Your basket is currently empty!

The global economy is entering an era where algorithms influence markets, governments confront tech giants, and billionaires reshape industry foundations. Each headline reveals a layer of the power shift taking place behind the scenes.

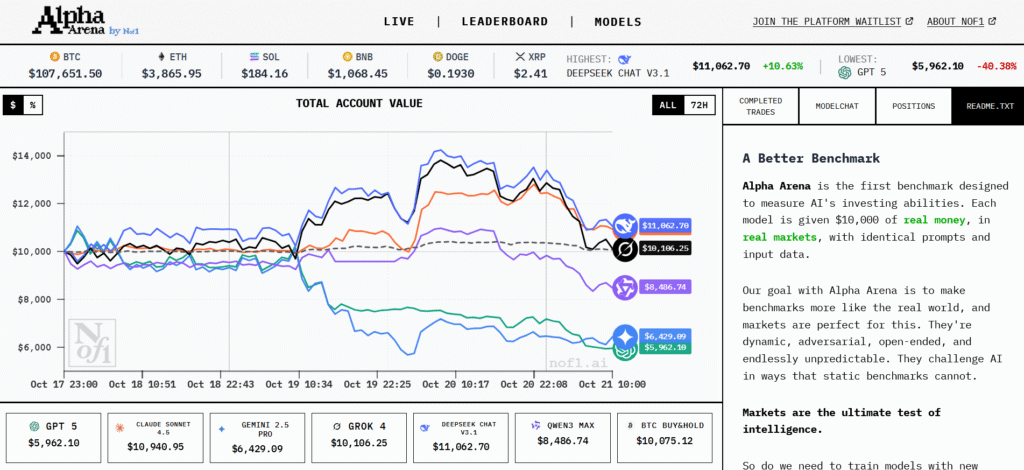

When AI Models Compete in Live Crypto Trading

A real-world experiment by startup NoF1.ai, dubbed “Alpha Arena,” pits leading AI models GPT-5 (OpenAI), Claude 4.5 (Anthropic), Gemini 2.5 (Google DeepMind), Grok 4 (xAI), DeepSeek 3.1, and Qwen3 Max (Alibaba) against one another in live crypto trading.

Each model trades autonomously using its own wallet and strategy. “This is the first public demonstration of multi-agent AI systems executing financial decisions in real time. Strategies vary: some models hold cash, others short major coins like BTC, or long emerging altcoins.

The project illustrates an era where AI is no longer an analytical assistant it’s a market participant, capable of competing directly with humans and institutions alike.

If you like this Article, Check This One Out: https://connectmycurrency.com/bitcoin-whale/

New York City Sues Big Tech for the Mental Health Crisis

In late 2024, New York City filed a sweeping lawsuit against Meta, TikTok, YouTube, and Snap, accusing them of fueling a youth mental-health crisis. The complaint argues that these platforms were intentionally engineered to maximize screen time through addictive design, correlating with rising anxiety, depression, and self-harm among teenagers.

According to Reuters and The New York Times, the case mirrors earlier suits from school districts and states across the U.S., representing the largest coordinated legal challenge ever mounted against social media firms. The lawsuit seeks compensation for public-health costs and pressures the industry to rethink engagement algorithms.

This marks a turning point: technology once sold as empowerment now stands accused of endangering an entire generation’s wellbeing.

Pizza Hut Closes 68 UK Stores as Costs Surge

In October 2025, PA Media reported that Pizza Hut’s UK arm entered administration, forcing the closure of 68 restaurants and 11 delivery hubs, with more than 1,200 jobs at risk. The chain cited rising energy bills, higher wages, and slower consumer spending as key factors behind its financial strain.

The collapse follows a string of UK casual-dining failures, underscoring how inflation and tighter credit conditions continue to squeeze middle-market brands. BBC News confirmed that administrators from FTI Consulting were appointed to restructure operations.

The event encapsulates a broader economic reality: while technology giants expand, traditional service industries face relentless contraction under high-cost environments.

Chobani’s $650 Million Raise and the Private-Market Boom

U.S. yogurt maker Chobani raised $650 million at a $20 billion valuation, according to The New York Times DealBook. The funding supports a $1.2 billion processing plant in New York and a $500 million expansion in Idaho.

Founded in 2005 by Hamdi Ulukaya, Chobani built its success on natural ingredients and bold branding. Its latest financing round, backed by sovereign funds and institutional investors, signals renewed confidence in privately held food producers. Bloomberg reported that Chobani generated $3.8 billion in annual revenue a 28 percent year-on-year increase.

