Your basket is currently empty!

Key Takeaways

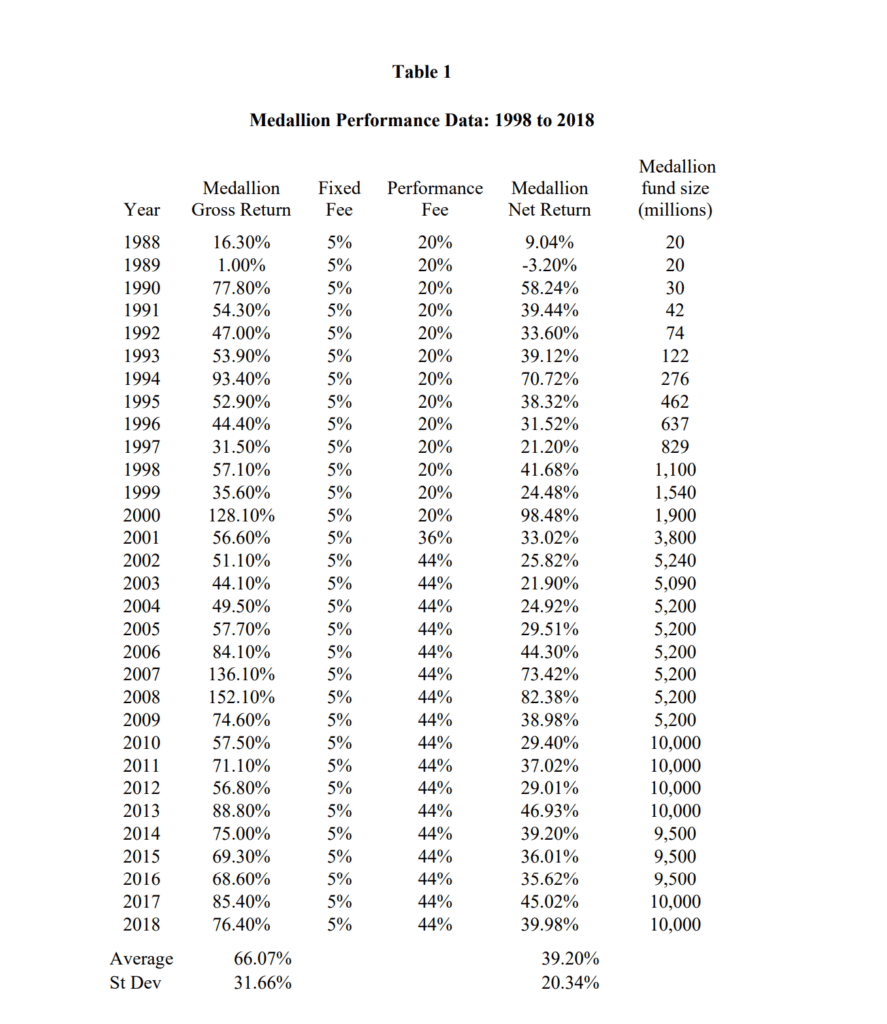

- Jim Simons transformed mathematics into the most profitable trading operation ever built.

- His firm, Renaissance Technologies, earned over 66% average annual returns for three decades.

- Behind those returns were quantitative systems statistical arbitrage, ensemble modeling, adaptive algorithms.

- Retail traders can mirror his logic using data-driven rule sets, automated execution, and disciplined optimization.

- The future belongs to traders who think like engineers, not gamblers.

Introduction

Markets used to reward instinct.

Then Jim Simons arrived with mathematics.

Armed with equations, cryptographic experience, and a deep belief that prices hide repeatable structure, he built Renaissance Technologies, a company that decoded the language of markets.

While others traded stories, Simons traded probabilities.

His secret was not intuition it was system design.

This post unpacks those systems and shows how modern traders can apply the same frameworks, even with retail tools.

From Math to Markets

Simons was a geometry professor turned code-breaker.

When he left academia in 1978 to start Monemetrics, the goal wasn’t speculation it was research.

He treated financial time-series the same way he treated encrypted messages: as patterns waiting to be solved.

