Your basket is currently empty!

Estimated read time: 7 minutes

If you’ve ever looked at a price chart and felt like you were up against an invisible force, something you couldn’t quite see but knew was there, you weren’t imagining it.

Today’s markets are dominated by trading algorithms, the secret weapon of billion-dollar hedge funds, elite banks, and institutional investors. While retail traders grapple with fear and emotion, algorithms execute complex strategies at lightning speed, often before you’ve even had time to click the mouse.

Yet, most traders don’t realize just how deeply algorithms have penetrated global markets. And fewer still know that many of the same principles behind these institutional systems can be harnessed by everyday traders with the right tools.

In this post, I’ll break down:

How institutions like Bridgewater Capital deploy advanced algorithms to manage billions.

The truth about the famous Pure Alpha algorithm.

Why trading robots aren’t just a shortcut; they are a necessity in today’s market.

The different trading algorithms I personally use and offer, including MSP 3.0 FX, AF Supply and Demand 3.5 PRO, AF MoneySprout, AF Blitz Turbo, and MSP 3.5 Crypto.

The Rise of the Algorithm: From Human Intuition to Machine Precision

Decades ago, trading floors were noisy jungles of shouting brokers waving paper tickets. Today, most of those traders are gone, replaced by black boxes and servers in temperature-controlled data centers.

According to the TABB Group, over 80% of daily volume in U.S. equity markets is algorithmically driven. In forex and futures markets, the numbers are similar.

Why? Because algorithms

- Do not get tired or emotional.

- Can react to news and price changes in milliseconds.

- Process huge data sets humans simply cannot.

- Execute consistent strategies without hesitation.

For banks and hedge funds, algorithms are not optional. They are the backbone of profitability.

Inside the World of Bridgewater Capital and the Pure Alpha Algorithm

When people think of elite quant trading, they often think of Bridgewater Associates, the largest hedge fund in the world, managing over 160 billion dollars in assets.

Bridgewater’s flagship strategy, Pure Alpha, has become legendary.

Pure Alpha is not a single strategy. It is an ecosystem of interlocking algorithms designed to profit in any market condition.

How does Pure Alpha work?

While the exact details are proprietary, here is what is publicly known:

It uses a vast set of economic and market signals, including interest rates, GDP data, inflation trends, and sentiment surveys.

Models are built to forecast relationships between these variables and asset prices.

Algorithms generate trades across hundreds of markets, including currencies, bonds, equities, and commodities.

Everything is rigorously backtested and stress-tested to simulate extreme events.

Ray Dalio, Bridgewater’s founder, has called it a machine that bets on everything.

The takeaway:

Bridgewater does not rely on guesswork. They rely on structured, systematic trading and have built one of the most profitable funds in history because of it.

Why You Need Algorithms in Your Trading

If you are still trading manually, you are competing against:

Quant funds with hundreds of PhDs designing models.

Servers colocated at exchanges for faster order execution.

AI systems that continuously learn and adapt.

That does not mean you cannot win, but it means you must be systematic and disciplined, and ideally have automation on your side.

That is exactly why I started using and offering my suite of trading robots. Each one is engineered to tackle a different market or trading style, helping traders like you leverage technology that was once reserved only for institutions.

The Trading Robots I Use and Offer

Here is an inside look at each of my trading algorithms:

MSP 3.0 FX Robot

MSP 3.0 FX is my flagship multi-strategy robot for the forex market.

What it does:

It combines scalping, momentum breakout, and trend-following modules into a single expert advisor.

How it works:

Analyzes volatility and liquidity windows.

Identifies 6 Unique Price Action Signals and automatically trades them at support and resistance levels.

Automatically places stop-loss and take-profit orders with adjustable risk parameters.

Ideal for:

Traders who want consistent long and short-term trades on major and minor forex pairs without sitting at the screen all day.

