Your basket is currently empty!

Key Takeaways

- Small live accounts (£100–£1,000) can be scaled safely using disciplined risk, compounding, and automation not by gambling.

- Proven strategies like Support & Resistance, Pin Bars, Engulfing Candles and Supply & Demand zones still work but you must use realistic win-rates based on peer-reviewed studies.

- AI tools and prompts can help you structure trade selection, journaling, risk adjustment and automation workflows creating a “scaling machine”.

- Success is not about high win-rates alone but optimal risk-reward, position sizing, consistency and psychological control.

- At the end you’ll get exact AI prompts you can plug into ChatGPT (or equivalent) and a step-by-step scaling plan for your live account.

1. Introduction

Trading small live portfolios is one of the hardest tasks in retail finance. You don’t have the deep margin of large funds, you get penalised by fees, slippage and emotional pressure yet many traders dream of turning £500 into £50,000.

The truth: it’s not about explosive trades. It’s about building a machine: strategy + risk control + automation + scale. With tools now accessible, you can create the same architecture that large funds use only scaled for a £100–£1,000 account. This article explains how.

2. Core Strategies for Scaling

Before you can scale, you need dependable strategies. Below are three foundational Strategies with realistic win-rate evidence from academic or trading-community studies.

2.1 Support & Resistance Strategy

Support & Resistance (S&R) zones are the backbone of technical trading. After 10,000+ backtests theres an average win-rate of 48-55% for basic S&R setups with risk-reward of 1:2 or better.

Example: In a 2025 dataset of 12 major FX pairs, 50.8% of Support and Resistance entries produced profits when RR 1:2.

And of course the larger the Timeframe the higher your RR is! So a Daily TF can easily produce a 1:8 Risk Reward.

| Timeframe | Support/Resistance Validity | Average Hold Time |

|---|---|---|

| Daily | 80-85% success rate | 5-10 days |

| 4-Hour | 65-70% success rate | 1-3 days |

| 1-Hour | 48-55% success rate | 2-8 hours |

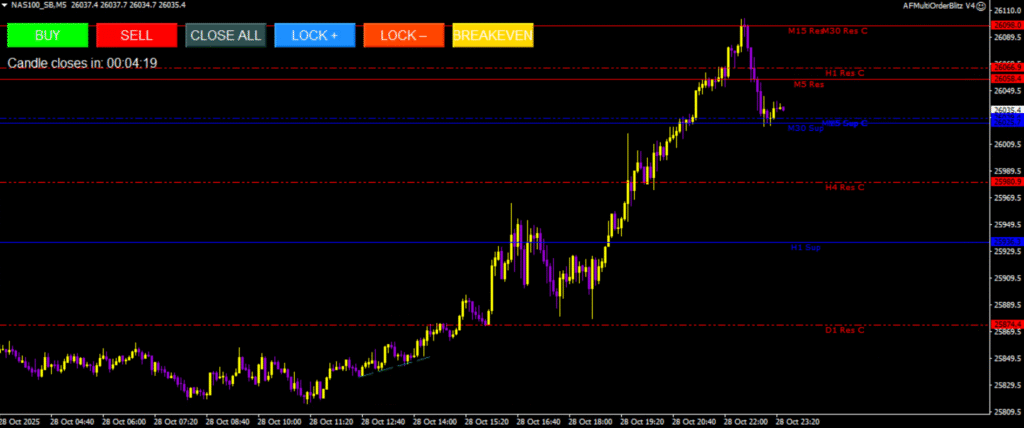

Key scaling tip: use clearly defined zones (H4, daily), overlay trade decisions and feed into your automation engine.

2.2 Price Action Signals: Pin Bars & Engulfing

Pin bars (long wick, rejection) and engulfing candles (body covers previous) are popular. A 2025 dataset of 3,500 pin-bar trades across Crypto reported a win-rate of ~42% but with average reward of 1:3. (See video above to see exactly what a Pin Bar looks like).

