Your basket is currently empty!

Introduction

In an uncertain global economic climate, many investors are turning to gold not just as a hedge, but as a strategic diversification tool. The shiny metal’s unique behaviour low correlation with some stocks and bonds, inflation hedge potential, safe-haven appeal makes it worthy of attention.

Rather than relying on a single “buy gold” approach, a more sophisticated method is to build a balanced gold portfolio, blending different exposure types: spot-price tracking ETFs, gold mining companies and royalty/streaming firms.

This blog walks you through how to construct an amazing portfolio, what each category contributes, tickers from each chart above and below, allocation ideas and key risks you’ll want to monitor.

Why Diversify Within Gold?

It might seem sufficient to just buy gold bullion or one gold ETF. But by diversifying within the gold sector, you stand to capture different sources of return and risk-mitigation:

- Spot gold ETFs give you a clean exposure to the gold price without directly running mines or operating costs.

- Gold miners introduce higher risk & higher reward: if gold prices rise, miners may amplify the move; but they’re also exposed to operational, regulatory and cost pressures.

- Royalty/streaming companies sit somewhere in between: they don’t operate mines, but fund them in exchange for revenue streams offering a lower-risk way to participate in production upside.

By combining all three, your portfolio can have a spectrum of risk/return, rather than being “all in” one bucket.

