Your basket is currently empty!

Reading Time: 5 minutes

Category: Market Intelligence | Crypto Trading | Insider Activity

Key Takeaways

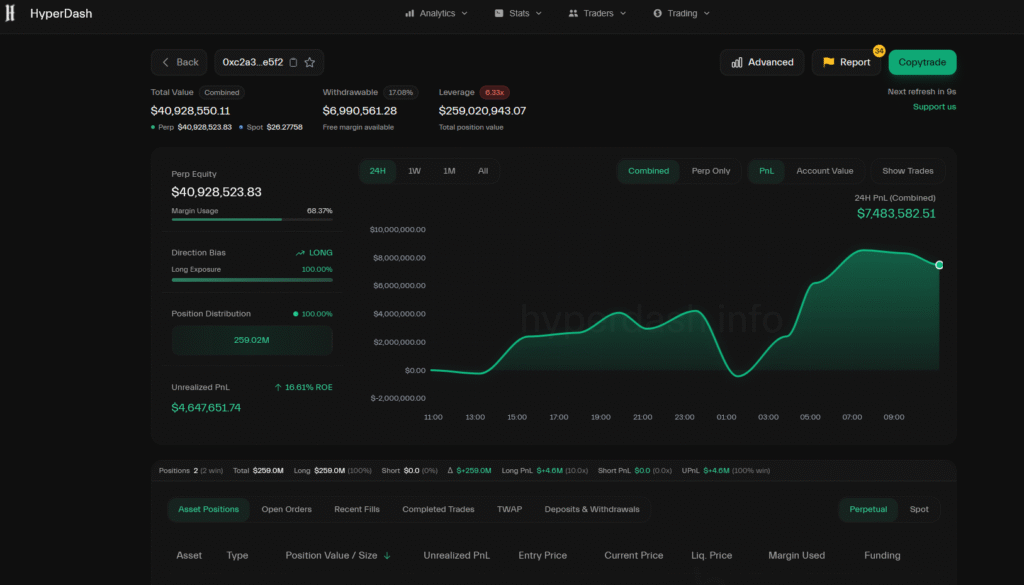

- A trader with a verified 100% win rate has just opened massive BTC and ETH long positions worth over $255 million.

- Historical data shows this insider’s previous short positions netted more than $4 million in profits in under 48 hours.

- Positions are live on HyperDash, with $178M in BTC longs (15x) and $80M in ETH longs (5x) showing high conviction in a major upside move.

- The timing coincides with a Federal Reserve conference on Bitcoin and digital payments, hinting at a possible institutional shift.

The Insider’s Track Record

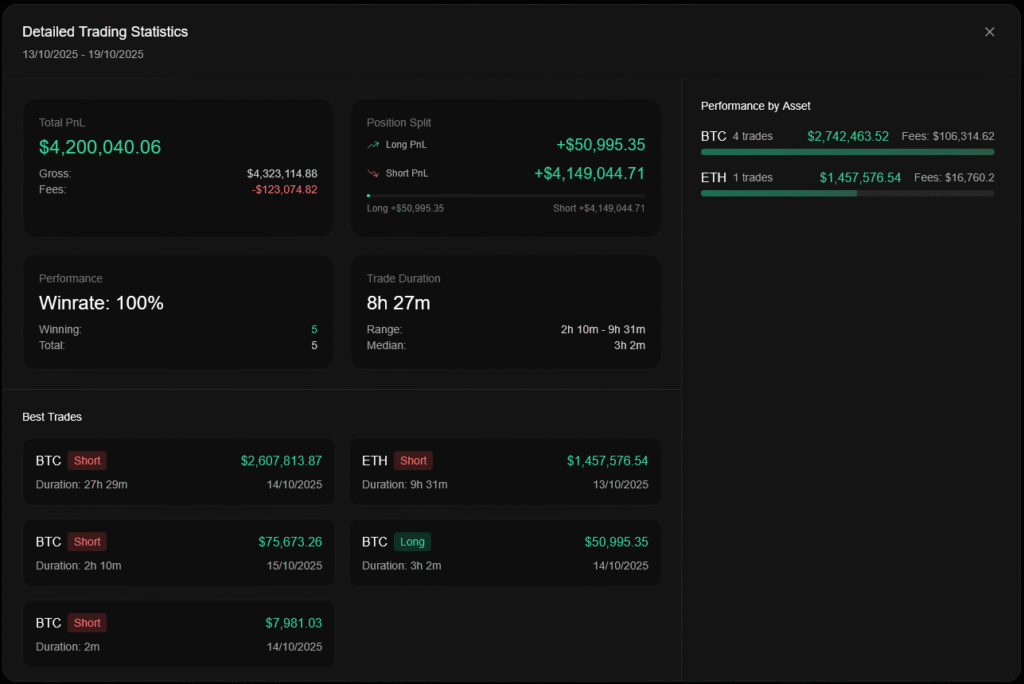

According to on-chain analytics from HyperDash.info, the trader’s performance between October 13th and 19th, 2025 is nothing short of extraordinary:

- Win rate: 100% (5 out of 5 successful trades)

- Average trade duration: 8h 27m

- Best trades:

- BTC Short: +$2.6 million profit

- ETH Short: +$1.45 million profit

Each position was closed in profit, suggesting elite-level timing and strategy. Now, this same trader has flipped from short to long with full leverage exposure a move that could anticipate upcoming institutional catalysts.