Explore More Here https://connectmycurrency.com/product/msp2-5/

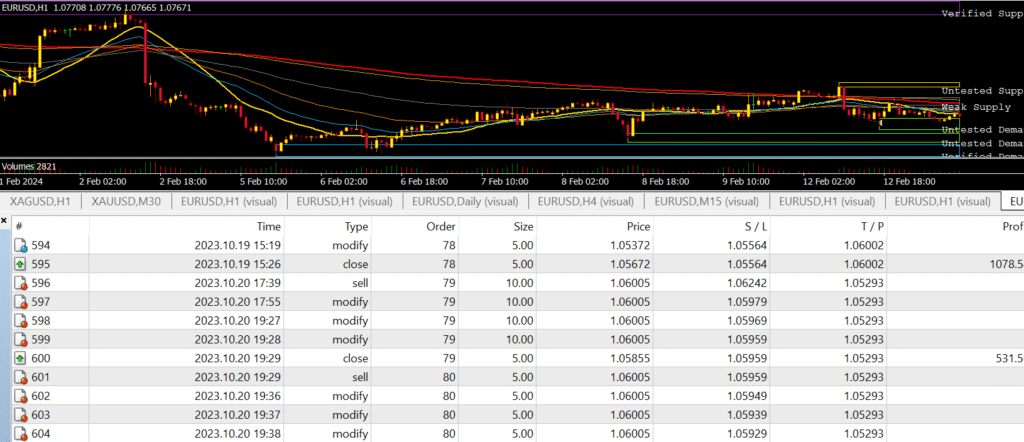

AF Supply and Demand 3.5 PRO Robot

AF Supply and Demand 3.5 PRO is built to trade based on institutional order flow zones.

What it does:

Detects high-probability supply and demand areas.

Times entries as price returns to these zones.

Includes advanced filtering to avoid false breakouts.

Why it is powerful:

Institutions leave footprints in the market when they build or unwind large positions. This robot identifies those footprints and trades alongside them.

Ideal for:

Traders who believe in price action and supply-demand dynamics but want automation to handle execution flawlessly.

More Details Here: https://connectmycurrency.com/product/afdigioffer/

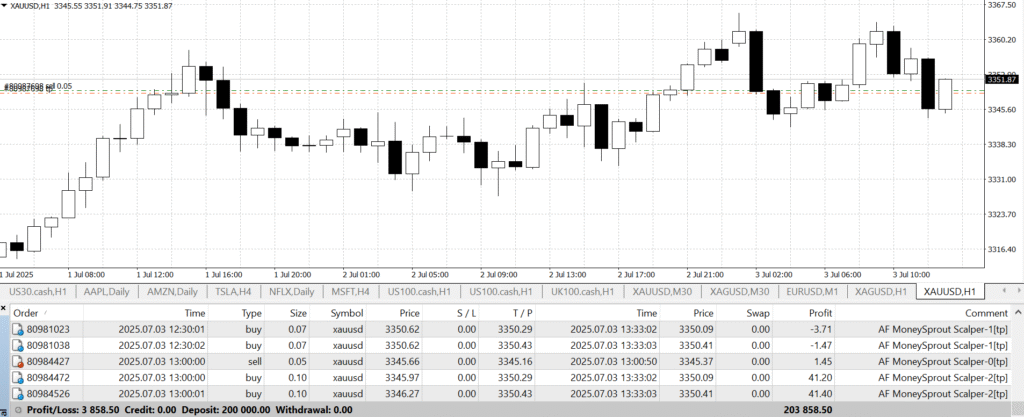

AF MoneySprout Robot

AF MoneySprout is designed for gold and silver scalping, though it works on other commodities as well.

What it does:

Hunts micro-trends in volatile commodities.

Executes high-frequency trades with low latency.

Can place multiple trades per session with tight stops.

Perfect for:

Traders who enjoy fast action and want to extract profits from short-term moves without manual clicking.

