Your basket is currently empty!

Reading Time 5 minutes

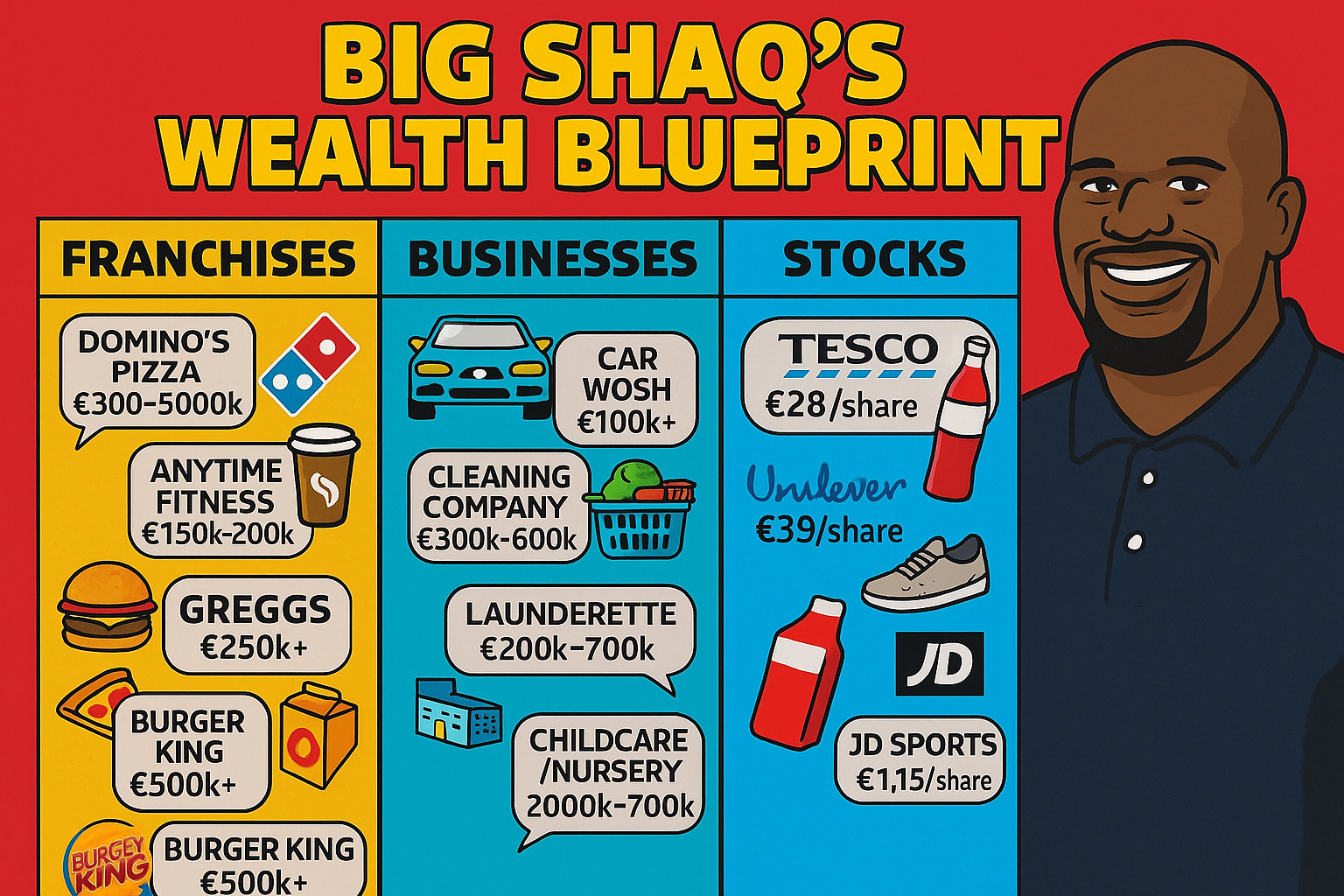

Shaquille O’Neal isn’t just a basketball legend he’s a business mogul. Today, he earns more from his investments than he ever did on the court. His secret? He doesn’t chase hype. He buys franchises, boring-but-profitable businesses, and even stocks of blue-chip companies.

This playbook isn’t limited to millionaires. With the right strategy, everyday investors in the UK can copy the same moves. Here’s how.

Path 1: Buy a Franchise

Franchises are plug-and-play empires. The brand, systems, and marketing are already proven. You’re buying a machine that’s already making money.

