Your basket is currently empty!

Artificial Intelligence is transforming the world, but it also demands an enormous amount of electricity to power large data centers and AI workloads. This places unprecedented pressure on our traditional power grids, which were not built for such dynamic and heavy energy use. The smart, AI-driven energy grid revolution is here and it’s opening exciting investment opportunities for those who want to fuel the future of technology and sustainability.

Why the Power Grid Matters for AI Growth

The energy consumption of AI operations is staggering. For instance, generative AI platforms consume up to 10 times the electricity of a standard Google search. Yet, the grid that supplies this power is only now beginning to catch up with advances like AI-powered demand response and predictive balancing.

Smart grids equipped with AI technologies optimize energy flows, accommodate distributed energy resources like microgrids and storage, and reduce waste. This makes AI expansion sustainable rather than a looming energy crisis.

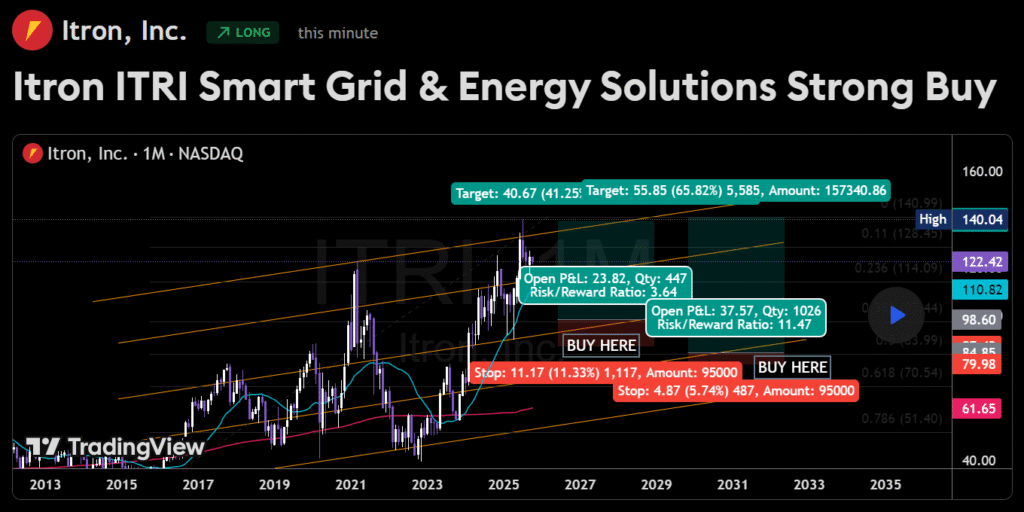

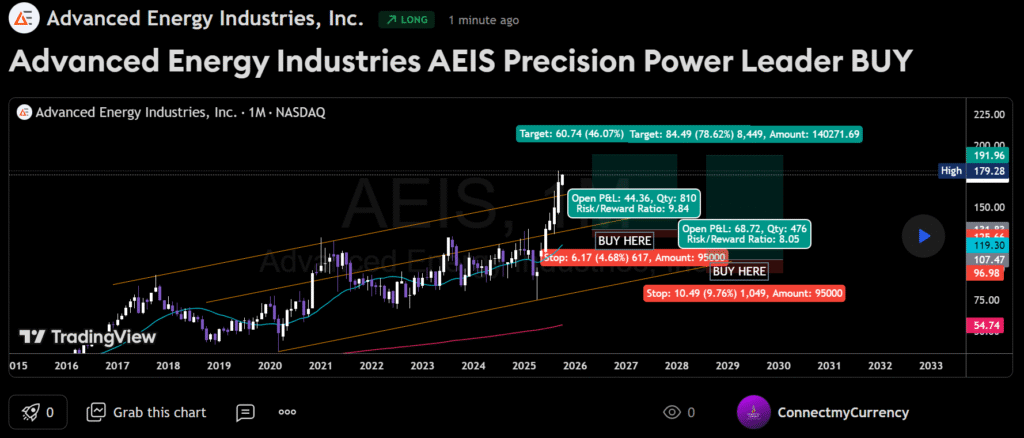

For investors, this transformation points to companies involved in grid modernization, smart meters, and AI software for utilities. Consider stocks like Itron (ITRI) (The Chart Above), a leader in smart grid solutions, or Advanced Energy Industries (AEIS), which provides precision power components crucial for data centers and renewables integration. These companies provide essential infrastructure for the AI-powered energy future.