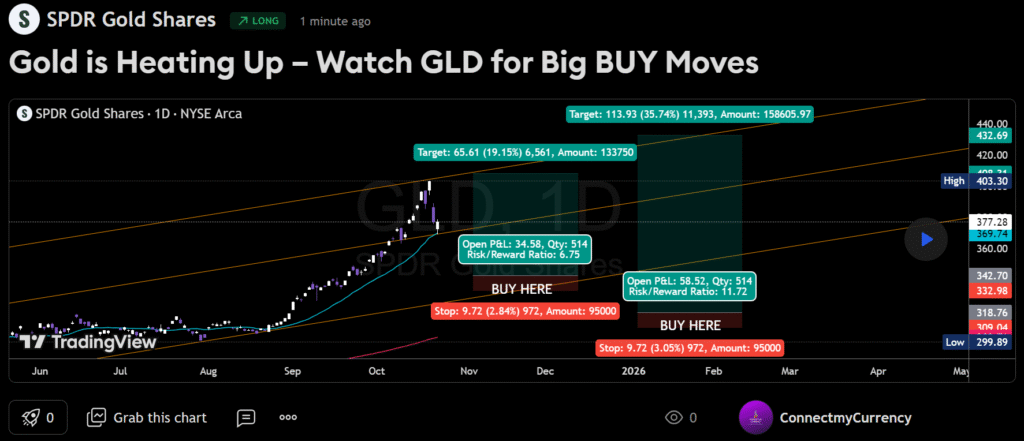

Spot Gold ETFs

What they are & why include them

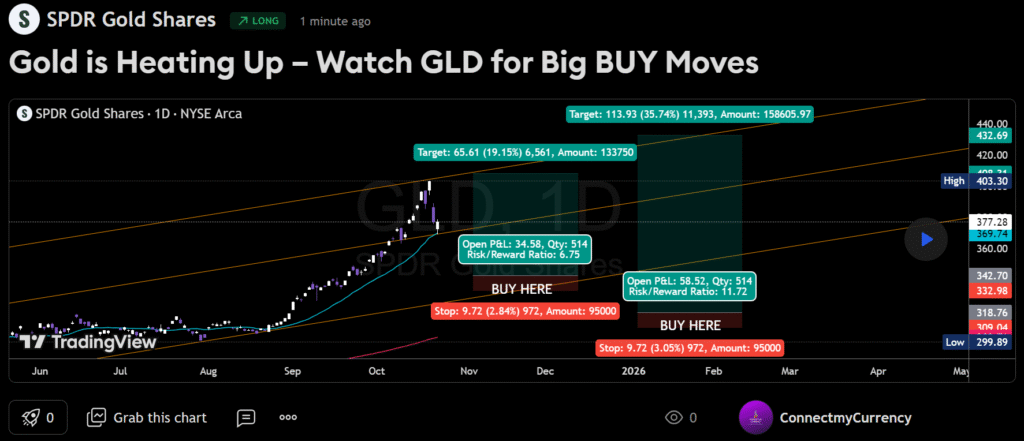

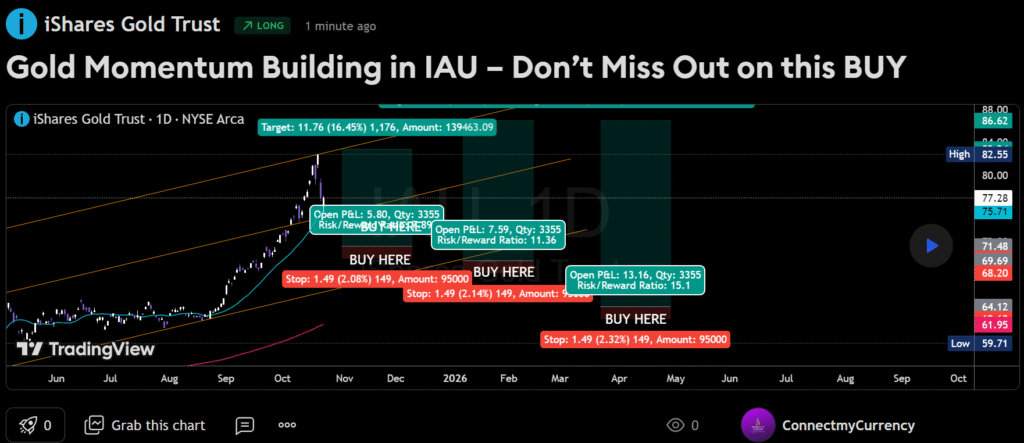

Spot gold ETFs are funds whose value is intended to track the price of gold bullion (adjusted for fees, trust structure, etc.). For example, the SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) are among the largest in this category.

They are relatively low-maintenance: you’re not managing mines, you’re simply gaining exposure to gold’s price moves.

Pros & cons

Pros:

- Liquidity, ease of trading

- Broad exposure to gold price

- Good as a “core” gold allocation

Cons: - You get just the price of gold not the leverage or operational upside of miners

- Fees and trust‐structure drag (even if small)

- Doesn’t capture potential growth from new mines, reserves etc

Suggested allocation in a gold-diversified portfolio

For a broad portfolio: maybe 40-60% of your gold allocation goes to spot gold ETFs. They form the foundation stable, reliable gold exposure.