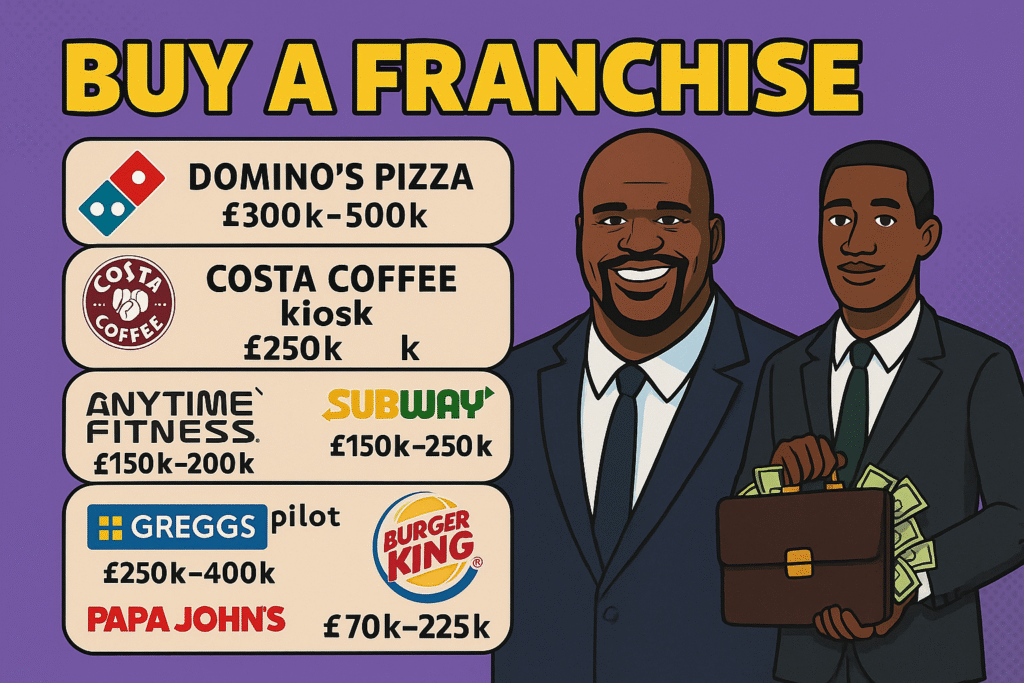

7 UK Franchise Examples:

- Domino’s Pizza Requires around £300k–£500k. High turnover, proven demand, especially in urban centres.

- Costa Coffee (kiosk model) £250k–£300k. Popular in airports, stations, and malls.

- Anytime Fitness £150k–£200k. UK health market is booming. Membership model = recurring revenue.

- Subway £150k–£250k. The UK has one of the densest Subway networks outside the US, but local high streets can still deliver steady sales.

- Greggs franchise pilot (limited rollout) Costs vary, often £250k–£400k. The UK’s most beloved bakery brand.

- Papa John’s Pizza £170k–£225k. Competing directly with Domino’s in certain areas.

- Burger King Entry is steep at £500k+, but you’re buying into a global powerhouse.

Franchises suit investors who want brand strength but are okay with paying royalties and following strict playbooks.

Path 2: Buy a Normal Business

This is the Shaq playbook on the ground. You buy cash-rich local businesses. They may look boring, but they print money every month.

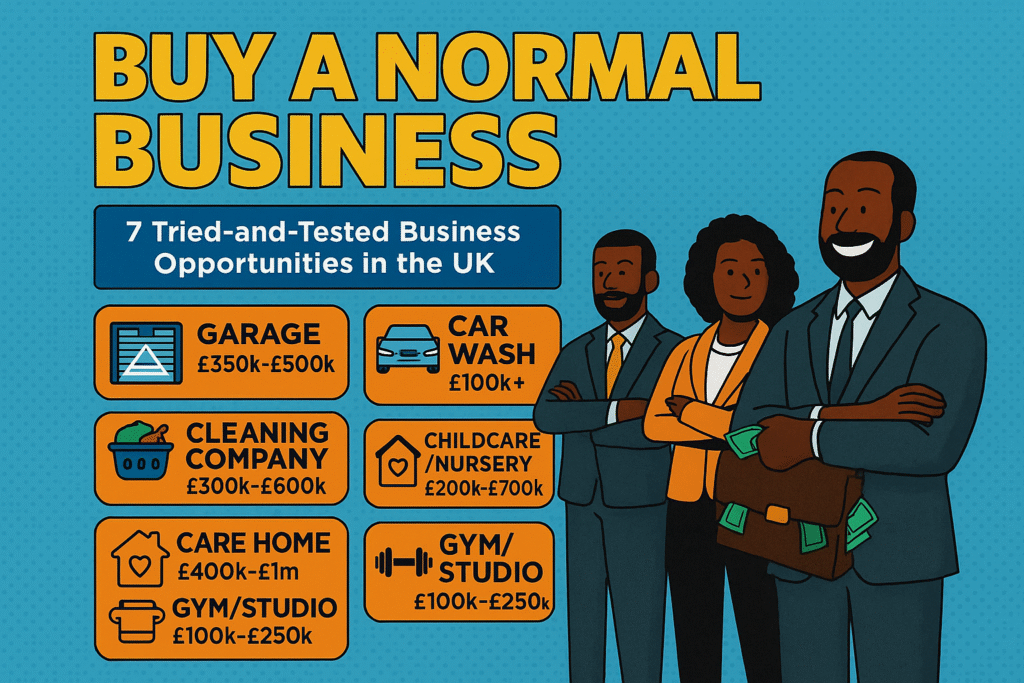

7 UK Business Examples:

- MOT Garage £350k–£500k to acquire a small one with steady contracts. Cars will always need inspections and repairs.