Demand Response: AI’s Role in Managing Energy Spikes

Demand response programs automatically adjust energy consumption patterns during peak times. AI predicts spikes and signals devices like EV chargers, factories, and lighting to reduce load temporarily.

This cutting-edge grid flexibility is essential to avoid blackouts as AI data centers drive huge demand spikes.

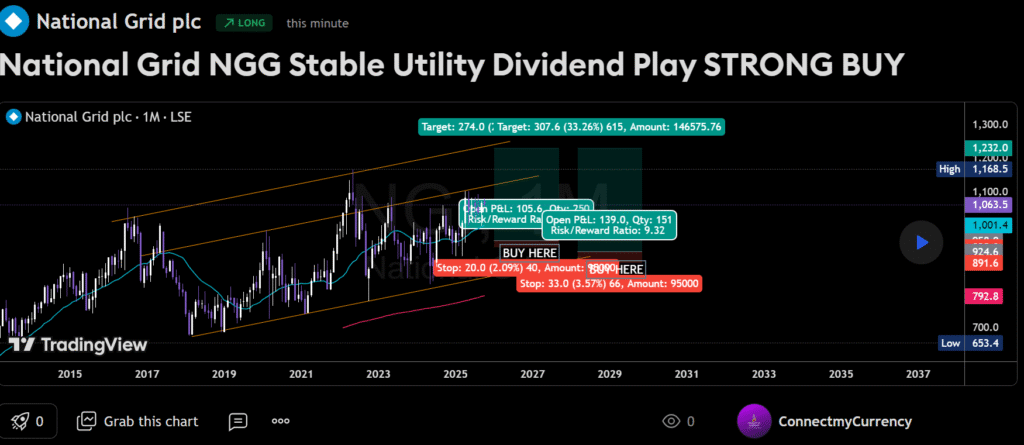

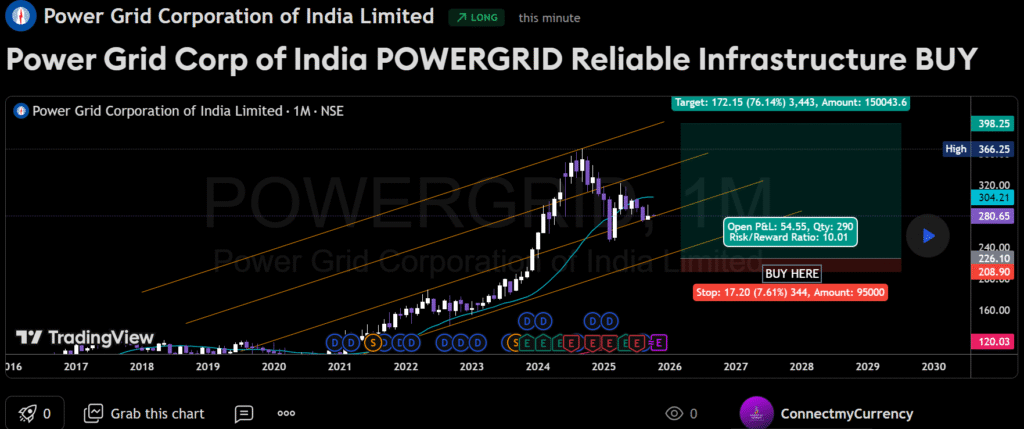

Utility-centric companies like National Grid plc (NGG) and Power Grid Corporation of India (POWERGRID.NS/POWERGRID.BO) are expanding their smart grid capabilities across continents, benefiting directly from demand response adoption and grid digitization. They offer relatively stable dividends and exposure to the ongoing modernization trend.

