Your basket is currently empty!

Reading Time: 5 minutes

Most people believe the ultra rich stay ahead by simply earning more. But what separates them from everyone else is how they structure their money. One of the most shocking yet completely legal strategies involves paying rent for a mansion they secretly own. The trick lies in using international trust law to shift ownership while keeping full control.

This blog breaks down how billionaires appear to pay rent on properties they already control, how Malta plays a key role, and what it would take to set this up for yourself if you are building serious wealth.

The Rent Illusion Explained

Imagine a billionaire paying one million dollars every month in rent. On paper they are a tenant. The lease looks legitimate. Rent payments are made from their personal account and recorded like any normal expense. But the entity receiving the rent is a trust they control. That trust legally owns the property and quietly funnels the rent money back into their own ecosystem.

It looks like rent. It feels like rent. It is filed as rent. But it is actually a legal loop where money stays under their umbrella and is never truly lost. The person gets to live in the mansion while transferring millions into a tax friendly legal structure.

How Billionaires Hide Ownership Without Losing Control

Billionaires do not list mansions under their personal names. They use offshore trusts to create legal distance between themselves and the property. One of the most popular places to register these trusts is Malta. A trust registered in Malta can own real estate, bank accounts, or entire companies. The ownership is kept private. The names of the real controllers and beneficiaries are not publicly disclosed.

Behind this trust, the billionaire often installs a legal role called a protector or sets up corporate layers that allow indirect control. They do not appear to own the property but they still make all the decisions behind the scenes.

This creates a situation where they live in a home that they do not legally own. They rent it from the trust. And the trust is legally separate but privately controlled.

Why Malta Is the Chosen Jurisdiction

Malta is a financial hub that caters to foreign wealth. It has one of the most attractive and secretive trust frameworks in Europe. Income earned from foreign sources is often exempt from local tax if structured correctly. Rental income received by a Maltese trust from a foreign individual can be classified in this way.

Trusts in Malta are not publicly recorded the way company registries are. The government does not publish who the beneficiaries or protectors are. As long as the trust is registered and compliant, it can operate in near total privacy.

This makes Malta the perfect place to hold real estate on behalf of wealthy individuals who want to appear separate from their assets while maintaining practical control.