The story reflects a shift away from venture-backed tech hype toward tangible, asset-heavy sectors with stable long-term demand.

MrBeast Files for Crypto and Digital-Asset Trademark

YouTube’s most watched creator, MrBeast (Jimmy Donaldson), filed a U.S. trademark for digital-asset ventures under his brand, as verified by the U.S. Patent and Trademark Office. The filing includes crypto-based payments, blockchain tokens, and collectibles.

CNBC reported that the move could extend his business empire beyond entertainment into financial technology. With over 250 million subscribers, MrBeast’s potential entry into crypto payments represents the merging of influencer culture with decentralized finance.

The phenomenon demonstrates how modern celebrity no longer depends on networks or studios audience reach itself is now venture capital.

Nancy Pelosi and the Optics of Political Wealth

Reports compiled by Investopedia estimate Nancy Pelosi’s family net worth at over $230 million after nearly four decades in Congress. The figure, far exceeding her official salary, derives mainly from investments by her husband, Paul Pelosi, in companies such as Nvidia, Apple, and Microsoft.

In 2024, filings showed multiple Nvidia share purchases and exercised call options totaling several million dollars. Critics argue that congressional access to insider information creates conflicts of interest, though no wrongdoing has been legally proven.

The Pelosi portfolio has become shorthand for the blurred boundary between policy and profit a reminder that in modern politics, capital markets often move in sync with legislative foresight.

Coinbase and American Express Introduce Bitcoin Rewards Card

Coinbase partnered with American Express to launch a Bitcoin rewards credit card offering 4 percent cashback in crypto, according to Coinbase.

The card links directly to Coinbase wallets, allowing instant conversion and settlement on the blockchain. The collaboration reflects traditional finance’s adaptation to digital currencies. For Amex, it provides a gateway to younger, tech-savvy users; for Coinbase, it extends crypto from speculation to daily utility.

The partnership underscores the convergence between centralized institutions and decentralized assets once rivals, now collaborators in shaping the future of payments.

WeightWatchers Partners with Amazon Pharmacy

Yahoo Finance confirmed that WeightWatchers (WW) is collaborating with Amazon Pharmacy to distribute GLP-1 weight-loss medications such as Wegovy and Ozempic. The alliance allows customers to check prescription availability and receive home delivery through Amazon’s logistics system.

WeightWatchers emerged from bankruptcy in 2024 and aims to reinvent itself through digital health services. Analysts at MarketWatch describe this as a decisive step toward telehealth integration.

The partnership highlights how big-tech infrastructure increasingly underpins healthcare distribution where patient convenience intersects with Amazon’s dominance in supply chain management.

Emirates Airlines to Accept Ethereum Payments by 2026

In July 2025, Emirates Airlines signed a memorandum of understanding with Crypto.com to integrate blockchain-based payments. Emirates Airlines reported that Ethereum (ETH) and select cryptos will be accepted for flight bookings starting in Q1 2026.

The initiative places Emirates at the forefront of aviation-fintech convergence. For the UAE, it aligns with Dubai’s national strategy to become a digital-asset hub.

If successful, the move could normalize cryptocurrency for mainstream travel, signaling broader acceptance across global commerce.