Microgrids and Energy Storage The Future of Resilient Power

Microgrids localized grids powered by renewables and batteries are becoming pivotal for AI data centers, providing uninterrupted power even during wider grid failures. AI continuously optimizes when to store or use energy, borrowing from solar or wind batteries when needed.

Investing in microgrid and energy storage companies is another way into this theme. For instance, Stem Inc. (STEM) develops AI-driven software for energy storage optimization, while Enphase Energy (ENPH) supplies microgrid components like solar inverters that power decentralized renewables.

Big Energy Bets in AI Infrastructure

Some of the most robust investment opportunities lie in companies securing long-term power deals with AI hyperscalers and driving large-scale infrastructure upgrades:

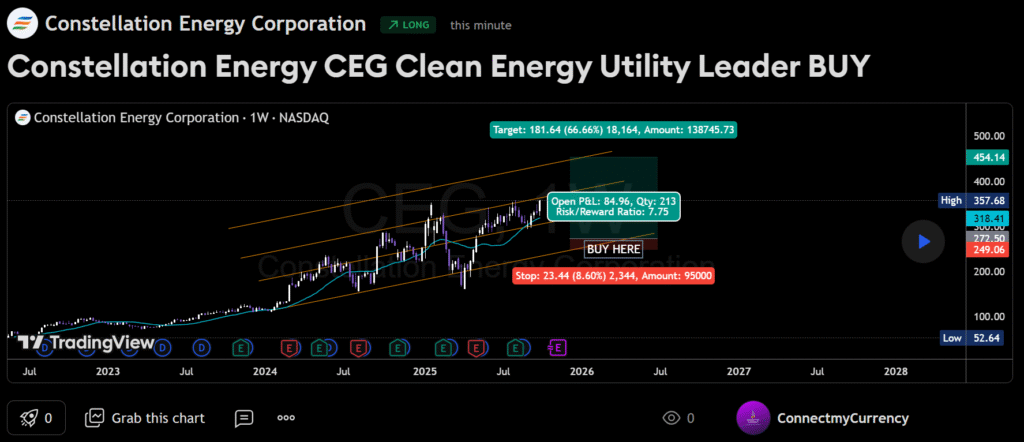

- Constellation Energy (CEG) is a leading U.S. nuclear power operator with 20-year contracts powering Microsoft and Meta’s AI projects. Its acquisition of Calpine will make it the largest clean energy company in the U.S., expanding reach into tech-heavy markets like Texas and California. CEG has delivered 195% gains over two years, making it an AI energy stalwart.

