Your basket is currently empty!

The past week has delivered a whirlwind of money stories that show just how quickly wealth, technology, and global finance are shifting. From bizarre ATMs that expose your bank balance to governments erasing millions of accounts overnight, these events highlight the fragile and fascinating future of money.

Below, I break down seven shocking stories each carrying lessons for investors, entrepreneurs, and everyday people navigating today’s financial landscape.

The ATM Leaderboard Public Wealth on Display

At a New York art museum, an ATM installation caused chaos by displaying people’s bank account balances on a public leaderboard the moment they withdrew cash. Alongside the number, their photo appeared for everyone to see.

Balances ranged from zero to over $2.5 million, instantly turning wealth into performance art. While some laughed, others cringed at how money was exposed in such a raw, competitive way.

Takeaway: In a world where digital finance increasingly blends with social media, the concept of money is becoming not just private security but public identity.

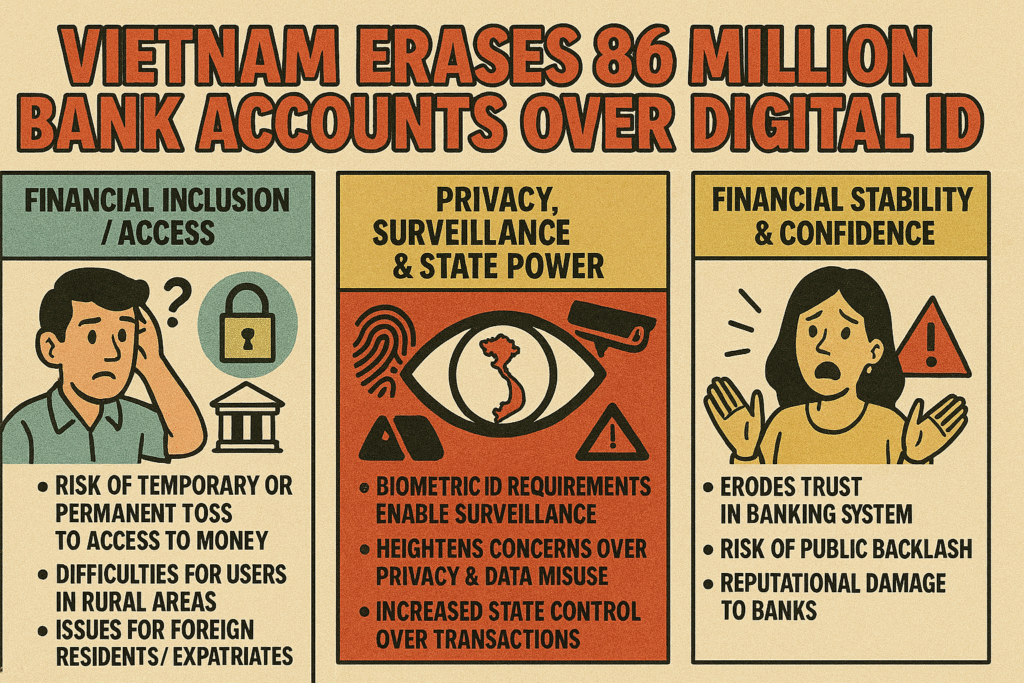

Vietnam Erases 86 Million Bank Accounts Over Digital ID

Vietnam shocked the world when reports surfaced that 86 million bank accounts were wiped overnight for citizens who hadn’t verified their new Digital ID. Non-compliant users lost access to savings, wages, and payment systems instantly.

This event is one of the most extreme examples of financial centralization tied to biometric and digital identity systems. Critics argue it’s a warning about how governments could control populations through banking infrastructure.

Takeaway: As countries push digital IDs and cashless economies, financial access may soon depend on compliance with state-driven systems. Investors and everyday people alike should be aware of the risks of centralized finance.

UFC Boss Dana White’s $25M Gambling Debt

Dana White, CEO of the UFC, was reported to have over $25 million in gambling debt tied to Red Rocks Casino in Las Vegas. Anonymous sources suggested the real number could be closer to $50 million, as White allegedly borrowed large sums of casino credit to play high-limit baccarat and blackjack.

The story shocked sports and business fans alike, highlighting how even successful billionaires and executives are not immune to the destructive nature of gambling.

Takeaway: High-stakes betting mirrors the risks of speculative trading fortunes can disappear faster than they are built if discipline is lost.

Wang Ning’s $6B Labubu Collapse

Wang Ning, creator of the viral collectible brand Labubu, has seen nearly $6 billion in value vanish as demand for the once-hyped dolls collapsed. What started as a cultural craze became a financial empire, only to fall as fast as it rose.

Collectors who once treated Labubu as a status symbol have now moved on, leaving shelves full of unsold toys and investors nursing heavy losses.

Takeaway: Speculative bubbles aren’t limited to stocks or crypto collectibles and cultural trends can rise and collapse just as brutally.

Burger King’s $1.99 Gold-Plated Pokémon Cards

In 1999, Burger King launched one of the most iconic promotions in fast food history: 23K gold-plated Pokémon cards sold for just $1.99 with a meal. Millions were produced, but today the surviving sets are collectors’ treasures.

The cards represented a crossover of fast food, pop culture, and speculative value that has only grown over decades. Some sealed sets now sell for hundreds, proving how nostalgia and scarcity create long-term value.

Takeaway: Nostalgia-backed collectibles often outperform traditional investments when tied to global cultural icons like Pokémon.

The U.S. $250 Tourist Visa Fee

Starting October 1, 2025, the United States will charge a $250 tourist visa fee for visitors from India, Brazil, Mexico, and China.

The move reflects tightening immigration policy and an attempt to generate billions from travel fees. For families, it represents a major added cost to visiting the U.S., while analysts see it as a way to monetize global demand for entry into American markets.

Takeaway: As global mobility becomes more expensive, tourism is evolving into a wealth filter. Costs like these highlight the hidden financial systems attached to borders.

AI-Generated R&B Artist Signs $3M Deal

AI continues to disrupt the creative industry. Xania Monet, an AI-generated R&B singer, just signed a $3 million record deal. Behind her voice is Talisha Jones, a poet and designer who used AI tools to craft both music and image.

The move demonstrates how AI avatars are stepping into mainstream culture earning chart placements, streaming revenue, and major contracts.

Takeaway: The music industry is now directly competing with AI-generated talent. Investors should note how this shift could redefine entertainment economics.

Wrapped Up: A New Era of Money, Power, and Control

From digital IDs erasing millions of bank accounts to AI singers signing multimillion-dollar contracts, the world of money is being reshaped in ways few could have predicted a decade ago.

The common thread? Power, visibility, and control. Whether it’s governments centralizing banking, casinos fueling billion-dollar debts, or culture turning Pokémon and AI into investments, every story shows that the financial system is no longer just about money it’s about influence, technology, and identity.

For traders, investors, and entrepreneurs, the message is clear: stay ahead of the shifts, because the next financial shock may be cultural, technological, or political not just economic.

0 responses to “From Digital IDs to Billion-Dollar Losses: 7 Money Stories That Shocked the World This Week”