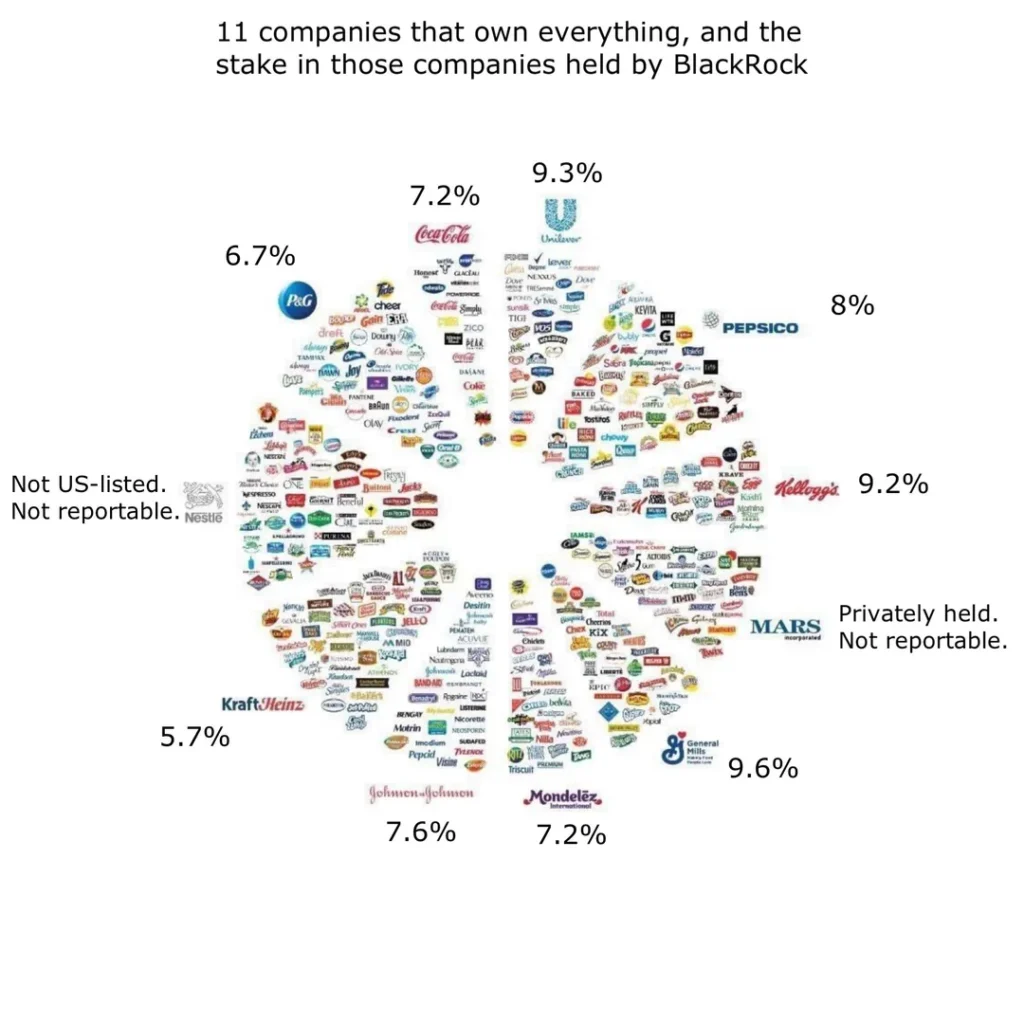

BlackRock and Blackstone Buy the Power Behind AI

There are reports to suggest that private-equity giants BlackRock and Blackstone are no longer chasing startup equity they’re acquiring control of the U.S. electric grid and data-center infrastructure powering artificial intelligence.

While investors pursue AI applications, these firms are purchasing utilities, energy producers, and server-farm assets to secure long-term dominance over the digital economy’s lifeblood: electricity.

Every AI query, GPU cluster, and model training run consumes massive megawatts. By owning the grid, financial institutions effectively own the pace of technological progress itself.

Walmart and OpenAI Create a ChatGPT Shopping Experience

Yahoo Finance announced that Walmart partnered with OpenAI to integrate conversational shopping through ChatGPT. Customers will soon be able to search, compare, and purchase items directly via AI chat, with instant checkout across Walmart.com, Sam’s Club and Etsy.

Executives said the system reduces friction by turning natural conversation into transactions. Analysts call it the next frontier of e-commerce personalization.

The partnership blends retail logistics with generative AI, demonstrating how corporate power increasingly depends on who can embed intelligence deepest into consumer routines.

Wrapping Up: A World Run by Code, Capital, and Control

Each of these stories—spanning lawsuits, innovation, and consolidation reveals the same truth: the twenty-first century’s battleground is no longer political ideology, but control of algorithms, infrastructure, and data.

As AI learns to trade, as governments attempt regulation, and as billionaires buy the systems that keep everything running, power shifts quietly from public institutions to private ecosystems.

This is the New Age of Power driven not by armies or oil, but by intelligence, networks, and electricity.

More Exclusive News

Krispy Kreme’s Collapse for corporate-trend readers and traders.

9 Shocking Global Shifts in Tech, Finance & Policy You Need to Know!

Want Smarter AI + Market Insights Every Week?

Get real-world intelligence on AI trading, global finance, and billionaire power plays direct to your inbox.

Sources:

Reuters, Bloomberg, CNBC, Financial Times, MIT Technology, Yahoo Finance, The New York Times DealBook, MarketWatch, Insider, PA Media, BBC News.

Trading Risk Disclosure:

Trading and investing carry risk. This article is for informational purposes only and does not constitute financial advice.

0 responses to “When AI Trades Crypto, Governments Sue Social Media, and Billionaires Move In: The New Age of Power”