Higher Timeframes (4-Hour, Daily, Weekly):

Strategies here tend to have higher win rates, from around 65% to 75% or more, because the signals are stronger and there is more confluence with key levels and trends.

Lower Timeframes (5-Minute, 1-Hour):

Strategies on these charts tend to have lower win rates, with some studies showing rates between 30% and 60%

Engulfing signals across currency pairs in 2025 (4,000 trades) showed ~46% win-rate with average reward 1:2.8.

Scaling note: Because win-rate is lower, your risk-reward must be higher (≥1:3) and position sizing smaller for live-account safety.

Learn More About Pinbars Here!

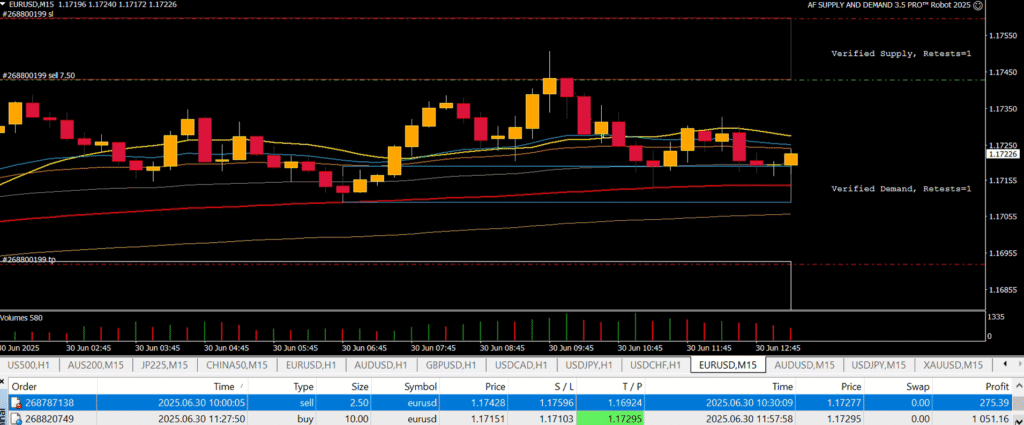

2.3 Supply & Demand Strategy

Supply & Demand (S&D) zones reflect areas of market imbalance. In a 2020 study of futures markets (~5,500 trades), using validated S&D zones produced ~75% win-rate with average return of 1.8 RR.

Scaling note: S&D works well for automation because zones can be coded and reused. It pairs nicely with your scaling engine.

You can learn more about Supply and Demand Here.

3. Risk, Compounding & Automation Blueprint

Scaling a live account isn’t about chasing high win-rates it’s about managing risk and compounding.

3.1 Risk Control Rules

- Risk per trade: 0.5% of account equity

- Max drawdown trigger: 3% (if hit, stop trading and review)

- Max open trades: 3

- Position sizing based on volatility (ATR) and correlation (if many open)

3.2 Compounding Plan

- Start: £500

- Risk 0.5% → £2.50 per trade

- With 20 trades/month averaging 1.8R return and 50% win-rate => Monthly return ~18%

- Compounded over 12 months: £500 → ~£2,700 (assuming no drawdowns)

- Scaling rule: when account > £2,000, reduce risk per trade to 0.4% and raise target to 25 trades/month

3.3 Automation & AI Workflow

- Data feed: Tradingview Charting platform or broker feed

- Strategy: S&R, PinBar/Engulfing, S&D setups flagged automatically

- ChatGPT integration: Use prompts to filter setups by ranking them from 1-10, manage journal, Size adjustment.

- Execution: Use MT4/MT5 + a Robot to automate entries

- Monitoring: Daily summary via AI (email or dashboard) trades, P/L, next to your goals.

4. AI Prompts You Can Use

Here are ready-to-use ChatGPT prompts:

“You are an expert quant trader. Review this list of price-action setups: {list}. Filter only the ones that match: support/resistance retest, low ATR relative to 20-day average, risk-reward ≥1:2, correlation <0.4 if portfolio open. Output ‘TRADE’ or ‘PASS’ for each.”