By 1982, Monemetrics became Renaissance Technologies.

He began hiring physicists, mathematicians, and linguists instead of Wall Street traders.

Together, they built the foundation of quantitative trading a machine that learns from data rather than opinion.

The Birth of Renaissance Technologies

The firm’s philosophy was radical for its time:

“We don’t start with models. We start with data.” – Jim Simons

Instead of asking why prices moved, they measured how often movements repeated.

By 1988, their flagship Medallion Fund launched.

Within ten years, it became the most successful investment fund in history.

Inside the Machine How Renaissance Really Traded

For decades, the precise code behind Medallion stayed secret.

But former insiders, academic papers, and statistical clues reveal a clear framework: Renaissance ran multiple adaptive systems, each exploiting a small, repeatable market inefficiency.

Let’s break down the architecture and how any disciplined trader can replicate its logic.

System 1: Statistical Arbitrage (Mean Reversion Pairs Model)

What Renaissance Did:

They ran pairwise regressions between correlated assets, hunting for temporary divergences that would mathematically revert.

Retail Replication:

- Build a Spread Ratio:

- Choose two correlated markets (e.g., NAS100 & SP500).

- Calculate

Spread = A – β × B, where β is the hedge ratio from a 60-day regression.

- Normalize the Spread:

- Compute the Z-score:

(Spread – Mean) / StdDev. - When |Z| ≥ 2, the relationship is statistically stretched.

- Compute the Z-score:

- Execution Rules:

- Enter: Long undervalued / short overvalued when Z ≥ 2.

- Exit: When Z returns to 0 or ±0.5.

- Stop: |Z| > 3 or correlation < 0.5.

That’s a quantifiable, automatable edge not a visual guess. But if thats too advanced to start building. Here is the MT5 Code you can punch straight into Metaeditor 5.

1) Statistical Arbitrage (Pairs Mean Reversion, Z-Score Hedged)

File: StatArb_Pairs_ZScore.mq5

(Limited Time Only)

How to Use and Test the MT5 Expert Advisor + Source Code

These instructions apply to all .mq5 Expert Advisors.

1. Install MetaTrader 5 (MT5)

- Download MetaTrader 5 from your broker or from the official website: https://www.metatrader5.com.

- Open MT5 and log in to a Demo or Live account.

A demo account is recommended for testing before trading live.

2. Locate the Correct Folder

- In MT5, click File → Open Data Folder.

- Navigate to the following path:

MQL5 → Experts - Copy the downloaded

.mq5files (for exampleStatArb_Pairs_ZScore.mq5) into the Experts folder.

3. Compile the Expert Advisor

- Return to MT5.

- Press F4 to open MetaEditor 5.

- In MetaEditor, locate your files under

MQL5 → Experts - Double-click any

.mq5file (for exampleStatArb_Pairs_ZScore.mq5). - Click Compile or press F7.

If successful, you will see:0 errors, 0 warningsA compiled version (.ex5) will be created automatically in the same folder.

4. Attach the EA to a Chart

- Return to MT5.

- Open the Navigator panel (Ctrl + N).

- Expand Expert Advisors to locate your compiled EA.

- Drag the EA onto a chart of the symbol you want to trade or test (for example NAS100Cash, M5 timeframe).

- In the EA settings window:

- Enable Allow algorithmic trading.

- Adjust inputs such as risk, timeframe, and symbols.

- Turn on Algo Trading from the toolbar (the button should appear green).

The EA is now active on that chart.

5. Run a Historical Backtest

- Open View → Strategy Tester or press Ctrl + R.

- Choose your Expert Advisor from the dropdown.

- Configure your backtest:

- Symbol: for example NAS100Cash, US500Cash, or EURUSD

- Model: select “Every tick based on real ticks” for maximum accuracy

- Date Range: select an appropriate period (for example, the last 3 months or 1 year)

- Deposit and Leverage: match your broker or prop firm settings

- Check Visualization if you want to see the trades plotted live.

- Click Start to begin the test.

MT5 will simulate the EA’s performance and display the balance curve, trade list, and statistics once complete.