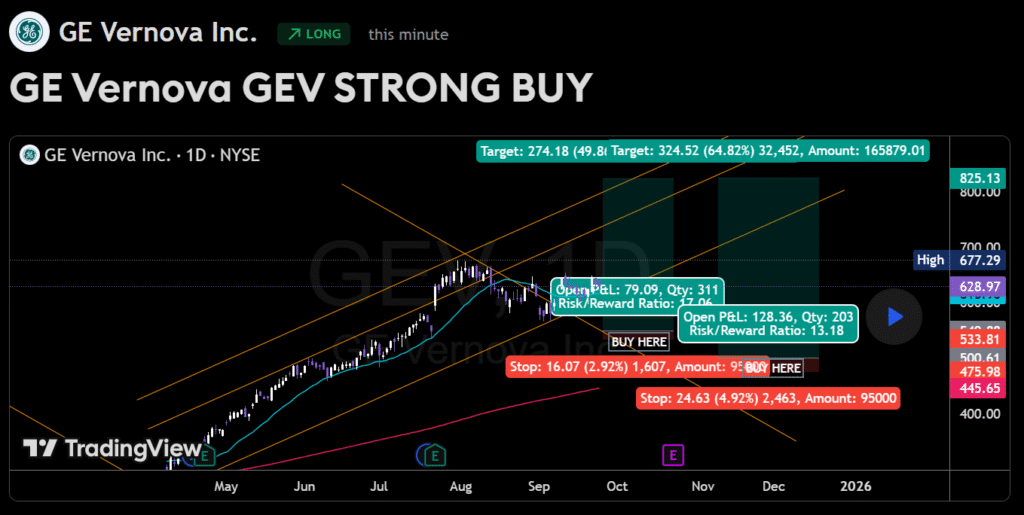

- GE Vernova (GEV) manufactures key components like turbines and smart grid systems, crucial for powering AI data centers where grid reliability is uncertain. Its shares have surged 98% year-to-date, backed by bullish analyst recommendations.

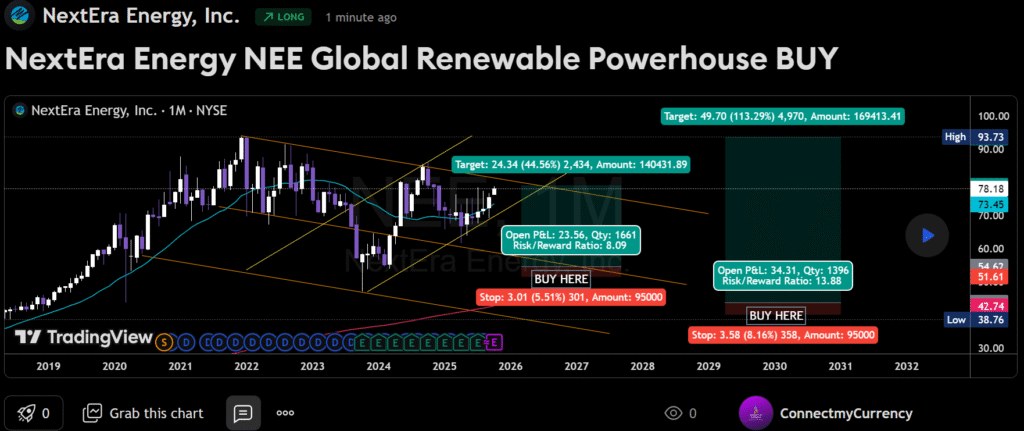

- NextEra Energy (NEE) is another heavyweight powering AI initiatives through renewable expansion and grid investments, offering appealing dividend yields.