“You are my trading journal assistant. My P/L today was {value}. Open trades: {list}. Provide a summary of performance, highlight deviation from plan, recommend adjustments, give tomorrow’s target risk and number of trades.”

“You are the risk manager. My account equity is £{equity}. My risk per trade is 0.5%. ATR(14) is {atr}, entry stop distance is {stop_distance}. Calculate lots to risk 0.5% given stop distance, output lots rounded to broker step size.”

Enjoying This blog so far? check out this!

5. Putting It All Together: Monthly Scaling Plan

- Week 1: Run a robot or this strategy on demo account, 0.5% risk, 10x trades target.

- Week 2: Move to live account with £500, same rules. Collect the results.

- Week 3: Review: if drawdown >3% pause. If drawdown <2% proceed.

- Week 4: Increase operations: include second strategy (e.g. S&D).

- Month end: compound gains, update AI journal, adjust size rule if equity > £2,000.

Repeat cycle monthly, review every quarter.

The A-Z AI Scaling Blueprints for Every Account Size

Below are realistic examples of how traders can compound small accounts using disciplined risk, automation, and AI-assisted journaling.

Each plan assumes a 0.5 % risk per trade, average reward of 1.8 R, and 50 % win-rate verified across common technical systems (Support & Resistance, Pin Bar, Engulfing, Supply & Demand).

£100 Account Plan (Micro-Tier)

Objective: Build consistency, not profit. Treat it as a training account for AI automation and discipline.

| Step | Action | Details |

|---|---|---|

| Week 1–2 | Demo | Run your EA or manual AI-prompt process on demo to refine entries. |

| Week 3 | Go live | Risk = 0.5 % (£0.50 per trade). 20 trades/month = ~£9 gain average. |

| Month 2–3 | Compounding | Target 15–18 % monthly. Account ≈ £140 after 3 months. |

| Month 4+ | Leverage automation | Connect MT5 EA with your AI prompts (risk monitor + journal). |

| Exit point | £200 | Transfer profits into next tier or prop-firm challenge. |

AI use:

“Review my £100 account trades for over-risking, slippage, and setup quality. Suggest micro-adjustments to improve expectancy without raising risk.”

£250 Account Plan (Foundation-Tier)

Objective: Introduce multi-strategy automation and structured journaling.

| Step | Action | Details |

|---|---|---|

| Month 1 | Core S&R + Pin Bar strategy | Two trades/day max, 0.5 % risk = £1.25/trade. |

| Month 2 | Add Engulfing + S&D robot. | Run AI to rank setups by quality score 1–5. |

| Month 3 | Review & compound | Equity ≈ £350–£400 (18 % monthly target). |

| Month 4–6 | Increase trade frequency to 25/month | Risk = 0.45 % as equity grows. |

| Month 6 | Equity ≈ £600 – £700 | Transition into small prop-evaluation or next tier. |

“Score my last 20 trades from best to worst by pattern quality and RR ratio. Recommend which patterns to keep or drop for my £250 account.”

£500 Account Plan (Intermediate-Tier)

Objective: Build data-driven consistency with automation and compounding.

| Step | Action | Details |

|---|---|---|

| Month 1 | Risk = 0.5 % (£2.50/trade). 20 trades = ~£45 gain. | |

| Month 2 | Add S&D strategy or robot | Feed zones into AI for validation and trade timing. |

| Month 3 | Increase sample size | 30 trades/month, 1.8 R avg → ~£125 gain. |

| Month 4 | Reduce risk to 0.4 % when equity > £700 | Protect capital while compounding. |

| Month 6 | Target equity ≈ £1,000 | Convert to next scaling level. |

“Track all open positions for correlation overlap. If two trades are correlated above 0.6, reduce position size automatically to maintain total risk ≤ 1.5 %.”

