Your basket is currently empty!

Read Time: 9 Minutes

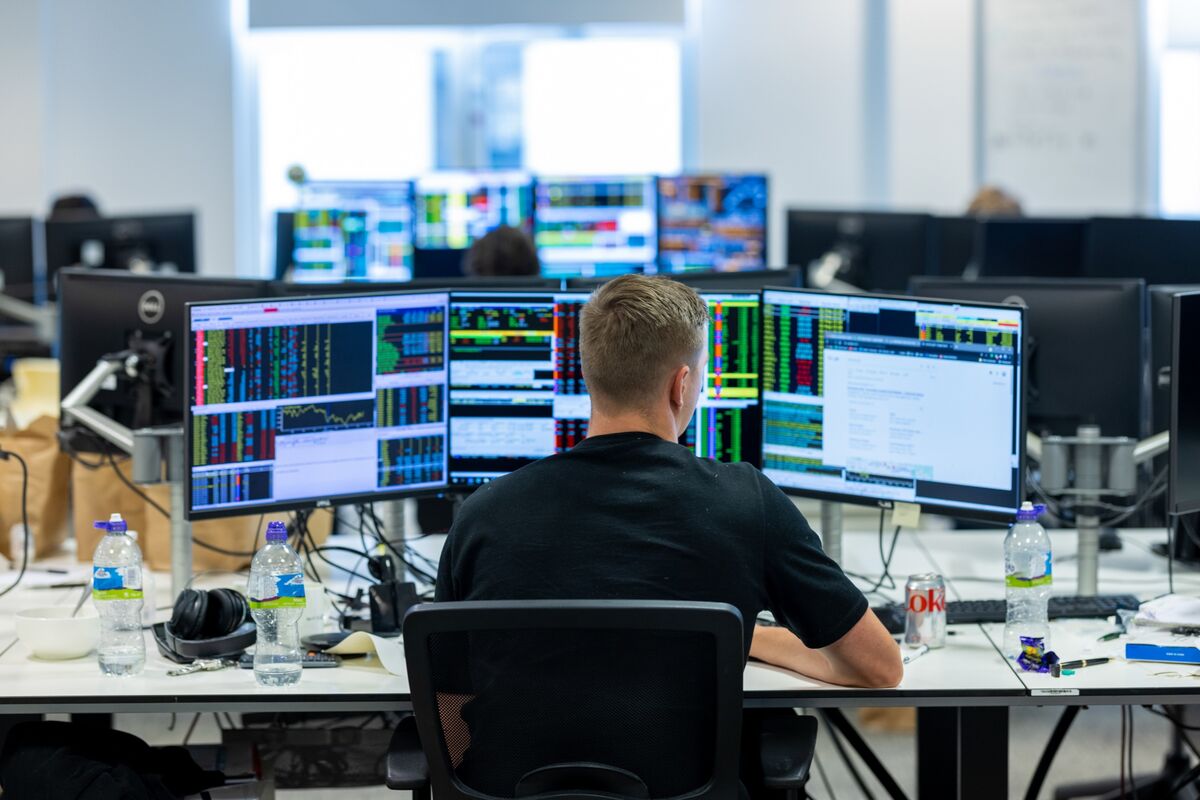

The Truth Behind Hedge Fund Power: Why They Win Before You Even Begin

If you’ve ever opened your trading platform and wondered how a stock surged or crashed just before the news broke, the answer is simple. The game is not rigged in your favor. It’s not about poor timing or bad luck. It’s about access to a world of information, infrastructure, and influence that most retail traders will never see. While the public waits for headlines, hedge funds move on whispers. They’re already in the trade, out of the trade, and profiting before the average investor has even started reading.

The reason hedge funds consistently win isn’t intelligence or risk tolerance. It’s architecture. They build their entire strategy around minimizing delay and maximizing predictive intelligence. The headlines you read are history to them. They trade on the future.

It’s Not Just Research. It’s Access, Intelligence, and Speed

Retail traders often believe that deep research or better technical analysis is the key to consistent returns. But hedge funds aren’t playing that game. They don’t just analyze charts or earnings reports. They operate in a universe of privileged data, custom-built algorithms, and private networks that give them a market-moving edge.

They employ ex-government advisors, data scientists, and engineers who specialize in building systems that react to information the second it appears or before it becomes public at all. These are not random trades. They are precision strikes based on data pipelines and predictive analytics that never appear in public trading courses.

Retail Reacts. Hedge Funds Predict

The public has been trained to believe that markets respond to news. But by the time you read an article or hear a financial analyst speak, the trade has already been executed. Hedge funds don’t wait for headlines. They build models that detect sentiment shifts, policy changes, and economic turns before the public ever catches on.