6. Review the Results

After the test finishes:

- Open the Results tab to review each trade.

- Switch to the Graph tab to view the equity curve.

- Save a full report by selecting Report → Save as HTML.

- Focus on key performance metrics such as:

- Profit Factor

- Expected Payoff

- Maximum Drawdown

- Win Rate

- Sharpe Ratio

7. Run Optimizations (Optional)

MT5 allows automatic optimization of parameters.

- In the Strategy Tester, tick the Optimization box.

- Define parameter ranges (for example, ATR period 10 to 50).

- Click Start.

MT5 will test multiple combinations and identify the most profitable or stable settings.

8. Forward Testing

To verify performance in real-time:

- Attach the EA to a demo account chart.

- Let it run for several market sessions.

- Monitor the Experts and Journal tabs for trade entries and logs.

- Once results are consistent with backtesting, the EA can be used on a live or funded account.

9. Troubleshooting

| Issue | Solution |

|---|---|

| EA does not appear in the Navigator panel | Recompile or restart MT5 |

| “Algo Trading disabled” message | Enable the Algo Trading button |

| No trades are executed | Check input settings, market hours, and symbol names |

| Wrong symbol name | Match the broker’s naming format (for example, “NAS100.cash” instead of “NAS100Cash”) |

| Backtest stops immediately | Adjust the date range or use valid historical data |

10. Recommended Folder Structure

Keep your workspace organized by following a simple structure:

MQL5

└── Experts

├── StatArb_Pairs_ZScore.mq5

├── Microstructure_3Bar_ATR.mq5

├── MarketNeutral_Blend.mq5

├── Ensemble_3Edges.mq5

├── Adaptive_Regime_Engine.mq5

├── Volatility_Clustering_Sizer.mq5

└── Execution_Slicing_TWAP.mq5

11. Backtesting Data Quality

For accurate performance results:

- Use brokers that provide high-quality tick data (99 percent accuracy or higher).

- Avoid weekend gaps or holidays when testing.

- Test during active trading sessions such as London or New York.

- Keep lot sizes and risk settings identical when comparing multiple systems.

12. Suggested Settings

| EA | Recommended Timeframe | Typical Asset | Default Risk |

|---|---|---|---|

| StatArb Z-Score | M5 | NAS100 vs SP500 | 0.10 lots per leg |

| 3-Bar Reversal | M1 to M15 | NAS100 | 0.10 lots |

| Market-Neutral Blend | M5 to H1 | Indices | Trend 0.05, Mean Reversion 0.05 |

| Ensemble 3 Edges | M15 | NAS100 | 0.05 lots |

| Adaptive Regime | H1 | Major FX or Indices | 0.10 lots |

| Volatility Sizer | M30 | Indices | Automatic |

| TWAP Execution | M1 | NAS100 | 0.05 per clip |

13. Further Learning

For continued learning, focus on:

- How to interpret strategy performance reports

- How to adjust inputs based on volatility

- How to combine strategies in a portfolio

- How to maintain consistent risk management across all systems

System 2: Short-Term Pattern Mining (Microstructure Model)

What Renaissance Did:

They analyzed millions of micro-patterns inside tick data order-flow bursts, volatility pockets, and volume absorption.

Retail Replication:

- Use 1-minute data and code a micro-pattern scanner to detect repeating structures (three-bar reversals, false breakouts, micro engulfings).

- Backtest thousands of instances to find conditional probabilities above 55%.

- Deploy automation that executes only when both pattern and volatility filters align.

This transforms pattern reading into data-driven frequency trading.

System 3: Market-Neutral Portfolio (Adaptive Hedging Engine)

What Renaissance Did:

Medallion balanced long and short exposure so that returns came from relative value, not direction.

Retail Replication:

- Operate two strategies: one trend-following (long bias), one mean-reverting (short bias).

- Equalize exposure so total account beta ≈ 0.

- On MT5, assign different Magic Numbers to each EA to run simultaneously and aggregate results.

The portfolio earns from spread efficiency, not prediction.

System 4: Ensemble Signal Blending

What Renaissance Did:

Instead of a single “holy grail,” they ran thousands of tiny models with weak edges. Combined, they formed a powerful, self-correcting super-signal.