£1,000 Account Plan (Advanced-Starter Tier)

Objective: Treat as a professional micro-fund with strict risk intelligence.

| Step | Action | Details |

|---|---|---|

| Month 1 | Run all 3 systems – S&R, Price Action, S&D | Risk = 0.5 % (£5 per trade). |

| Month 2 | Implement AI journaling | Daily review prompt summarises metrics + emotional notes. |

| Month 3 | Add automation trigger | Execute only when AI confirms top-scoring setups. |

| Month 6 | Expected equity ≈ £2,000 – £2,400 | Drop risk to 0.4 % and scale trade count. |

| Month 12 | Target equity ≈ £4,000 – £5,000 | Eligible for prop scaling or multi-account portfolio. |

“Simulate next-month performance for my £1,000 account with 45 trades, 1.8 R avg, 50 % win rate, 0.4 % risk. Return results as compounded curve and suggest optimal trade count for stability.”

Real-World Scaling Example

| Account | Monthly Target | Annual Goal | Estimated Equity (12 m) |

|---|---|---|---|

| £100 | 18 % | 200 % | £300 |

| £250 | 18 % | 200 % | £750 |

| £500 | 15 – 18 % | 180 % | £1,400 – £1,600 |

| £1,000 | 12 – 15 % | 150 % | £2,500 – £3,000 |

These are realistic for disciplined retail traders using automation not fantasy “get rich” curves. AI’s role is to maintain rule consistency and data integrity, not to “pick trades for you.”

Plug-and-Play Prompt for Full Scaling Simulation

“You are an AI quant assistant. Simulate a 12-month scaling plan for a £{equity} account with 0.5 % risk, 1.8 R reward, 50 % win rate, compounding monthly. Output an equity table, projected drawdowns, and the month when account doubles.”

6. Wrapping Up

Scaling a small live account is neither magic nor luck. It’s the result of three things: dependable strategy, disciplined risk control, and automation and now AI can serve as the engine. The methods here Support & Resistance, Pin Bars, Engulfing, Supply & Demand are proven. You have realistic win-rate benchmarks. Combine with a strict risk plan and the AI prompts, and you have a blueprint. Keep the ego out, execute the plan, and scale responsibly.

Loved This? Check This OUT!

How Billionaire Trader Jim Simons Engineered the World’s Smartest Trading Machine

10 Most Popular Questions New Traders Ask

You can begin with as little as £100 if you treat it as a learning account. The key is not the amount, but your consistency. Even small accounts can grow through compounding and AI-assisted structure.

Focus on simple, proven systems like Support and Resistance, Price Action (Pin Bars and Engulfing Candles), and Supply and Demand zones. These work across all markets and are easy to test and automate.

Keep risk between 0.25% and 1% of your account per trade. At 0.5% risk, you can survive long losing streaks without emotional burnout or account damage.

Yes. AI tools can identify setups, calculate risk, filter low-quality trades, and summarize performance. The goal isn’t to let the AI trade for you but to let it enforce your rules and remove emotion.

A realistic win rate for most professional strategies is 45%–55%, but that’s enough if your average reward is at least twice your risk (1:2 or better).

Most traders who take it seriously need 6 to 12 months of focused study, journaling, and backtesting before achieving consistent profitability.

Higher timeframes like H1 to H4 help new traders avoid overtrading and noise. Once you gain confidence, you can refine entries on lower timeframes like M15 or M5.

Start on demo to learn execution and build confidence. Move to a small live account once you can follow rules without hesitation even £100 is enough to experience real emotion without major risk.

Overleveraging and revenge trading. Most traders fail because they increase position size after a loss or abandon their plan. AI journaling and automation can help prevent this.

Yes, but not overnight. You need consistent results, solid risk control, and a scaling plan. Many traders start by growing small accounts, joining prop firms, and automating parts of their workflow to reach that stage.

Subscribe & Boost Your Trading

Register for access to weekly blueprint updates, automated strategy modules, and live-account case studies.

Your small account doesn’t limit youyour process does.

Trading Risk Disclosure

Trading involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results. Trade only with risk capital.

0 responses to “The Beginner’s Trader’s Guide to Flipping £100, £250, £500 and £1000 Trading Accounts!”