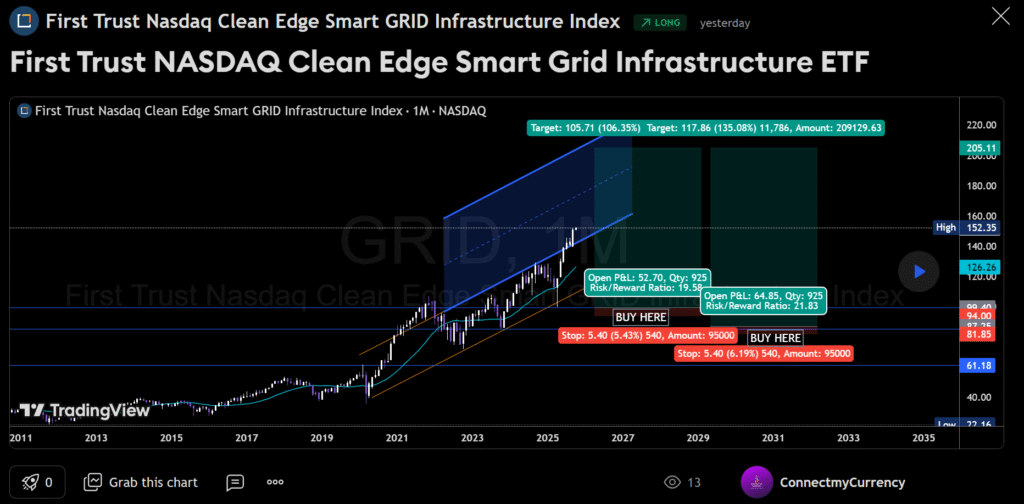

ETFs and Easily Accessible Investment Options

For investors seeking diversified exposure with smaller capital, ETFs like the First Trust NASDAQ Clean Edge Smart Grid Infrastructure ETF (GRID) bundle smart grid and energy transition leaders. This ETF trades around $152, capturing multiple companies innovating across smart energy infrastructure.

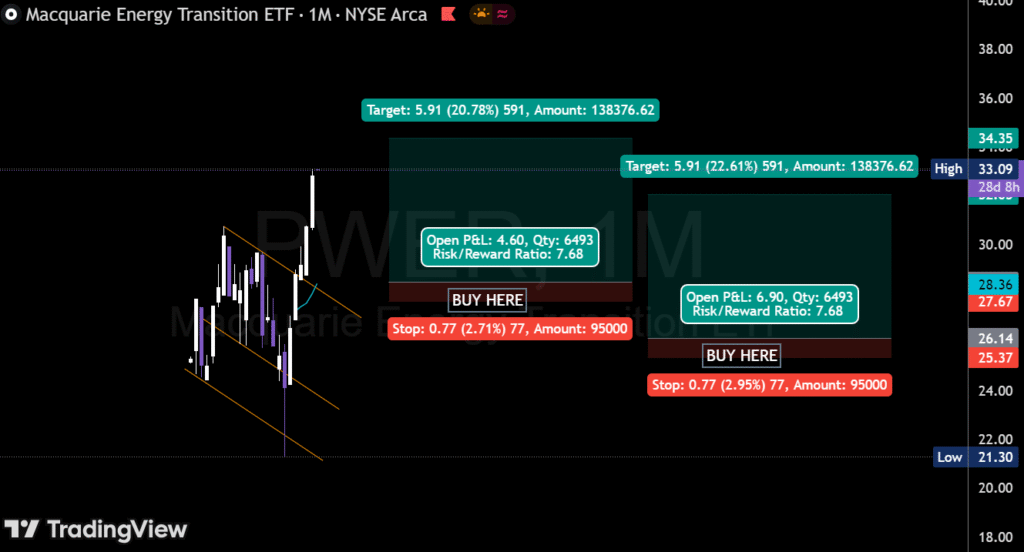

Other promising ETFs include the Macquarie Energy Transition ETF (PWER), focusing on advanced energy technologies fueling the AI revolution.

The Bottom Line

AI and energy grids are now inextricably linked. The rapid growth of AI is driving urgent investments in energy storage, microgrids, grid digitization, and nuclear and natural gas power that can reliably meet massive new demands.

Investing in companies at this intersection offers a frontline opportunity to participate in the dual growth story of AI technology and the modernization of global energy infrastructure. With global electricity demand expected to surge over the next decades, smart energy stocks are a compelling theme for 2025 and beyond.

By strategically allocating capital to stocks like Constellation Energy (CEG), Itron (ITRI), National Grid (NGG), and ETFs like GRID, investors can ensure they are part of powering not just AI but the future of energy itself.

Subscribe to my Newsletter for Weekly deep dives into the stOries that expose how the world really works!

Risk Disclosure

The information provided on this blog is for educational and informational purposes only and should not be construed as financial, investment, or trading advice. Trading and investing involve significant risk, including the potential loss of your entire investment. Past performance is not indicative of future results.

Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any financial decisions. The blog owner and contributors are not responsible for any losses or damages incurred as a result of the use of the information presented here.

By using this blog, you acknowledge and accept these risks.

0 responses to “AI in the Grid: How Smart Energy Networks Fuel AI Expansion and Investment Opportunities”