Retail Replication:

- Build a mini ensemble of 3–5 micro systems (e.g., Support/Resistance scalper, Gap reversal, Breakout EA).

- Weight each equally and reduce allocation when one hits a drawdown threshold.

- The goal is not accuracy but statistical aggregation exactly how Medallion smoothed returns.

System 5: Adaptive Optimization (Self-Learning Parameters)

What Renaissance Did:

Their models re-trained themselves daily, adjusting parameters as market volatility shifted.

Retail Replication:

- Use walk-forward testing to re-optimize key parameters each month.

- Adjust SL/TP based on 30-day ATR averages.

- Automate this refresh cycle in MT5 or Python so your system adapts without manual tweaks.

This is how small strategies survive regime changes.

System 6: Volatility Clustering & Dynamic Sizing

What Renaissance Did:

They discovered that volatility clumps in time quiet markets stay quiet, chaotic ones stay chaotic.

Position size was scaled up or down accordingly.

Retail Replication:

- Monitor ATR on your timeframe.

- Reduce size by half if ATR > 2× its 20-period average.

- Increase size slightly when volatility contracts.

- You end up with a smoother equity curve and stable risk profile.

System 7: Execution Algorithms (Minimizing Market Impact)

What Renaissance Did:

They broke orders into thousands of tiny lots using VWAP/TWAP logic to avoid slippage and detection.

Retail Replication:

- Scale into positions with small time-staggered orders instead of one large entry.

- Use multi-order scripts like AF MultiOrderBlitz aka ECAP StrikeBurst to simulate institutional execution.

- This alone can improve net performance by 1–3 % per month on scalping systems.