They don’t chase price. They anticipate it. While retail traders are watching candlesticks and indicators, hedge funds are watching activity in the bond markets, reading unpublished research, and acting on economic data leaks that never make the mainstream. Timing is their advantage. Your delay is their opportunity.

Surveillance Economics: Alternative Data Powers the Modern Edge

Today’s hedge funds aren’t just reading reports. They’re generating predictive insight from real-time alternative data. They track satellite imagery of parking lots to measure factory activity. They buy access to anonymized credit card swipes to detect consumer behavior trends. They scan shipment data from global ports to assess supply chain flow before earnings are reported.

Many use mobile tracking data to monitor app usage across cities, providing near-instant feedback on behavioral changes. Others analyze weather patterns to forecast commodity supply before official government reports are released. This isn’t speculation. It’s real-time economic intelligence gathered by systems built for surveillance and prediction.

Political Foresight Is Bought Legally

The line between legal research and political foresight has been blurred by hedge funds through the use of expert networks. These are formal networks where ex-CIA analysts, former Federal Reserve economists, SEC consultants, and Capitol Hill insiders are hired to provide insight. These individuals no longer hold office, but they maintain access, relationships, and knowledge of the machinery behind policymaking.

These insights help hedge funds anticipate regulation, tax policy shifts, interest rate moves, and enforcement actions. While retail waits for official announcements, institutional players are already positioned. The edge is not always in the data itself. Often, it’s in the interpretation of power and timing.

High Frequency Warfare: Where Every Microsecond Counts

Hedge funds don’t just analyze faster they execute faster. By physically placing their servers next to the exchange’s data centers, a strategy called co-location, they shave microseconds off order placement time. This allows them to front-run trades, fill orders at better prices, and exit before volatility sets in.

Custom fiber optic cables, proprietary routers, and optimized trading code give them a timing edge that makes standard retail execution feel like dial-up internet. Their AI models aren’t just reactive. They’re predictive, constantly scanning for subtle shifts in price action and sentiment across thousands of assets. In this battlefield, milliseconds can mean millions.

Private Conversations Move Public Markets

Not all information is digital. Some of it is conversational. Hedge funds participate in closed-door events that are invitation-only. They attend private CEO dinners, take part in pre-market analyst calls, and sit in on informal chats with regulatory officials. These are not public disclosures. They are off-the-record meetings where direction is hinted at, tone is interpreted, and opportunity is silently shaped.

These events are not listed on calendars. They do not appear in press releases. But the information shared in those rooms becomes tomorrow’s headlines. And for those who attend, it becomes today’s trade.

Legal, But Just Barely

Hedge funds are not typically breaking laws, but they are engineering themselves around them. They operate in the gray area where information is technically public but functionally privileged. They use expert networks to gather sensitive data without crossing the legal line. They study body language and tone during earnings calls, dissect central bank language for hidden meaning, and monitor obscure legal filings for early clues on litigation risks.

They exploit delays in regulation, ambiguity in definitions, and technicalities in disclosure rules. This is not insider trading. But it’s close enough to produce institutional-grade profits without triggering regulatory alarms.

Delay Is the Greatest Disadvantage

By the time you read an alert, listen to a podcast, or see a spike in your stock app, they have already entered, exited, and possibly reversed their position. This is not a coincidence. It’s a calculated advantage. Your delay whether it’s thirty seconds or two hours is the wedge they use to drive profit.

The longer you wait, the more they win. And while their gains don’t require your loss, their precision depends on your latency.

The Invisible Tools That Power Their Trades

Most retail traders are using free charting platforms, low-cost brokers, and forum-based research. Hedge funds operate on a completely different scale. They build custom dashboards that integrate over one hundred live data feeds. They license Bloomberg Terminals at twenty-five thousand dollars per year per user. Their bots scrape financial documents the instant they are uploaded and use sentiment analysis to trigger alerts.

They join private communities and mastermind groups that share intelligence well beyond what is available to the public. They invest millions in infrastructure because the return on milliseconds can be astronomical. They are not guessing. They are calculating.

You’re Playing a Different Game

The playing field is not level. You’re watching the scoreboard while they’ve already finished the game. They don’t wait. They don’t guess. They build systems that act on signals you don’t even know exist. And they win because they’ve removed the uncertainty that defines retail trading.

The future of successful trading is not about luck or instinct. It’s about building access, speed, and intelligence into your workflow. Without those advantages, you’re competing against an opponent who sees the move before the clock even starts.

Main Takeaways

Hedge funds win because they have faster execution, superior data access, political connections, and private intelligence systems. They legally operate in a gray zone, using architecture that gives them a time and knowledge edge over every other participant. The markets are not random to them. They are engineered outcomes backed by infrastructure and insight.

Now ask yourself this what are you doing to reduce your delay? Are you still trading with instinct, or are you building systems that allow you to compete?

0 responses to “How Hedge Funds Get Free News First and Convert It Into Billions”