Your basket is currently empty!

Welcome to your end-of-week roundup, highlighting deal-making, market moves, and the latest in tech, pharma, energy, and media headlines.

Corporate News

- Tech sector:

Elon Musk’s AI startup xAI announced legal action against Apple, alleging unfair App Store ranking favoritism toward OpenAI’s ChatGPT. Musk criticized Apple for not featuring his chatbot Grok and the X app among the “Must Have” apps despite their high popularity, escalating a high-profile tech feud.

Apple announced a $100B US investment; Nvidia secured US approval to export AI GPUs to China, lifting its market cap by $900B and boosting tech indices. - Pharma:

The price of the popular weight-loss drug Mounjaro is set to increase significantly in the UK starting September 1, 2025. Manufacturer Eli Lilly plans to raise prices for all doses by up to 170%, with the highest dose’s monthly cost jumping from £122 ($165) to £330 ($447). The increase aims to align UK pricing with other European markets after initial below-market pricing to improve access. This hike affects privately paying patients and providers but does not impact NHS prescriptions, which remain under separate agreements. The move has led some patients and providers to consider alternative treatments like Wegovy. - Energy:

Renewable energy stocks outperformed, underscoring sustained momentum towards sustainability-driven growth. - Media:

Reports surfaced about Paramount’s interest in acquiring UFC, signaling big moves in sports and entertainment sectors (monitoring ongoing developments).

Major Headlines

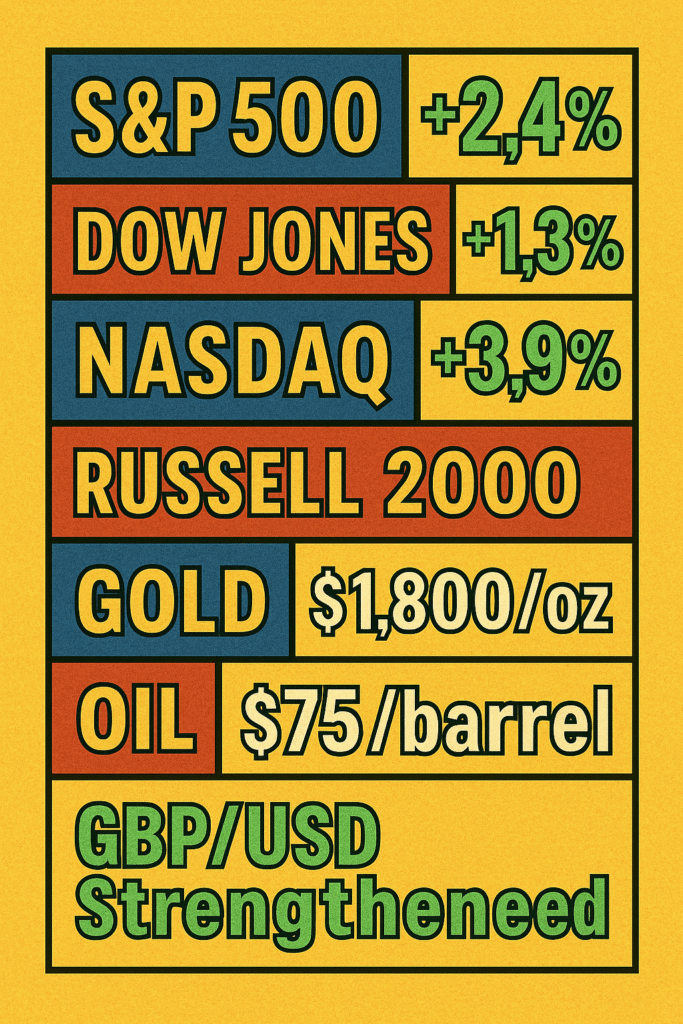

Global stocks staged a strong rally, with the S&P500 up 2.4%, Dow Jones gaining 1.3%, and Nasdaq soaring nearly 4%. Investor optimism grew as US inflation cooled and hopes of upcoming rate cuts surfaced. Merger and acquisition activity surged, especially in tech and AI, while tariff anxieties and ESG scrutiny continued to shape global business.

Markets Roundup

- S&P500: +2.4%

- Dow Jones: +1.3%

- Nasdaq: +3.9%

- Russell 2000: +2.4%

- Gold: $1,800/oz

- Oil: $75/barrel

- GBP/USD: Strengthened

Macro & Policy Developments

August’s inflation came in at around 3% year-over-year, matching forecasts and raising anticipation for a Federal Reserve rate cut in September. The Bank of England also maintained its rates. On the jobs front, demand for data scientists and AI engineers soared in the ecommerce sector, reflecting broader tech trends. Meanwhile, insurance losses from natural disasters topped $80B, nearly doubling the decade average.

Emerging Trends & Insights

- AI investment: Tech and defense contracts are pushing AI front and center.

- Digital payments & crypto: Finance firms expanded crypto wallet integration amid rapid fintech adoption.

- Sustainability & ESG: ESG investing normalized as businesses face new climate and regulatory benchmarks.

Looking Ahead

Key events next week include the Federal Reserve’s Jackson Hole conference and Nvidia’s upcoming earnings report. Investors will also be closely watching implications from the high-stakes summit between former US President Donald Trump and Russian President Vladimir Putin held on August 15, 2025, in Alaska.

The meeting lasted over two and a half hours and saw discussions around a potential peace agreement to end the Russia-Ukraine war rather than an immediate ceasefire. This has sparked mixed reactions with concerns over emboldening Russia’s military while negotiations continue.

The summit introduced short-term uncertainty and geopolitical risk, potentially impacting energy prices, defense stocks, and global trade dynamics next week. Traders will monitor US-Ukraine diplomatic developments closely, especially ahead of Trump’s planned meeting with Ukrainian President Volodymyr Zelenskyy. Any progress or setbacks in peace talks could influence volatility across equities and commodities.

European responses will also be watched carefully as key EU leaders coordinate support for Ukraine amid this fragile diplomatic situation.

Thanks for reading! If you enjoy these weekly wrap-ups, subscribe for more insights or let us know which topics and sectors you’d like covered in future editions.

0 responses to “Dealmakers & Disruptors: Business News Unpacked (Mid August 2025 Edition)”