$255 Million Long Exposure: A Bold Reversal

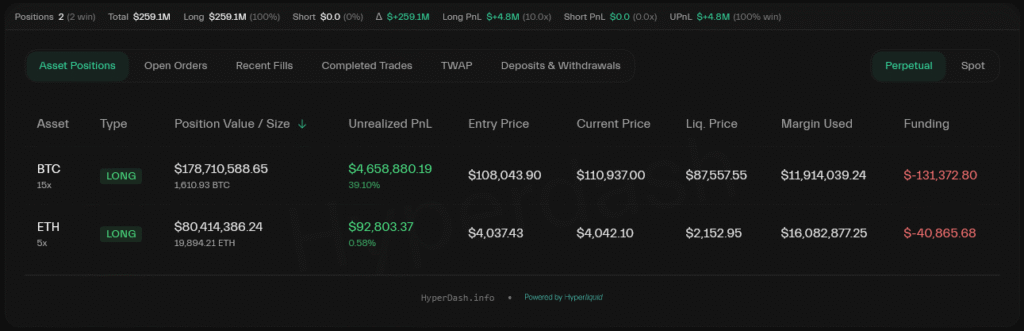

The insider has opened two new long positions valued at a combined $258.9 million:

| Asset | Type | Leverage | Position Value | Entry Price |

|---|---|---|---|---|

| BTC | LONG | 15x | $178,710,588 | $108,043 |

| ETH | LONG | 5x | $80,414,386 | $4,037 |

This reversal from shorting to aggressively longing both Bitcoin and Ethereum implies a strategic conviction, possibly based on unreleased institutional or macro data.

Analysts suggest that if these trades mirror the success of the last batch, the result could be a multi-billion-dollar swing in the broader crypto derivatives market.

Federal Reserve Conference Announcement: A Major Macro Catalyst

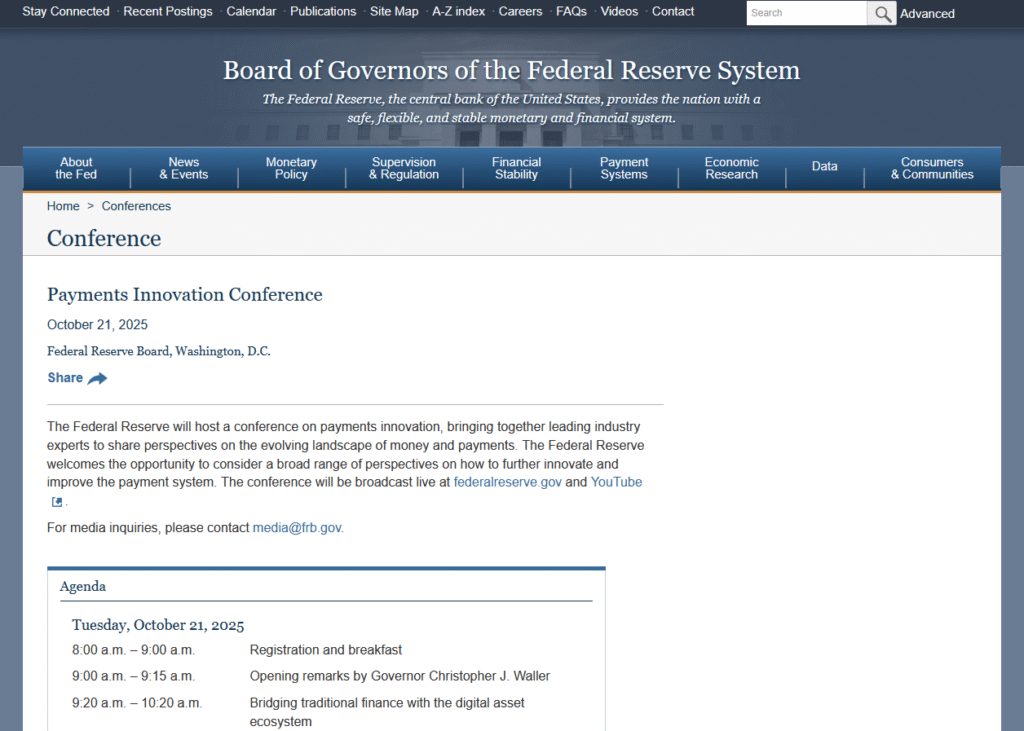

The timing of these trades coincides with a breaking announcement from the U.S. Federal Reserve.

