Your basket is currently empty!

Author: Ewan Capital

-

This week brought some of the most jaw-dropping stories we’ve seen all year. Here’s what you absolutely need to know: Let me walk you through the most important stories from this week that nobody’s really connecting. Because when you look at these together, you start seeing patterns that most people miss. Key Takeaways The Drug…

-

Read Time: 7 minutes The Ultimate Trading Plan Journal: Free Download Want to fix these 10 signs immediately? We’ve created a complete, fill-in-the-blank Trading Plan Journal that walks you through building your own structured trading system step by step. Inside you’ll get: Goal-setting worksheetsRisk management calculatorsEntry & exit rule templatesDaily/weekly review checklistsPsychology & mindset trackers…

-

Artificial Intelligence is transforming the world, but it also demands an enormous amount of electricity to power large data centers and AI workloads. This places unprecedented pressure on our traditional power grids, which were not built for such dynamic and heavy energy use. The smart, AI-driven energy grid revolution is here and it’s opening exciting…

-

Let’s be honest talking about cars as “investments” usually makes purists roll their eyes. But here’s the thing: if you’re smart about it, buying the right car can actually be one of the most enjoyable ways to park your money. You get to drive something special, turn heads at the petrol station, and potentially make…

-

Artificial Intelligence (AI) is no longer just a buzzword it’s rapidly reshaping how we live, work, and consume energy. While many investors chase headline names like NVIDIA, Microsoft, or Meta, the world’s largest private equity firms are focusing on something more fundamental: the infrastructure that makes AI possible. Blackstone, the world’s biggest alternative asset manager,…

-

The landscape of retail trading has transformed dramatically over the past decade, and the recent emergence of accessible AI assistants has created an entirely new dimension of opportunity. What once required expensive research subscriptions, professional analysts, and years of education can now be supplemented by powerful AI tools like ChatGPT, Claude, Grok, and GitHub Copilot…

-

Reading Time 5 Minutes The ultra-wealthy don’t just focus on earning money they strategically engineer fake debt to minimize their taxable income while their real wealth grows exponentially behind the scenes. This isn’t about illegal debt but a sophisticated financial strategy involving multi-layered legal entities such as LLCs, trusts, and offshore companies. What Is Fake…

-

September 2025 has been a dramatic month for equity markets, with a select group of stocks attracting outsized attention thanks to their impressive rallies, transformative business shifts, and momentum in technology leadership. The following ten companies represent the most popular and widely traded assets on Wall Street, spanning sectors from artificial intelligence and data analytics…

-

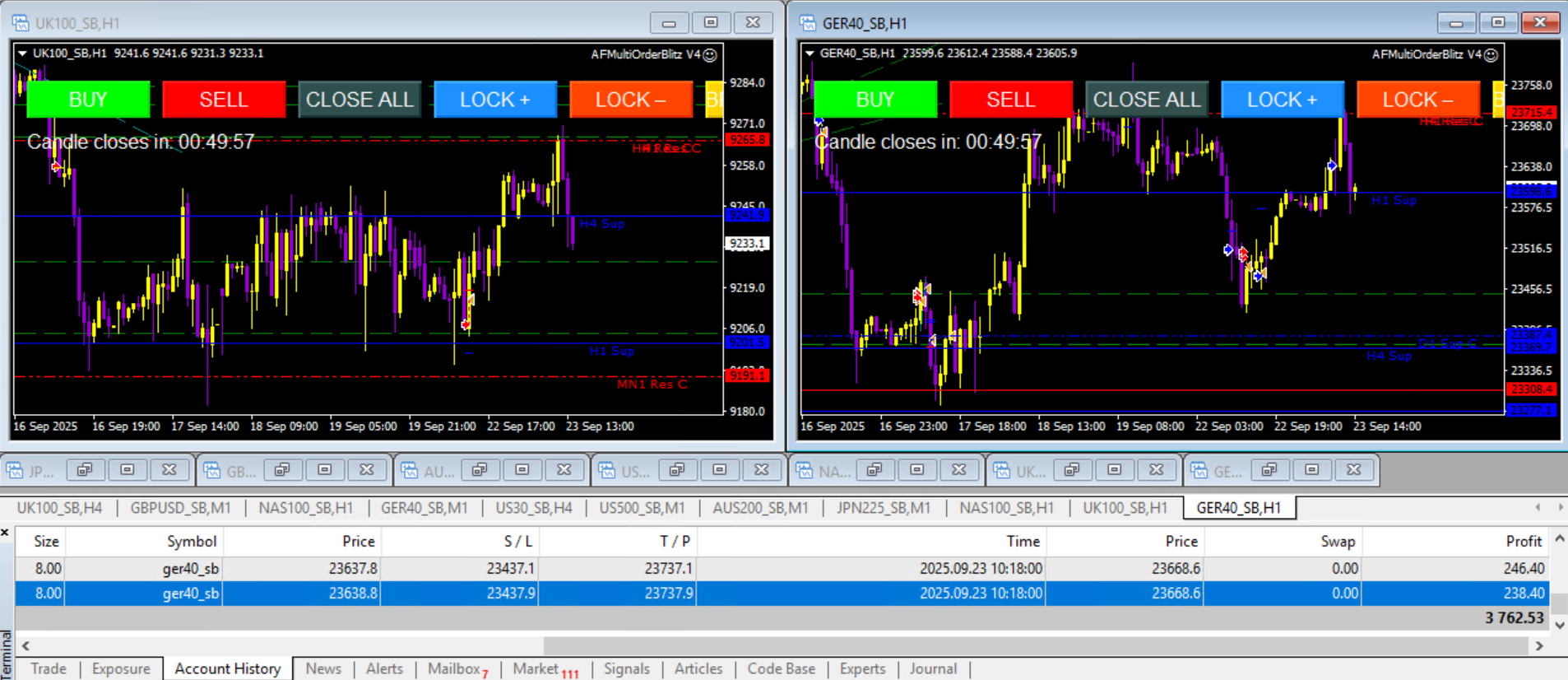

Last Updated: September 2025 | Reading Time: 12 minutes Table of Contents: Why 95% of Day Traders Lose Money: The Mathematical Truth Behind Trading Failure Did you know that 95% of day traders lose money within their first year? This isn’t just a statistic it’s a mathematical certainty rooted in what we call the Zero…

-

Water is one of the world’s most critical resources and yet it remains one of the most overlooked asset classes. While tech and AI dominate headlines, a quieter revolution is underway in water infrastructure, utilities, and water-management companies. Billionaires and institutional investors are increasing their exposure to this sector because they see steady growth, regulatory…

-

Artificial intelligence is no longer science fiction. It is the engine driving everything from self-driving cars to medical breakthroughs, from automated trading to voice assistants in your pocket. For investors, AI represents one of the biggest wealth-building opportunities of the 21st century. But where should you start? Which companies are truly positioned to dominate the…

-

When most people dream of owning a yacht, they imagine luxury, prestige, and leisure. For the ultra-wealthy, however, the yacht is only half the story. The real game is not about buying the vessel it is about making sure the world never knows who really owns it. This is why underground investors often use chains…