Your basket is currently empty!

Football is more than a sport; it is one of the largest industries in the world. With over 3.5 billion fans, it generates billions of dollars annually through broadcasting rights, ticket sales, sponsorships, merchandise, betting, and digital platforms. For investors, this scale provides a unique opportunity. Football stocks give exposure to a global economy that is deeply embedded in culture and entertainment.

In this guide, we will explore the major opportunities available in football-related investments. We will look at publicly traded football clubs, sportswear companies, broadcasting giants, betting and data firms, and the rise of fan tokens and digital football technology. We will also consider the risks and provide a clear framework for building a football investment portfolio.

Why Football Stocks Are an Investment Opportunity

The business of football offers investors stability and growth that is not always found in other sectors. Football has a loyal global audience, and fans continue to watch, buy merchandise, and follow their clubs regardless of economic cycles. This demand creates a strong base of predictable revenue.

Football also benefits from its cultural influence, making clubs and brands household names across continents. New markets are opening rapidly in Asia, Africa, and North America, where audiences are expanding. Furthermore, digital transformation is creating fresh ways to monetise the sport, including streaming services, virtual experiences, and data-driven platforms.

According to the Deloitte Football Money League report, the world’s top clubs generate billions annually from sponsorships, matchday sales, and television deals. This scale makes football not just a sport but a commercial powerhouse.

Publicly Traded Football Clubs

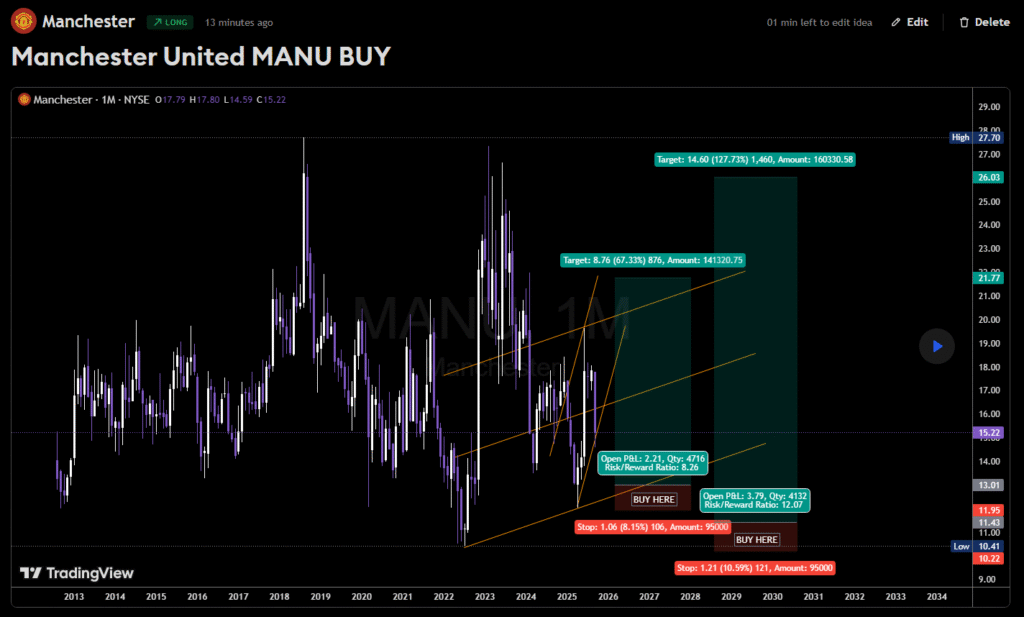

Manchester United (NYSE: MANU)

Manchester United is the most recognised football club listed on the stock market. Its revenue streams come from broadcasting, sponsorship, merchandise, and ticket sales. The club’s global brand ensures consistent attention from investors. However, risks include ownership uncertainty, significant debt levels, and the dependency on consistent sporting success. Share prices often react directly to Champions League qualification and transfer news, making it a volatile but highly visible stock.

