Your basket is currently empty!

Bitcoin Treasury Stocks: The Ultimate Guide to Companies Betting Billions on BTC (+ How to Trade Them Smarter)

Bitcoin isn’t just for retail traders and crypto diehards anymore. Over the last few years, some of the world’s largest publicly traded companies have quietly transformed their balance sheets by buying and holding massive amounts of Bitcoin.

These companies, often called Bitcoin treasury stocks, provide investors a unique opportunity: exposure to Bitcoin without having to hold the digital asset directly. For many, it’s a way to blend the liquidity and familiarity of stock ownership with the explosive potential of crypto.

Today, we’re diving deep into what Bitcoin treasury stocks are, why companies buy Bitcoin, and how you can track and trade them more intelligently.

What Are Bitcoin Treasury Stocks?

In simple terms, Bitcoin treasury stocks are publicly listed companies that have made Bitcoin a significant part of their corporate treasury reserves. These firms buy Bitcoin for various reasons:

- Hedge against inflation

- Speculation on long-term price appreciation

- Signaling innovation to shareholders

- Diversification away from fiat currencies

Some companies have modest allocations, while others have gone all in, taking on debt to fund purchases and becoming de facto Bitcoin ETFs.

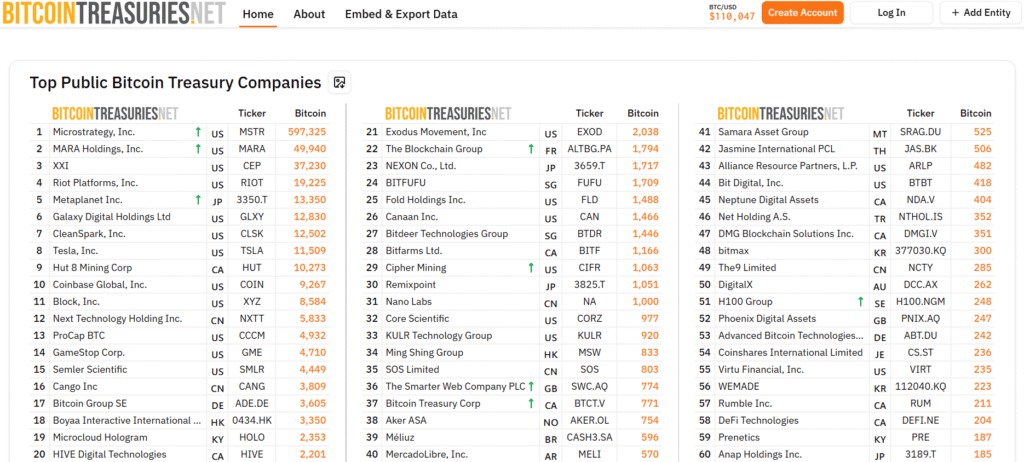

The Complete List of Major Bitcoin Treasury Stocks (Latest Data)

Below, you’ll find the full list of companies holding Bitcoin and check out https://bitcointreasuries.net for more.

Why Companies Hold Bitcoin

Diversification: Bitcoin offers an alternative to bonds, cash, and equities.

Speculation: Many CEOs expect Bitcoin to appreciate over decades.

Inflation Hedge: As governments print money, Bitcoin’s fixed supply attracts capital.

Brand Value: Holding Bitcoin signals forward-thinking leadership.

Risks to Know

While exciting, Bitcoin treasury stocks can be extremely volatile.

- Balance Sheet Exposure: BTC price swings can impact earnings.

- Regulatory Uncertainty: Accounting standards and tax treatment remain in flux.

- Leverage Risk: Companies like MicroStrategy have collateralized debt with BTC.

How to Track Bitcoin Treasury Stocks More Effectively

Researching all these companies and understanding their exposure can feel overwhelming.

That’s why we recommend AF Stockview Pro, our dynamic charting and analysis platform built to help traders monitor Bitcoin-related equities in real time.

Trade Bitcoin Stocks Smarter With AF Stockview Pro

AF Stockview Pro isn’t just another charting tool. It’s your edge in the markets.

Live Data & Alerts: Track Bitcoin treasury stocks side by side with BTC prices.

Dynamic Charting: Visualize correlations between Bitcoin price and stock performance.

Custom Watchlists: Stay organized and never miss critical moves.

Integrated News Feeds: Know when companies buy, sell, or comment on their holdings.

If you’re serious about trading Bitcoin-related equities, this is the tool professionals trust.

How to Buy Bitcoin Treasury Stocks

You don’t need a crypto wallet to get started. Most of these companies trade on major exchanges:

Nasdaq (e.g., MSTR, MARA, RIOT)

NYSE (e.g., SQ)

TSX (e.g., GLXY, HUT)

Check your broker platform, search the ticker, and place a trade just like any stock.

Bitcoin treasury stocks are a fascinating intersection of traditional finance and digital assets. They offer a unique way to capture upside and risk in the crypto market without needing to self-custody coins.

If you’re ready to track, analyze, and trade these stocks smarter, don’t forget to explore AF Stockview Pro today.

0 responses to “Bitcoin Treasury Stocks: The Ultimate Guide to Companies Betting Billions on BTC (+ How to Trade Them Smarter)”