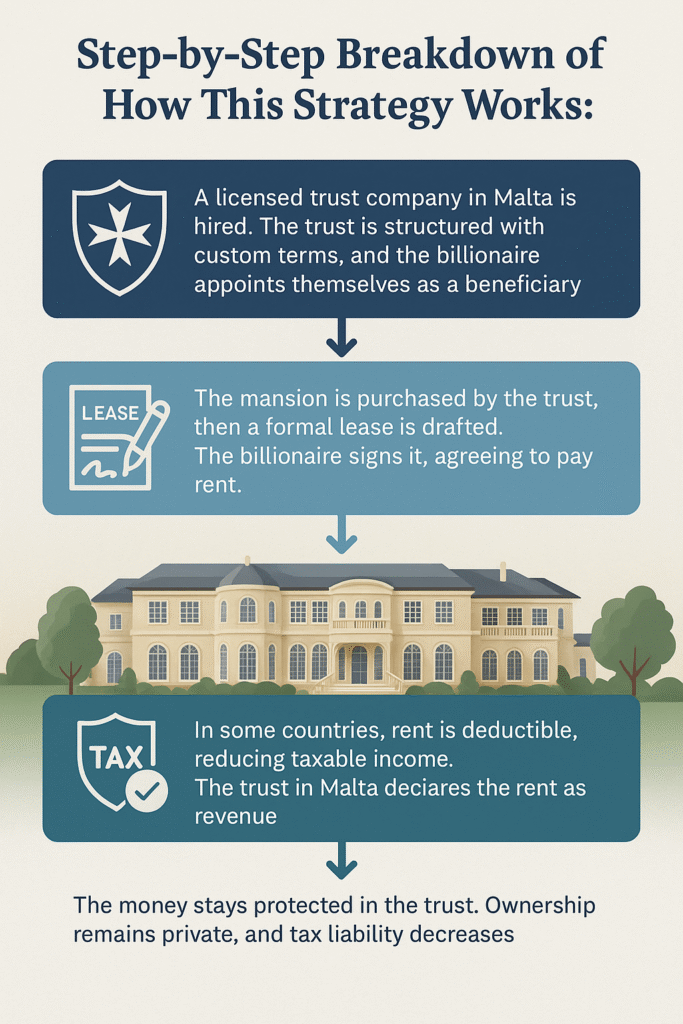

Step by Step Breakdown of How This Strategy Works

A licensed trust company in Malta is hired. They act as the formal trustee and handle registration and administration. The trust is structured with custom terms. The billionaire appoints themselves as a beneficiary and may install a trusted individual or firm as protector to influence decisions.

The mansion is purchased directly by the trust or transferred into it through legal instruments. The trust becomes the legal owner of the property. A formal lease is then drafted. The billionaire signs it as a tenant and agrees to pay rent to the trust. Rent payments begin and are recorded as monthly expenses.

In countries where rent is deductible this allows them to reduce their reported taxable income. Meanwhile the trust in Malta declares the income as rental revenue. Due to Malta’s favorable treatment of foreign source income the effective tax rate can be extremely low.

The trust uses the money to reinvest or hold for future beneficiaries. The mansion is enjoyed by the billionaire as usual. The money stays protected in the trust. Ownership remains private. Tax liability is lowered. And all activity remains within legal boundaries.

What the Paper Trail Looks Like

From a legal perspective the paperwork shows a clear division. Person A is renting a luxury property. The rent is paid to Trust X based in Malta. Trust X owns the mansion and is a separate entity. On the surface there is no connection between Person A and Trust X.

But behind the legal firewall Person A controls Trust X through carefully structured legal tools. They benefit from the rental payments. They protect the property from seizure. They plan for inheritance without estate tax. They enjoy full use of the home without ever being listed as its owner.

Why It Works and Why It Is Legal

This works because it follows the letter of the law in multiple jurisdictions. There is no misreporting. No lying. No concealment. Everything is declared correctly. The rent is paid. The trust receives income. Taxes are filed.

What makes it powerful is the combination of legal structures that make the billionaire look like a tenant while functioning as an owner. It is not tax evasion. It is tax optimization through international trust law.

This structure also offers protection from lawsuits or public inquiry. If someone tries to go after the mansion they will find it is not in the billionaire’s name. It belongs to a foreign trust with legal autonomy.

Long Term Wealth Advantages

This setup is not just a tax strategy. It is a full scale wealth system. The trust can survive for generations. Assets held inside can be passed to heirs without probate. The rent payments can grow the trust’s reserves year after year.

Because the billionaire is not the legal owner the property is insulated from divorce claims or business disputes. It also prevents estate taxes from eroding the value upon death. Trusts allow for flexible wealth distribution while keeping everything out of the public eye.

The trust can even own multiple properties. The same rent to self system can be repeated across cities or countries. Each mansion can be lived in while legally being held offshore and collecting rent from its own occupant.

Can Anyone Set This Up

Technically yes. But practically this is a tool for high income or high net worth individuals who have assets worth shielding. Setting up a Maltese trust requires legal oversight international tax compliance and an understanding of how to manage cross border entities.

If your income is growing or you are building a portfolio of real estate or international businesses this kind of structure can become essential. You do not need to be a billionaire to benefit from it. You just need to think like one and work with professionals who know how to build these systems the right way.

Billionaires are not just lucky. They are structured. They do not just make money. They move it with precision. This legal trick is one of the most powerful tools in the world of asset protection and elite tax planning.

Living in a home while renting it from yourself is not a loophole. It is a legal framework that separates control from ownership and protects wealth from erosion.

The mansion is still enjoyed. The money is still flowing. But the system keeps the power in their hands and the liabilities far away.

If you are serious about building wealth this is the kind of game you need to learn to play. Not by hiding. But by structuring.

0 responses to “THIS ONE LEGAL TRICK LETS BILLIONAIRES LIVE TAX-FREE IN MEGA MANSIONS”