions Practicing deep work (try the Pomodoro Technique) Reflecting on how far you’ve come

Month 5: Growth Mode Activated

By now, your confidence is rising. You’ve proven to yourself that change is possible. Use this momentum to scale your efforts. Maybe you start a passion project or increase your financial savings.

Growth tactics:

Learn a new skill or enroll in a course Increase intensity in workouts Improve diet and meal variety Join a mastermind or accountability group

Month 6: Transformation Realized

This is where the magic happens. You’re not just doing different things—you’ve become someone new. Look back at Month 1. You’ll be amazed at how far you’ve come.

Celebrate it. Share your story. Inspire others. And most importantly, set new 6-month goals.

Common Pitfalls and How to Avoid Them

1. All-or-Nothing Mentality

Missed a day? That’s okay. What matters is you come back. Progress isn’t linear—don’t let one bad day derail the entire journey.

2. Comparing to Others

Your journey is yours alone. Stay focused on your progress. Social media can be misleading—most people only share their highlight reel.

3. Burnout

Pace yourself. Build rest and fun into your routine. Without joy, consistency becomes a chore.

The Science Behind the 21/90 Rule

According to behavioral psychologists, it takes about 21 days to build a habit and 90 days to turn it into a permanent lifestyle. Six months gives you twice that buffer, allowing for setbacks, growth, and sustainability.

This rule is the perfect framework to anchor your transformation.

Case Studies: People Who Changed Their Lives in 6 Months

Jasmin – Lost 40 Pounds and Gained Confidence

Through simple meal prepping, 4 weekly workouts, and journaling, she transformed her health and self-image.

Carlos – Paid Off $10,000 in Debt

He tracked every dollar, automated savings, and picked up freelance work. In six months, he was debt-free and empowered.

Amina – Launched a Successful Online Business

Using consistent blogging and email marketing, she built a brand that now earns her passive income—all from scratch.

Morning Routines That Build Long-Term Consistency

Wake up at the same time daily Hydrate and stretch for 5–10 minutes Review your goals Practice gratitude or journaling Tackle the hardest task first (MIT: Most Important Task)

Evening Rituals to End the Day Strong

Unplug 1 hour before bed Reflect on wins and lessons of the day Set intentions for tomorrow Read something uplifting Prioritize sleep quality (cool room, dark, quiet)

The Role of Accountability and Support

Accountability boosts your consistency by over 65%. That’s huge.

Ways to stay accountable:

Join an online challenge or coaching group Partner with a friend Hire a mentor or coach Share your journey publicly (blog, YouTube, social)

The Mindset Shift: From Short-Term to Long-Term Thinking

Six months feels far away—until it isn’t.

Shift your mindset to play the long game. Think like a gardener, not a gambler. Plant the seeds, water them, and watch them grow.

Digital Detox and Focus Techniques

Limit phone use to specific hours Use app blockers like Freedom or Forest Practice mindfulness or meditation daily Replace screen time with creation or connection

FAQs

Q1: Is six months really enough time to change my life?

Yes! With consistent effort, six months is enough to see visible and meaningful results in health, finances, mindset, and more.

Q2: What if I miss a day or fall off track?

Don’t worry. Get back on track the next day. Progress is about trends, not perfection.

Q3: How do I stay motivated for six months?

Focus on systems over motivation. Create routines and use accountability partners or apps to stay engaged.

Q4: What are the best tools for tracking progress?

Habit-tracking apps, bullet journals, spreadsheets, or vision boards work well. Choose what suits your style.

Q5: Can I work on multiple goals at once?

Yes, but start small. Focus on 1–2 core goals at a time to avoid overwhelm.

Q6: What’s the most important thing to remember?

Consistency beats intensity. Daily small actions matter more than big bursts of energy.

Final Thoughts: Start Today, Not Tomorrow

You’re only six months away from changing your life.

You don’t need to wait for the new year, the perfect moment, or a sign from the universe. The sign is this article. Start now. Start small. Stay consistent.

Because six months from now, you’ll either be glad you started—or wish you had.

How Passive Ambition is Keeping You Stuck: Break Free With This Simple Formula

What Is Passive Ambition?

You dream of freedom, success, and fulfillment. You want the big life—the business, the flexibility, the wealth. But something’s holding you back. You stay in your comfort zone. You avoid risks. You wait for the “right” time. Sound familiar?

That’s Passive Ambition.

Passive Ambition is the illusion of desire without the commitment to act. It’s dreaming of more while playing it safe. It’s craving change but avoiding uncertainty. It’s wanting the rewards without stepping into discomfort.