- Car Wash From £100k upwards. Low staff, constant demand. Shaq himself owns 150+ in the US.

- Cleaning Company £300k–£600k. Especially those with commercial contracts (schools, offices, councils).

- Launderette/Dry Cleaning Shop £100k–£200k. Steady local demand, often cash-based.

- Childcare/Nursery Business £200k–£700k depending on size. Government subsidies keep revenue flowing.

- Care Home (small-scale) £400k–£1m. High regulation but also high margins in the ageing UK market.

- Independent Gym/Studio £100k–£250k. Yoga, CrossFit, or boutique gyms thrive in middle-class suburbs.

These businesses can often be bought with 70–90% financing (through UK bank loans or seller financing). You’re essentially buying cash flow.

Path 3: Buy the Stock

Not everyone wants to manage staff, leases, or regulations. Buying stocks lets you own a piece of proven empires with almost no overhead.

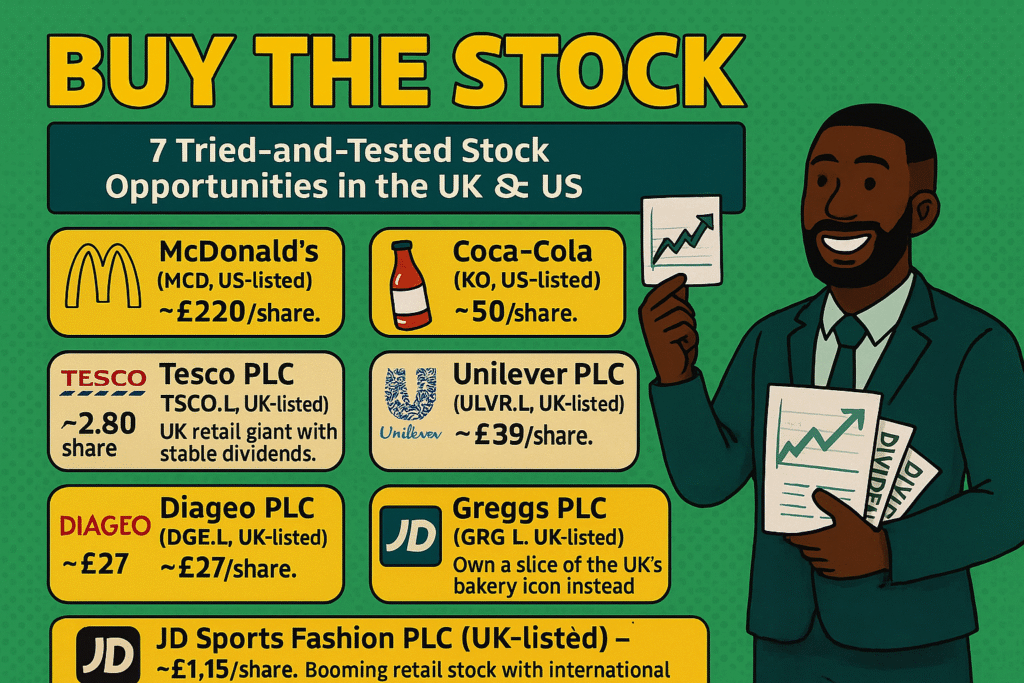

7 Stock Examples (UK-Friendly Picks):

- McDonald’s (MCD, US-listed) Around £220/share. Global dividend king.

- Coca-Cola (KO, US-listed) £50/share. Warren Buffett’s favourite income stock.

- Tesco PLC (TSCO.L, UK-listed) Around £2.80/share. UK retail giant with stable dividends.

- Unilever PLC (ULVR.L, UK-listed) £39/share. Owns brands like Dove, Ben & Jerry’s, and Hellmann’s.

- Diageo PLC (DGE.L, UK-listed) £27/share. Alcohol powerhouse with brands like Guinness and Johnnie Walker.

- Greggs PLC (GRG.L, UK-listed) £25/share. Own a slice of the UK’s bakery icon instead of a franchise.

- JD Sports Fashion PLC (JD.L, UK-listed) £1.15/share. Booming retail stock with international growth.

Stocks won’t give you the same explosive cash flow as a franchise or private business, but they’re the lowest-barrier way to start building wealth today.

How They Fit Together

- Franchise: Big upfront cost, lower risk, strong brand backing.

- Normal business: Mid-range entry, flexible, often higher cash flow.

- Stocks: Smallest entry cost, easiest to start, lowest stress.

A smart strategy is to layer them:

- Start with stocks (£100–£1,000).

- Use capital gains and savings to buy a small local business (£100k–£300k).

- Reinvest profits into a franchise empire (£300k+).

Shaq didn’t reinvent the wheel. He just bought businesses that would always have customers whether they sold burgers, washed cars, or poured pints.

Your wealth path doesn’t have to be glamorous. It has to be consistent. Start small with shares, scale into local businesses, and eventually step into the franchise game.

That’s how you turn “boring” into £7,000, £70,000, or even £700,000 per year.

0 responses to “Big Shaq’s $500 Million Blueprint: Franchises, Businesses, and Stocks You Can Copy”