Hours after the insider opened their positions, the Federal Reserve confirmed it will host a high-profile event titled “Payments Innovation: The Future of Money and Digital Assets”, set to begin October 21, 2025.

Official link: Federal Reserve Payments Innovation Conference

This conference will focus on:

- Bitcoin and digital payment systems

- Stablecoin regulation and interoperability

- Central Bank Digital Currencies (CBDCs)

- Public and private innovation in cross-border settlement

Federal Reserve Chair Jerome Powell is scheduled to speak, marking the first time the Fed has placed Bitcoin and decentralized crypto payments at the center of its monetary policy agenda.

The overlap between this policy event and the insider’s $255M long exposure is striking. Many traders believe this combination of insider activity and policy discussion could signal a coming institutional repricing of Bitcoin and Ethereum.

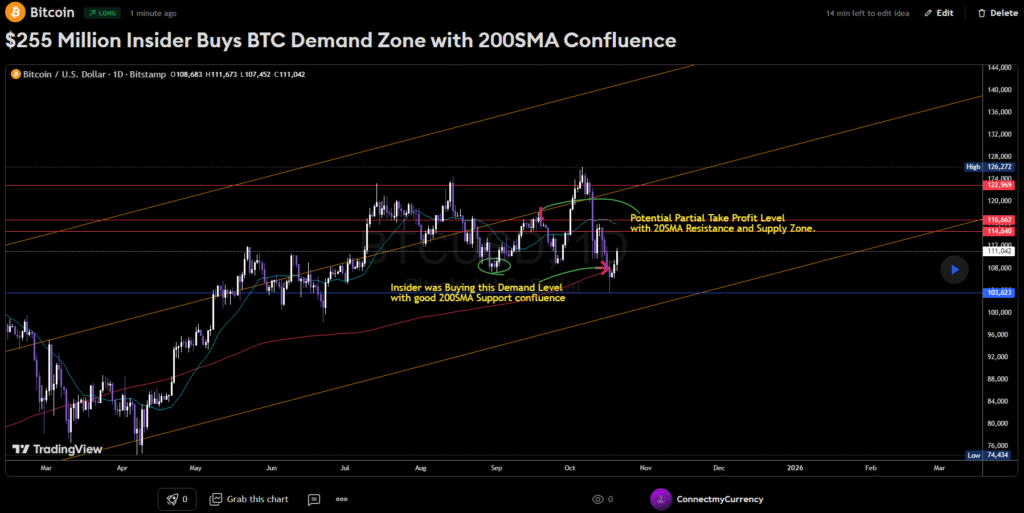

Technical Outlook: BTC/USD Key Levels

My current analysis on the daily chart shows Bitcoin holding steady around $110,800, trading just above the 200-day moving average.

Here are the technical zones to monitor:

- Immediate Resistance: $111,000 (current ask zone)

- Secondary Resistance: $114,640 (first structural ceiling)

- Major Resistance: $122,969 (top of current range, potential breakout trigger)

- Immediate Support: $108,000 psychological zone

- Major Support: $103,623 (200-day MA + lower channel base)

- High Target Zone: $126,272–$128,000 (top of ascending channel projection)

If BTC holds above $108,000, the structure supports a move toward $116K–$122K before any larger pullback.

A daily close above $122K would confirm the continuation toward the $126K–$128K target range.

A break below $108K, however, could lead to a retest of $103K, aligning with the lower boundary of your support channel.

This technical picture supports the insider’s long bias, implying they may be targeting the higher levels of this ascending range.

How Traders Can React

Tracking whale and insider positions through on-chain dashboards like HyperDash can provide asymmetric opportunities.

For most traders, copying such high-leverage plays is dangerous, but following the same directional bias with proper risk management can be an advantage.

Wrapping up

Trading data rarely lies. When an account with perfect accuracy suddenly loads a quarter-billion dollars in leveraged longs, and the Federal Reserve simultaneously announces a Bitcoin-focused conference, it paints a clear picture of what may come next.

Both on-chain data and macro events are converging at the same moment a rare alignment that could define the market direction for weeks ahead.

Stay sharp, trade small, and follow the smart money just not blindly.

Trading Risk Disclosure

Trading cryptocurrencies involves significant risk and may not be suitable for all investors. Leverage trading can amplify both gains and losses. This article is for informational purposes only and does not constitute financial advice.

0 responses to “Insider Alert: $255 Million Longs on BTC and ETH with 100% Win Rate Trader Strikes Again”