Your basket is currently empty!

Reading time: 9 minutes

Wealth investments are often associated with stocks, real estate, and private equity. Yet, some of the most lucrative and enduring forms of wealth building come from high-value art collections. Controlled by billionaires, financial institutions, and elite families, these art holdings are not just cultural treasures they are strategic assets designed to preserve and grow wealth.

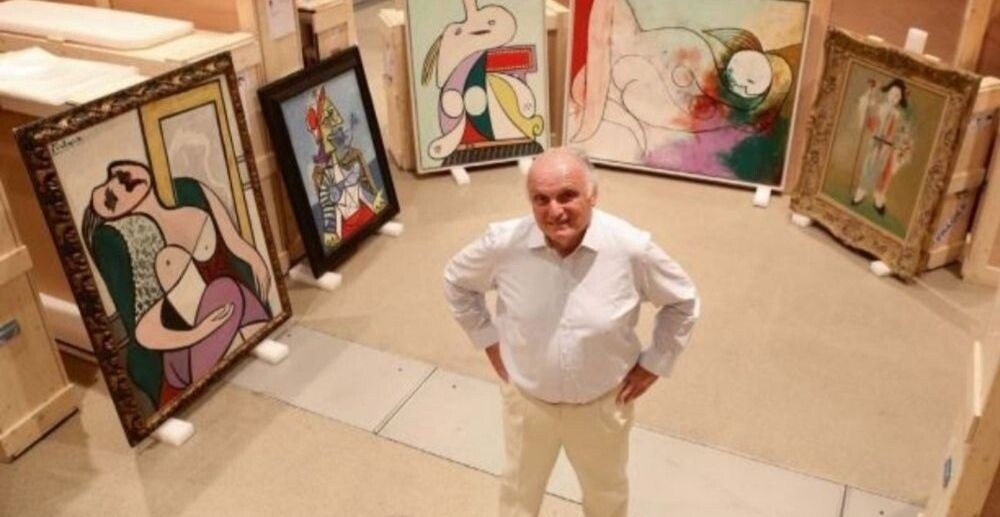

The Nahmad Family

Estimated Value: £2.4 – £4 billion

Artists: Picasso, Monet, Matisse, Rothko

The Nahmad family has quietly become one of the most dominant players in the global art market. With over 4,500 works stored in secure Geneva facilities, they control a portfolio that rivals major museums. By strategically releasing select pieces into auctions, they can influence pricing trends and create scarcity for particular artists. This level of control over a niche asset class is the ultimate in long-term wealth investments.

JPMorgan Chase Art Collection

Founded by: David Rockefeller

Size: 30,000+ works

JPMorgan Chase’s corporate art collection is one of the largest in the world. It serves a dual purpose projecting cultural prestige to clients while acting as a store of appreciating value. Modern and contemporary works are displayed in offices globally, reinforcing brand sophistication. Blue-chip art has historically outperformed many asset classes, making it a subtle yet powerful wealth investment strategy for one of the biggest banks on the planet.

Eli Broad (†)

Estimated Value: £1.75 billion

Public Museum: The Broad, Los Angeles

Eli Broad’s 2,000+ piece collection features works from Jeff Koons, Basquiat, and Keith Haring. Instead of locking his portfolio away, Broad created The Broad Museum, offering free public access. While his approach was philanthropic, the underlying asset value continues to appreciate, showing that even public collections can be structured as wealth investments with generational impact.

Deutsche Bank

Estimated Size: 57,000 – 60,000 works

Deutsche Bank’s art collection is vast, focusing on modern and contemporary pieces by artists such as Richter and Giacometti. By integrating high-value art into its offices worldwide, the bank builds brand image while holding an appreciating asset. This approach blends corporate marketing with tangible wealth investment, making it a blueprint for institutions seeking cultural and financial returns.

David Geffen

Estimated Value: £1.85 billion

David Geffen is known for executing some of the largest private art sales in history. His £400 million deal for works by Jackson Pollock and Willem de Kooning reset market benchmarks. Geffen’s strategy is pure investment timing buy at undervalued moments, sell at peak demand. His art dealings have become one of the most profitable personal wealth investment case studies.

Bank of America

Estimated Size: 50,000 – 60,000 works

Artists: Ed Ruscha, Frank Stella, Joan Mitchell, William Eggleston

Bank of America integrates its art collection into its client engagement strategy, displaying pieces in executive spaces and loaning them to museums. This dual function cultural branding and asset appreciation makes it a masterclass in corporate wealth investments that produce both financial and reputational returns.

The Bigger Picture in Wealth Investments

From private dynasties to global corporations, these collectors prove that fine art is not just a cultural passion it is a financial instrument. It offers:

- Preservation of wealth in a non-correlated asset class

- Market influence through scarcity and controlled releases

- Prestige and cultural capital in elite networks

- Long-term appreciation outperforming traditional investments

For those seeking diversification beyond stocks and property, fine art remains one of the most exclusive and effective wealth investments available today.

0 responses to “The World’s Most Valuable Art Collections and How They Shape Wealth Investments”