Gold Miners

What they are & why include them

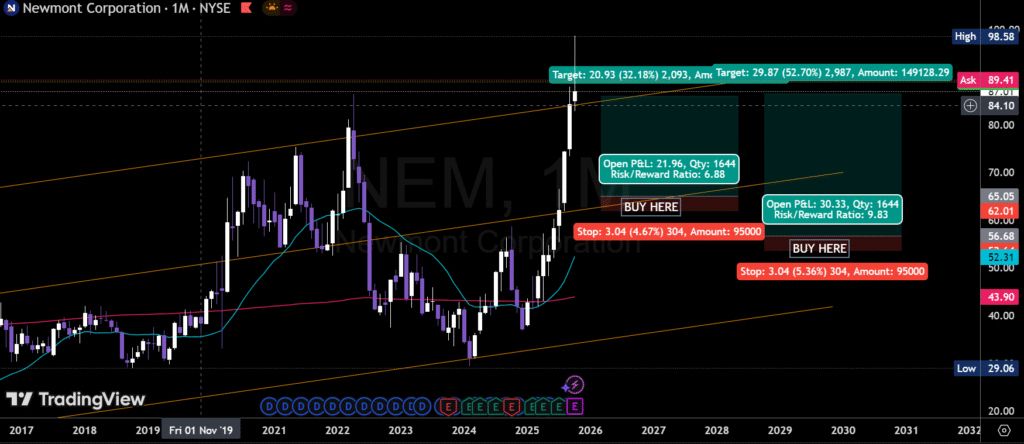

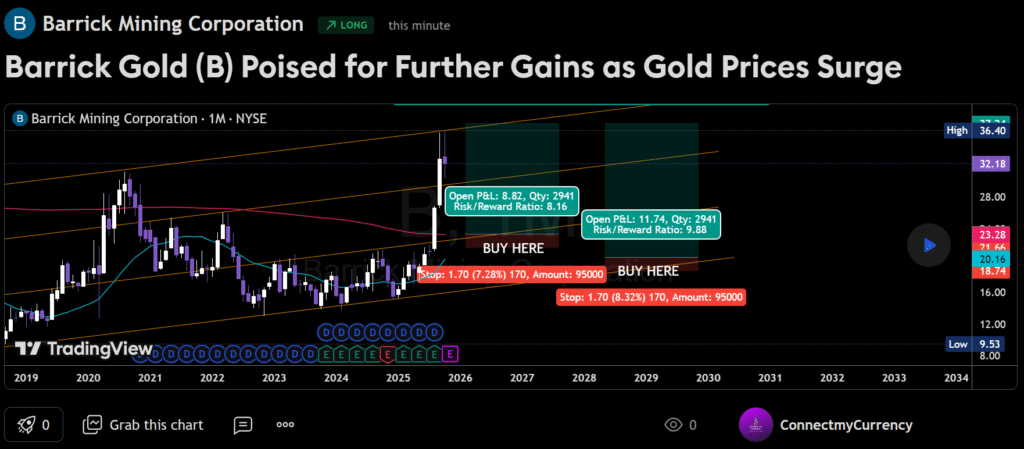

Gold mining companies actually extract gold (and often other metals). These firms are exposed to gold price, but also to costs: labour, fuel, regulation, exploration success, mine depletion. Because of that, their returns can be magnified (both up and down).

Including miners in your gold portfolio adds a growth dimension. If gold rallies, miners often outperform; if gold falls or costs rise, they can underperform.

tickers You need to add to your watchlist asap!

Some of the miners in my list:

- Newmont Corporation (NEM)

- Barrick Gold Corporation (GOLD)

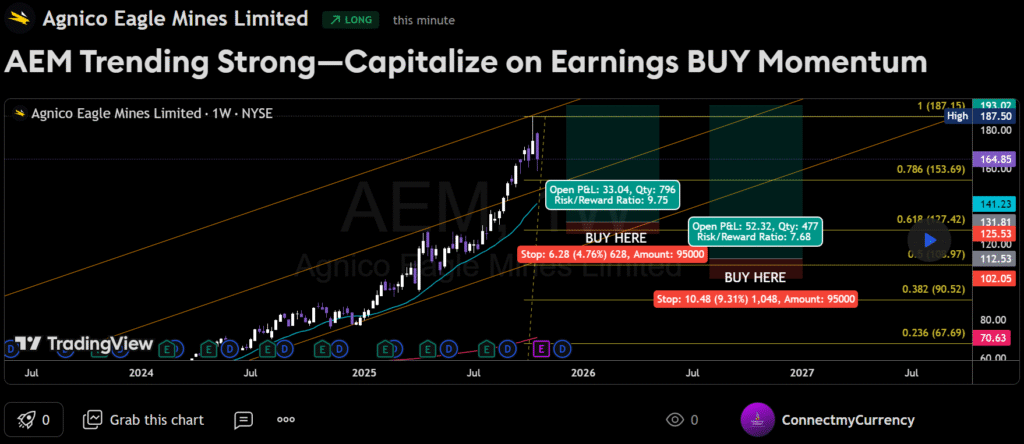

- Agnico Eagle Mines Ltd. (AEM)

These represent large-cap miners with diversified operations around the globe.

Pros & cons

Pros:

- Potential for outsized returns if gold price rises and mining costs are controlled

- Exposure to management skill, new discoveries, operational leverage

Cons: - Higher risk: cost inflation, mine accidents, regulatory issues, geopolitical risk

- Correlation with gold price but also with broader commodity/mining risks

Suggested allocation in a gold‐diversified portfolio

For the mining bucket, you might allocate 20-30% of your gold allocation here. Enough to benefit from leveraged moves, but not so much that you’re overly exposed to mining risk.

Royalty / Streaming Companies

What they are & why include them

Royalty and streaming companies (also called “mid-stream” gold companies) provide capital to mining operators in exchange for a share of production or revenue (a royalty) or a stream (right to purchase future production at set price). They don’t run mines themselves.