And here’s the catch:

The same instincts keeping you safe… are also keeping you small.

The Real Cost of Playing It Safe

So many people unknowingly follow a blueprint for stagnation. It feels like they’re being smart—saving money, avoiding mistakes, staying “secure.” But in reality, this strategy has a steep hidden cost.

Let’s break it down.

Step 1: Don’t Take Any Action

Play it safe. Do the minimum. Show up, collect the paycheck, and let someone else decide your path.

Don’t raise your hand. Don’t share your ideas. Don’t take initiative. Wait for “one day” to finally do the thing.

The problem? “One day” is the most expensive day of the year.

The more you delay action, the more you pay in lost time, lost momentum, and lost growth. There’s even a name for it:

The Price of Inaction.

Inaction compounds. It silently costs you opportunities, confidence, and clarity.

Step 2: Take Action You Barely Understand

Some people recognize they’re stuck and try to break out—but without direction. They confuse action with progress. They mistake movement for momentum.

Here’s what that looks like:

Buying a business you’ve never seen Jumping at an investment you can’t explain Launching a product without a plan Switching careers without strategy

Ambition without understanding isn’t bold. It’s reckless. And recklessness doesn’t make you rich—it makes you broke.

The Formula That Actually Works

So if inaction keeps you small and reckless action makes you vulnerable… what’s the alternative?

Smart Risk.

Here’s the winning formula:

SMART RISK = (Skill + Preparation) × Action

Smart risk means taking calculated steps.

You study the terrain. You build your skills. You prepare. Then, you move decisively.

You don’t need all the answers, but you do need a plan.

You’re not guessing. You’re betting wisely.

Why Smart Risk Is the Only Way Forward

Every successful entrepreneur, leader, and creator you admire once looked foolish. They started without approval. They took chances. And they often looked like they were flying blind.

But here’s what they had: conviction, clarity, and courage.

They built when no one was watching.

They risked failure to create freedom.

They felt the fear… and moved anyway.

You don’t need a perfect plan. You need motion.

The World Is Built By Movers

The world isn’t built by those who wait for permission—it’s built by those who just start.

No applause. No guarantees. No warm-up round. Just movement.

And movement leads to momentum.

That first awkward video.

That clunky first draft.

That nerve-wracking pitch.

Each one moves you closer to mastery.

Here’s the Truth Most People Avoid

No one’s coming to save you.

Not your boss. Not the economy. Not your partner. Not your dream job.

But here’s the flip side:

You might not need saving at all.

What if everything you need to grow is already inside you?

What if the real problem isn’t your job, your timing, or your tools…

What if it’s your unwillingness to bet on yourself?

5 Signs You’re Stuck in Passive Ambition

You wait for the “right time” to start You daydream but rarely execute You research endlessly but avoid decisions You envy others but justify your inaction You start things impulsively and give up quickly

3 Ways to Embrace Smart Risk Today

Invest in Skill Read. Practice. Take courses. Build experience that compounds. Make a Simple Plan Break your big goal into smaller, logical steps. Think direction, not perfection. Take One Aligned Action Don’t try to change your life in one weekend. Take one meaningful step today. Then another tomorrow.

Frequently Asked Questions

1. What is passive ambition?

Passive ambition is the desire for success without the willingness to take meaningful risks or actions. It’s dreaming of more but never committing.

2. How do I know if I’m being passively ambitious?

If you find yourself constantly saying “one day” or hesitating to act due to fear or overthinking, you’re likely stuck in passive ambition.

3. What is the difference between smart risk and reckless risk?

Smart risk involves preparation, skill, and thoughtful action. Reckless risk lacks strategy and is driven by impulse or desperation.

4. Why is inaction so costly?

Inaction leads to missed opportunities, wasted time, and decreased confidence. Over time, it compounds and becomes harder to escape.

5. Can I succeed without taking big risks?

Not necessarily. You don’t need to take reckless risks, but meaningful growth requires stepping outside your comfort zone and betting on yourself.

6. How can I start taking smart risks today?

Begin with clarity. Choose one goal, build the necessary skill, make a plan, and take small, consistent action. Focus on progress, not perfection.

Final Thoughts: You’re More Capable Than You Think

The scariest part of this journey is realizing no one’s coming to save you. But the best part?

You don’t need them to.

When you stop waiting, start preparing, and move with intention, everything changes.

You reclaim your power. You grow. You thrive.

It’s not about being fearless.

It’s about choosing courage—again and again.

What would your life look like if you gave yourself permission to go all in?