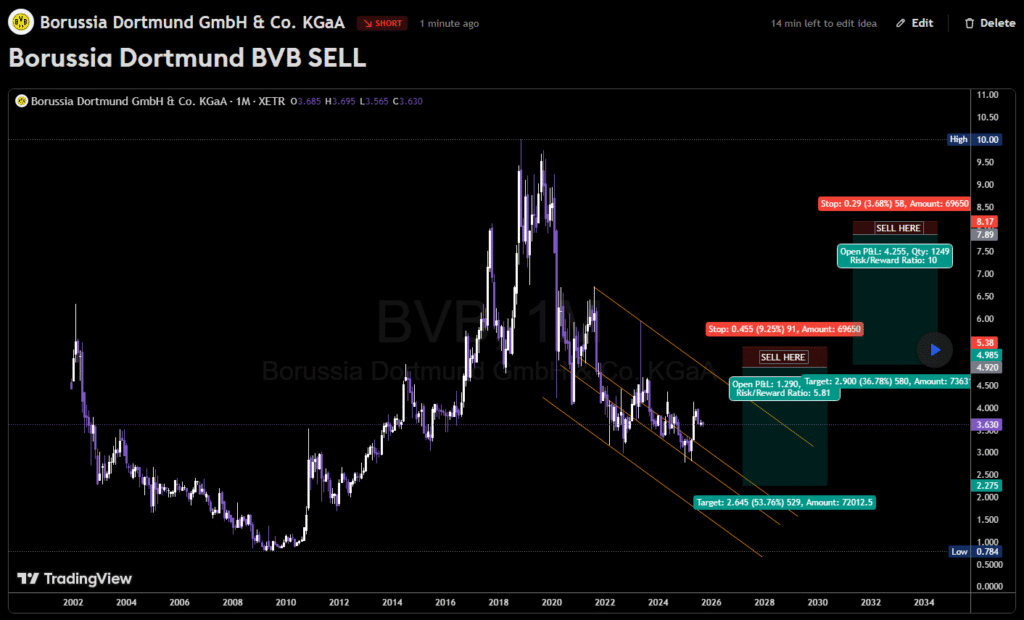

Borussia Dortmund (FRA: BVB)

Borussia Dortmund is a leading German club that has developed a reputation for nurturing and selling elite players. Its financial model is built on developing talent and selling players like Jadon Sancho, Erling Haaland, and Jude Bellingham for high transfer fees. Consistent appearances in the UEFA Champions League provide reliable revenue. The club does not have the global marketing power of English teams, but its disciplined approach makes it an attractive long-term investment.

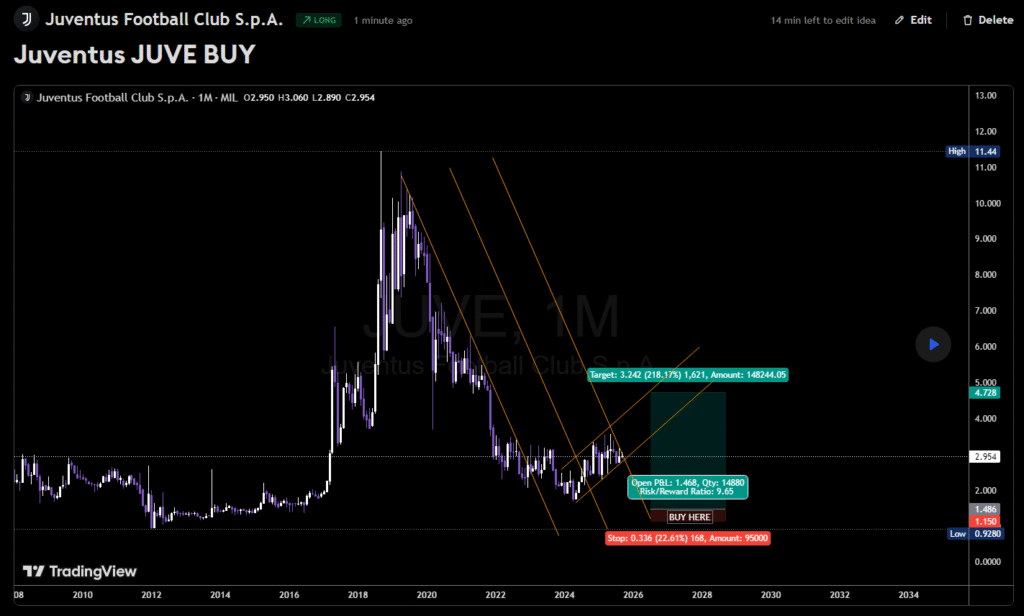

Juventus (BIT: JUVE)

Juventus represents another major European football brand available on the stock market. The club has a strong international following and has historically gained attention from high-profile player signings. However, its financial performance has been inconsistent, and regulatory scrutiny in Italy has created challenges. Investors considering Juventus must account for the volatility that comes with fluctuating revenues and reputational risks.

Sportswear and Kit Manufacturers

Investing in football clubs directly is not the only way to access the industry. Sportswear companies supply kits and merchandise to clubs and fans worldwide.

Nike remains a leader in global football sponsorship, with contracts covering national teams and elite clubs. Adidas has an equally strong foothold, supplying Real Madrid, Bayern Munich, and many World Cup teams. Puma has expanded its influence by supplying Manchester City and several high-profile players.

Unlike individual clubs, these companies do not rely on match results. Their revenues are driven by global sales of kits and sports apparel, as well as long-term sponsorship agreements. The football apparel market continues to grow steadily, driven by global fan culture and mega-events like the FIFA World Cup.

Broadcasting Rights and Media Companies

Television and streaming rights are the foundation of football’s financial power. The Premier League alone generates billions annually from broadcasting contracts. Investors can gain exposure through companies that secure and distribute these rights.