This business model offers a lower-risk way to participate in gold production upside you avoid many operational hazards, yet you participate in the benefit of production growth and higher gold prices.

more gold tickers to consider buying

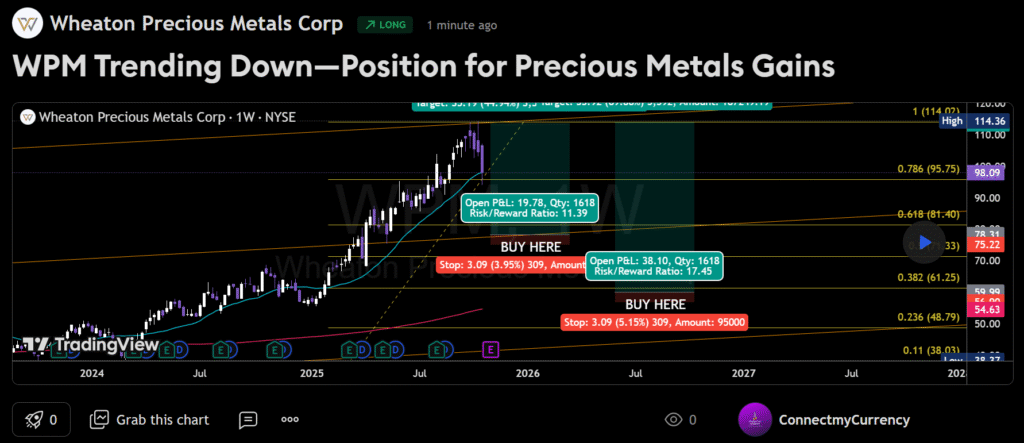

- Wheaton Precious Metals Corp. (WPM)

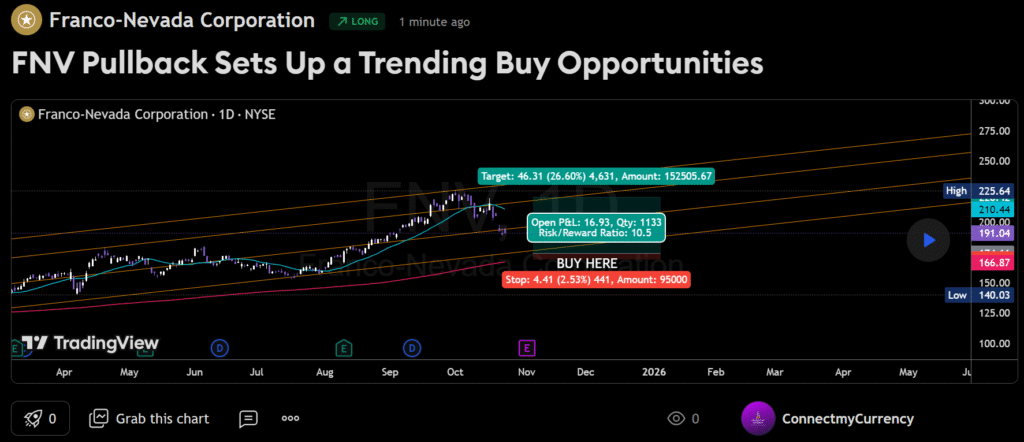

- Franco‑Nevada Corporation (FNV)

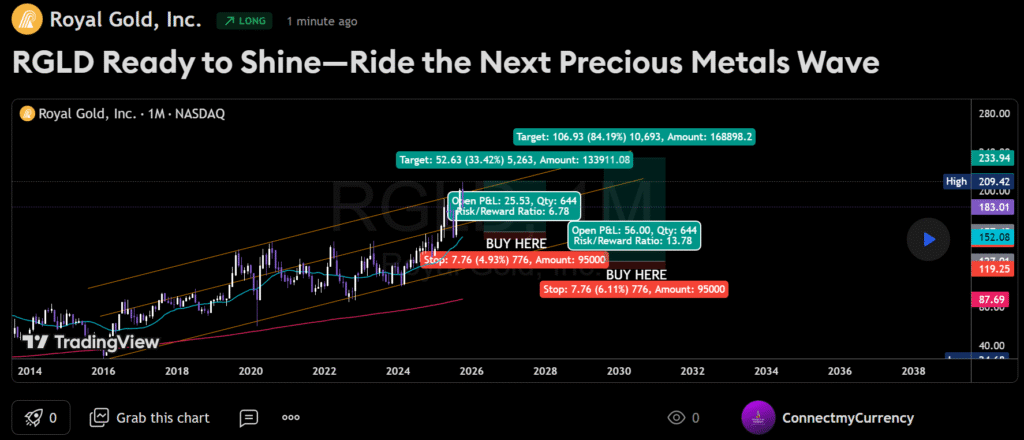

- Royal Gold Inc. (RGLD)

Pros & cons

Pros:

- Lower operational risk compared to miners

- Diversified royalty/stream portfolio across mines & geographies

- Often modest dividend income

Cons: - Less upside than pure miners if gold price explodes

- Still exposed to gold price risk, mine production risk, counterparty risk

- Valuations can get ahead of fundamentals (as some reddittors note) Reddit

Suggested allocation in a gold-diversified portfolio

This bucket might take 10-20% of your total gold allocation. It gives you that “steady middle” exposure more upside than spot, less risk than miners.