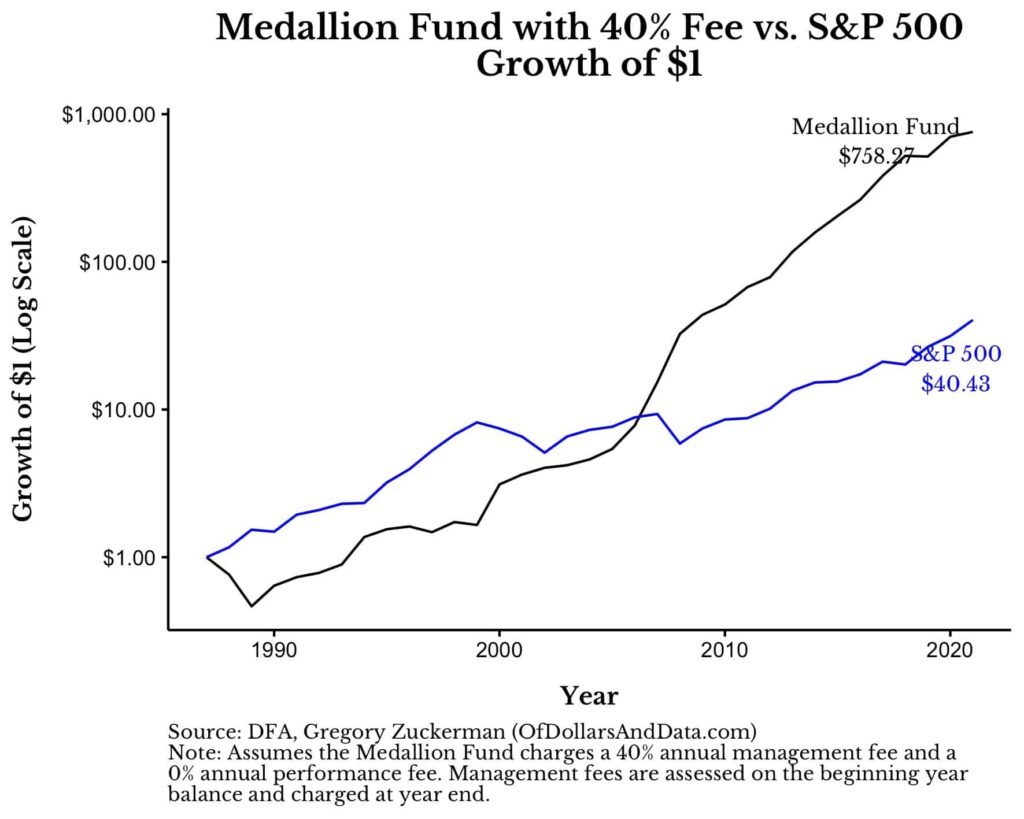

What Made Medallion Untouchable

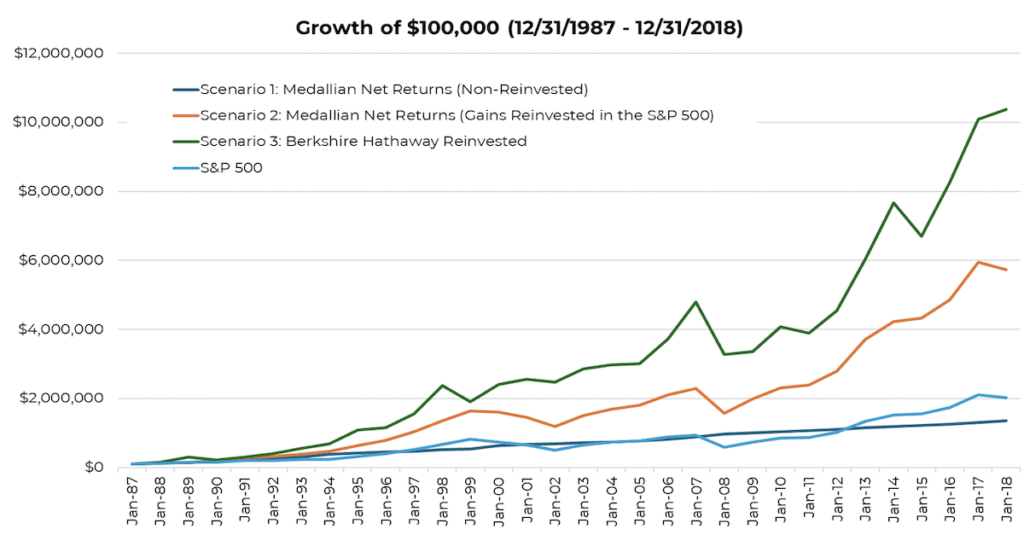

From 1987 to 2018 the fund compounded over 63 % annually after fees.

It did this by stacking thousands of edges, each statistically tested and continually refined.

When the S&P 500 collapsed in 2008 (-38 %), Medallion returned +74 %.

The secret was not luck it was mathematical brilliance.

Applying Simons’ Mindset Today

You can’t replicate Renaissance’s data center, but you can replicate its thinking:

- Codify Everything: Turn intuition into rules.

- Measure Edge, Not Emotion: Every setup must have quantified expectancy.

- Automate Discipline: Use software to execute your plan without fear.

- Diversify Signals: Many small edges > one big guess.

- Continuously Adapt: Markets change your parameters must too.

Even with a retail account, this framework creates a “Mini-Medallion”: a data-driven engine built on rules, not emotions.

Dont forget to grab a free copy of the Statistical Arbitrage (Pairs Mean Reversion, Z-Score Hedged) mt5 ea!

File: StatArb_Pairs_ZScore.mq5

(Limited Time Only)

The Legacy of Jim Simons

Simons proved that markets aren’t chaos they’re imperfect systems of information.

His greatest invention was not a fund but a philosophy:

“Patterns of price movement are not random. They’re just hard to see.”

For those who build systems to see them, the edge still exists.

The world’s smartest trading machine was human at its core discipline, logic, and relentless iteration.

Subscribe to Our Newsletter

Get weekly deep dives on the world’s top traders, strategies, and AI-driven market systems.

Trading Risk Disclosure

Trading involves significant risk and may not be suitable for all investors. Past performance does not guarantee future results. Always trade with money you can afford to lose.

0 responses to “How Billionaire Trader Jim Simons Engineered the World’s Smartest Trading Machine + (Free MT5 EA Download)”