Comcast, through NBC, broadcasts the Premier League in the United States, generating strong viewership growth. Disney, through ESPN, holds broadcasting rights for football across multiple regions. DAZN is a streaming-focused platform that is expanding its football coverage and is expected to go public in the near future.

These companies profit from subscription fees, advertising, and global streaming demand. As fans move from cable to streaming, broadcasting rights will remain a vital part of football economics.

Football Betting and Data Companies

Football is the largest driver of the global sports betting market. Companies in this space offer another way for investors to benefit from football’s reach.

Flutter Entertainment operates major platforms including FanDuel, Betfair, and Paddy Power. Entain owns Ladbrokes, Coral, and bwin, giving it a diverse portfolio of betting brands. Genius Sports is a specialist data provider, offering official live match statistics to leagues and betting firms, which is increasingly important for in-play betting.

The global online gambling industry continues to grow, driven by the rise of mobile betting and regulation changes in major markets such as the United States. Football’s constant calendar of matches provides continuous betting opportunities.

Fan Tokens, NFTs, and Football Technology

Digital transformation is reshaping football economics. Fan tokens allow supporters to engage with clubs in new ways, offering voting rights on minor decisions and access to exclusive content. Chiliz, through its Socios platform, has launched fan tokens for clubs including Barcelona, Paris Saint-Germain, and Manchester City.

NFTs are also becoming popular, with platforms like Sorare offering fantasy football powered by blockchain technology. Major investors, including SoftBank, back these platforms. Technology firms like Catapult Sports provide advanced analytics and wearable technology to clubs, offering another growth area in football-related investments.

These opportunities are high risk but represent the future of fan engagement and performance analysis.

Risks of Football Stocks

Investing in football carries unique risks. Sporting performance directly affects revenue streams. A poor season can mean missing out on Champions League income and reduced sponsorship opportunities. Debt levels are often high, with many clubs operating at financial losses. Regulation, including UEFA’s Financial Fair Play rules and gambling legislation, adds further uncertainty.

Football stocks are also prone to short-term hype. A major player transfer or a winning streak can inflate valuations, but these gains are often temporary. Investors should be aware of the volatility and avoid overexposure to any single club.

Building a Football Investment Portfolio

Investors looking at football stocks should adopt a diversified approach. Combining club shares with investments in sportswear companies, broadcasters, and betting platforms spreads risk across the football ecosystem. A balanced portfolio provides exposure to the sport’s growth without relying on one team’s performance.

Long-term trends, such as the growth of viewership in emerging markets like the United States, India, and Africa, should also be considered. Mega-events such as the FIFA World Cup and UEFA European Championship create revenue spikes, which can be anticipated in advance.

While there is not yet a pure football-focused ETF, investors can use broader entertainment or sports ETFs to gain indirect exposure.

Sportswear & Kit Suppliers

The real money often lies in the companies that kit out the players.

- Nike (NKE) – Sponsors major clubs and national teams.

- Adidas (ADS.DE) – Heavy focus on football, supplying Real Madrid, Bayern, and World Cup teams.

- Puma (PUM.DE) – Gaining traction through Manchester City and elite sponsorships.

These firms aren’t dependent on one club’s results but benefit from global fan purchases and World Cup cycles.

Broadcasting Giants

Broadcasting is the lifeblood of football. Billion-dollar TV rights shape club revenues.

- Comcast (CMCSA) – Owns NBC, which broadcasts the Premier League in the U.S.

- Disney (DIS) – ESPN holds football rights across multiple leagues.

- DAZN (Private, IPO expected) – Pure-play streaming disruptor.

Football Betting & Data Companies

Football drives the majority of global sports betting.

- Flutter Entertainment (FLTR.L) – Owner of FanDuel, Betfair, and Paddy Power.

- Entain (ENT.L) – Runs bwin, Ladbrokes, and Coral.

- Genius Sports (GENI) – Provides official match data to FIFA and sportsbooks.

The New Frontier: Fan Tokens, NFTs & Football Tech

Digital transformation is creating new revenue streams:

- Chiliz (CHZ) – Powers fan tokens through Socios.com.

- Sorare – NFT fantasy football game, backed by SoftBank, expanding globally.

- Wearable Tech & AI Analytics – Companies like Catapult Sports (private) provide performance tracking.

These high-risk plays could become the future of football monetisation.

Ending

Football is one of the most powerful global industries, with opportunities stretching far beyond the pitch. From Manchester United to Nike, from Flutter Entertainment to digital platforms like Socios, investors can access the passion and financial potential of football.

The key to success is understanding the risks and building a portfolio that combines clubs, brands, broadcasters, and digital innovators. Football will continue to expand its commercial reach, making it a sector that belongs on the radar of forward-looking investors.

0 responses to “Football Stocks to Invest In: The Complete Investor’s Guide”