Your basket is currently empty!

Reading time: 7 minutes

The hidden framework ultra wealthy families use is one of the most closely guarded concepts in finance. High net worth investors rely on this approach not just to grow their capital but to protect it across generations. Understanding this framework is the key to managing serious wealth and attracting investors who want more than just returns.

Thinking in Generational Timeframes

If you are managing serious capital, the question is not “what can I make this quarter” but “how do I position myself so I do not lose what I have built.” This shift in thinking moves you away from chasing hot trends and into structuring money in a way that can handle uncertainty. Markets will always cycle. What matters is not being forced out at the worst possible moment.

The Three Core Buckets of Wealth

Here is the simple structure I recommend you think about:

Preservation Capital is money you never want to risk. This is the cushion that lets you sleep at night, whether it is in prime property, gold, or very liquid defensive assets.

Growth Capital is the money you put to work in equities, funds, or systematic strategies that compound steadily over time.

Asymmetric Capital is where the opportunity lies. This is the smaller portion that takes calculated high reward positions such as algorithmic trading systems, early stage ventures, or trades with a one to eight risk reward profile.

What makes this work is balance. Too much in growth and you are exposed in downturns. Too much in preservation and you fall behind inflation. Too little asymmetric exposure and you miss the breakthroughs that transform wealth.

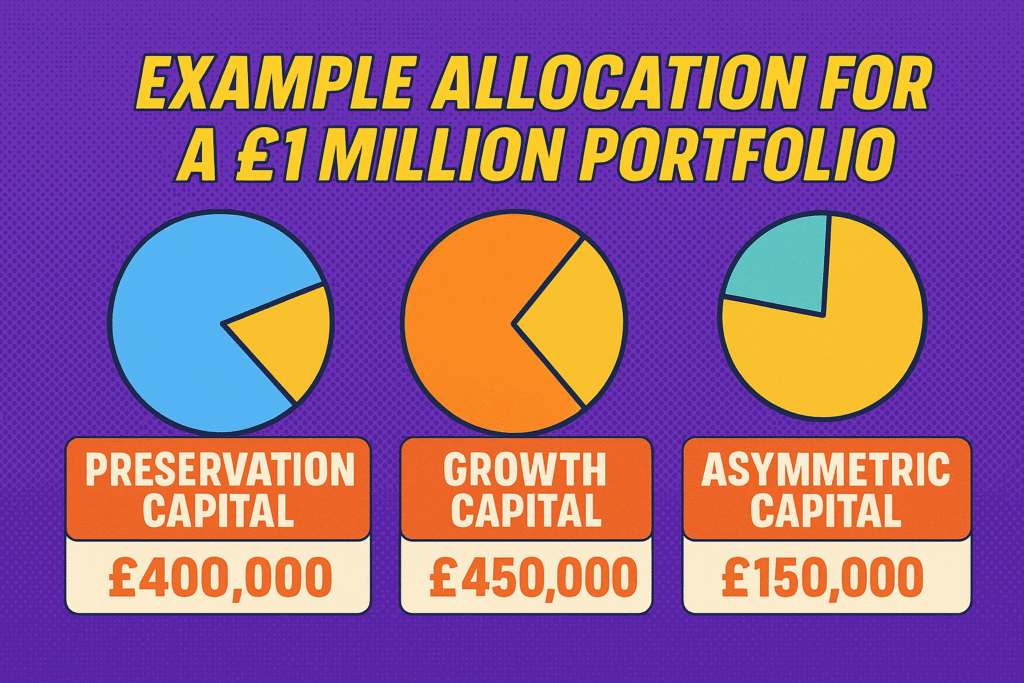

Example Allocation for a £1 Million Portfolio

Preservation Capital £400,000

This is the defensive core. It might include: £200,000 in prime real estate or REITs with strong rental demand, £100,000 in gold and commodities, and £100,000 in high grade government bonds or cash like assets.

Growth Capital £450,000

This portion works to steadily outpace inflation and compound. It could be spread across equities, systematic strategies with strict drawdowns, and long term private equity funds.

Asymmetric Capital £150,000

This is the smaller, high reward slice. The key here is not betting recklessly, but backing strategies with defined risk and asymmetric potential such as algorithmic trading, early stage ventures, or distressed opportunities.

Why Controlling Risk is the Real Edge

Investors often obsess over returns. But returns without risk control are meaningless. What separates strong managers is the ability to set hard limits, strict risk per trade, disciplined drawdown levels, and a capital first mentality.

Structure Creates Strength

It is not just what you invest in, but how you structure it. Clear separation between buckets of capital, using the right accounts or vehicles for each, and maintaining liquidity where it matters most all make a portfolio resilient. The aim is simple: never be forced to sell or buy at the wrong time.

Why Exclusivity Protects You

High net worth investors are approached constantly with new deals and managers. What sets you apart is not availability but exclusivity. The best opportunities are curated, limited, and presented as invitation only.

Putting This Into Practice

One way you might start applying this today is:

- Keep at least one third of your wealth in assets that protect your downside.

- Allocate the bulk of your growth capital to systematic, tested strategies.

- Reserve a small percentage for asymmetric opportunities, but only when the potential reward justifies the risk.

Wrapping Up

The hidden framework used by the ultra wealthy is not built on secrets. It is built on discipline, structure, and a long term horizon. High net worth investors are not looking for thrills. They want a manager who understands how wealthy families think and who has the systems to mirror it. If you can demonstrate that you operate by the same principles, you will not have to sell to them. They will recognise you as one of their own

0 responses to “The Hidden Framework Ultra Wealthy Families Use to Preserve Wealth for Generations”