Putting It All Together: Portfolio Structure

Here’s how you might allocate if you’re dedicating, say, 5% of your overall investable assets to gold. (You can scale the percentages up/down depending on how aggressive you are.)

| Bucket | % of Gold Allocation | % of overall portfolio (~) |

|---|---|---|

| Spot Gold ETFs | 50% | ~2.5% |

| Gold Miners | 30% | ~1.5% |

| Royalty/Streaming | 20% | ~1.0% |

Implementation Example:

- 2.5% of your portfolio buys GLD/IAU (spot).

- 1.5% buys a mix of NEM, GOLD, AEM (miners).

- 1.0% buys FNV, WPM, RGLD (royalties).

You can further diversify within each bucket (e.g., multiple miners, small‐cap miners, regional exposure) but the idea is to maintain that balance: foundational spot layer + growth miners layer + lower-risk royalty layer.

Key Risks & Things to Monitor

- Gold Price Risk: If gold falls, all buckets will likely be negatively impacted though miners and royalties may amplify the decline.

- Cost Inflation in Mining: Rising energy, labour, regulatory or environmental costs can squeeze miner margins even if gold prices rise slowly.

- Geopolitical / Country Risk: Many mining operations are in jurisdictions with regulatory, tax or political risk.

- Valuation Risk: Some royalty companies currently trade at high multiples compared to earnings/royalties; downside exists.

- Interest Rate / USD Strength: Gold often (though not always) moves inversely with interest rates and the U.S. dollar. Shifts there can hurt gold exposures.

- Liquidity / Leverage: While we aren’t focusing on leveraged ETFs here, some gold vehicles carry additional risk layers (e.g., levered miners, hedge funds).

- Portfolio Concentration: Keep your gold exposure reasonable relative to your full portfolio it’s a diversification tool, not necessarily the whole show.

enjoying my investment guides?

You might also want to check this out!

Why This Gold Allocation Makes Sense in 2025

- With inflationary pressures, central bank balance sheets still large and macro uncertainty elevated, gold stands out as a potential hedge and diversifier.

- Spot gold ETFs give you direct exposure without the complications of mining operations.

- Miners give you growth potential should gold rally sustainably.

- Royalties/streams provide a buffer, lower risk alternative, with exposure to production upside.

- By combining all three, you’re not putting “all your gold eggs in one basket.”

As noted, for instance, gold ETFs like IAU and GLD “often act as portfolio shock absorbers” as they have lower correlation to traditional stocks/bonds. And royalty companies have gained traction in investor discussions as a smart way to participate in gold’s upside while avoiding some of the miner pitfalls.

wrapping up & Next Steps to take

Building a gold portfolio is less about picking one shiny stock and more about constructing the right mix for your goals, risk tolerance and time horizon. If you already have good exposure to stocks, bonds and maybe other commodities, a well-balanced gold allocation like the one above can add real value.

Here are some more actionable steps

- Decide how much of your total portfolio you’re comfortable allocating to gold (e.g., 5%-10%).

- Pick one or two spot gold ETFs (e.g., GLD/IAU) and commit your “foundation” layer.

- Choose a diversified set of miners (large-cap, maybe one mid-cap) for the “growth” layer.

- Pick a handful of royalty/streaming companies for the “steady” layer.

- Set rules for rebalancing: e.g., review every 6-12 months, consider raising miners layer if gold price accelerates, or trimming if costs/risks rise.

- Keep monitoring key risk factors: gold price environment, interest rates, mining cost inflation, geopolitical developments.

- Treat this as part of your diversification strategy not a high-conviction “end all” bet unless you want to be highly speculative.

Trading Risk Disclosure:

Investing in gold, gold-related equities and ETFs involves risk, including the risk of loss of principal. Past performance is not indicative of future results. Gold prices fluctuate based on a wide range of factors (macroeconomic, monetary, geopolitical). Mining stocks and royalty/streaming companies add additional risk layers (production risk, cost risk, regulatory risk). Before investing, consider your own risk tolerance, investment horizon and consult a professional advisor.

0 responses to “How to Build a Balanced Gold Portfolio in 2025: ETFs, Miners & Royalties”