Grab it Here: https://connectmycurrency.com/product/af-moneysprout-scalper-v3/

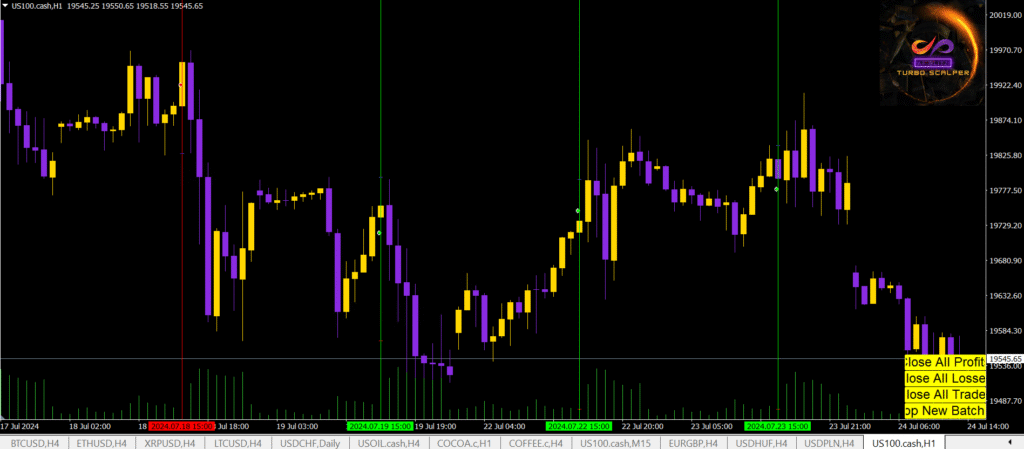

AF Blitz Turbo Scalper Robot

AF Blitz Turbo is my ultimate index scalping system, especially on NAS100, S&P500, FTSE100 and DOWJONES.

Key features:

Focuses on the first hours of the US trading session.

Times entries with a blend of trend bias and micro-pullback patterns.

Includes intelligent partial profit-taking logic.

Why I created it:

Indices have unique intraday volatility that many systems cannot handle. Blitz Turbo thrives in that environment and adopts volatility.

See More here: https://connectmycurrency.com/product/accountmanagement/

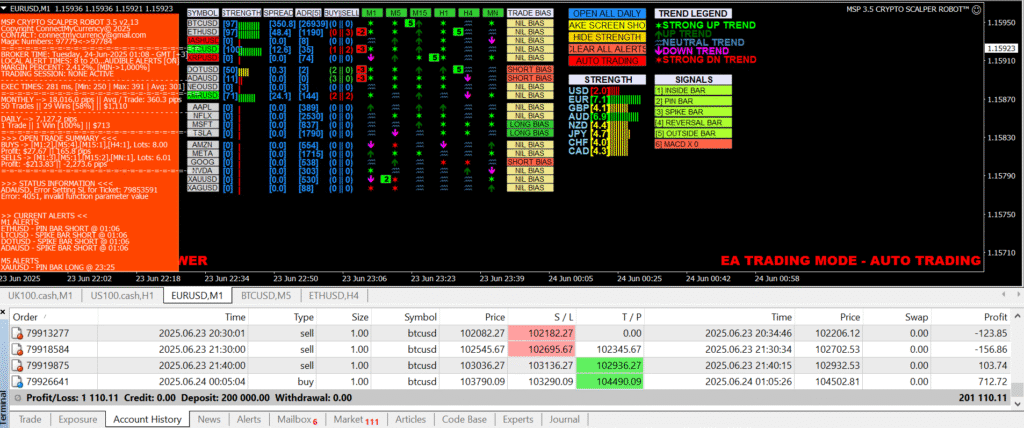

MSP 3.5 Crypto

MSP 3.5 Crypto is built for 24/7 crypto trading.

Core advantages:

Designed to handle constant volatility and active weekend trading in crypto.

Trades major coins like Bitcoin, Ethereum, Dash and more.

Includes dynamic risk scaling depending on volatility spikes.

Great for:

Traders who want around-the-clock automation in crypto markets.

Grab it here: https://connectmycurrency.com/product/msp-3-5-crypto-scalper-robot-precision-engineered-for-elite-crypto-traders/

How I Use These Systems Together

Just like Bridgewater diversifies across strategies, I run multiple robots across different instruments.

MSP 3.0 FX handles forex consistency.

AF Supply and Demand 3.5 PRO captures large moves around key zones in FX, Stocks, Crypto and Indices.

AF MoneySprout trades precious metals volatility.

AF Blitz Turbo scalps indices like NAS100 and FTSE100 etc.

MSP 3.5 Crypto operates nonstop in crypto.

By spreading risk and not relying on a single approach, I achieve smoother equity growth.

This is the closest you can get to the institutional approach without needing a billion-dollar infrastructure.

Trading Like a Pro in an Algorithmic World

We live in an era where algorithms decide the majority of price moves long before most traders can react.

You can fight this reality or embrace it.

Bridgewater’s Pure Alpha is proof that systematic trading works at scale. And thanks to the explosion of retail trading technology, you now have access to advanced tools that were unthinkable even a decade ago.

If you are ready to level the playing field, consider equipping yourself with professional-grade trading robots. Because in the world of modern markets, consistency and automation are not luxuries. They are survival tools.

Ready to learn more about any of these robots or want help choosing the right one for your trading style?

0 responses to “The Hidden Power Behind the Markets: How Trading Algorithms Rule Wall Street and How You Can Use Them Too”