Your basket is currently empty!

The landscape of retail trading has transformed dramatically over the past decade, and the recent emergence of accessible AI assistants has created an entirely new dimension of opportunity. What once required expensive research subscriptions, professional analysts, and years of education can now be supplemented by powerful AI tools like ChatGPT, Claude, Grok, and GitHub Copilot that are available to anyone with an internet connection.

While trading carries inherent risks and isn’t suitable for everyone, the combination of democratized market access and readily available AI assistance has created unprecedented opportunities for individual investors. These AI tools don’t replace the need for education and sound judgment, but they can significantly accelerate learning and improve decision-making for new traders willing to use them responsibly.

1. Access to Market Research and Analysis

Modern retail traders enjoy access to financial markets that were once exclusive to institutional investors, and AI assistants can now help make sense of this vast landscape. Today’s trading platforms provide access to thousands of stocks, bonds, ETFs, options, and cryptocurrencies, but understanding what to look for was traditionally overwhelming for new traders.

How ChatGPT and Claude Can Help: AI assistants can serve as your personal research team, helping you understand complex financial concepts, analyze earnings reports, and break down market terminology. You can ask ChatGPT to explain what metrics to look for when evaluating a stock, or have Claude walk you through understanding a company’s balance sheet in plain English.

These tools can help you research industries you’re unfamiliar with, understand economic indicators, and even provide historical context for market events. While they can’t predict the future or provide investment advice, they excel at education and explanation – helping you understand what professional analysts are discussing and what metrics matter for different types of investments.

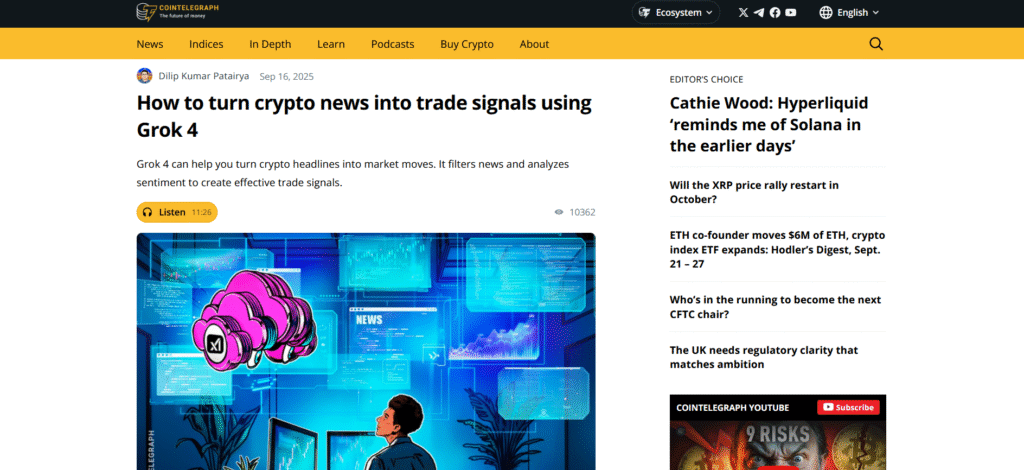

Grok can help you stay current with market news by summarizing complex financial articles and explaining how current events might impact different sectors. Instead of spending hours researching a new industry, you can have an AI assistant explain the key players, business models, and important trends in minutes.

2. Dramatically Reduced Learning Costs Through AI Education

The cost structure of learning to trade has been revolutionized by AI assistants. What once required expensive courses, books, and seminars can now be supplemented with free, personalized education from AI tools that are available 24/7.

How AI Assistants Reduce Learning Costs: Instead of purchasing expensive trading courses, you can have detailed conversations with ChatGPT or Claude about trading strategies, risk management principles, and market mechanics. These AI assistants can explain complex concepts multiple ways until you understand, provide examples specific to your questions, and never get impatient with repeated questions.

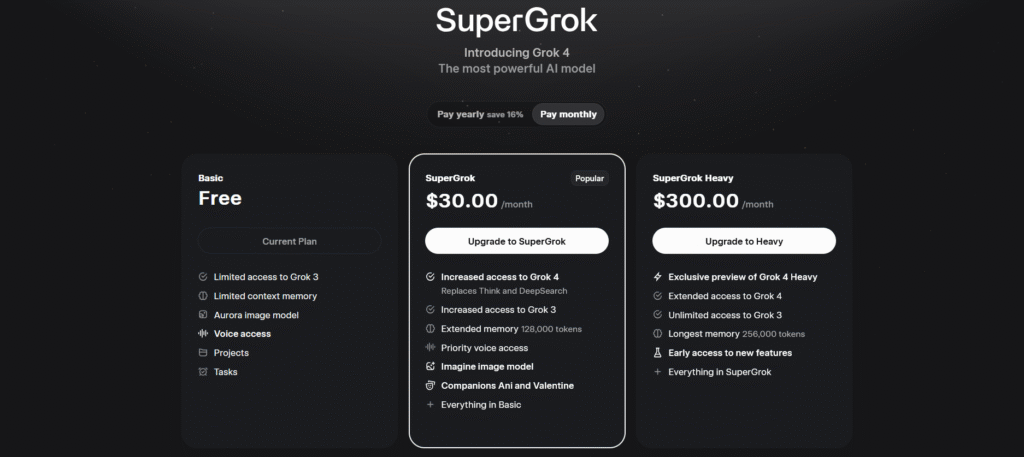

You can use Claude to review and explain financial statements, ask ChatGPT to walk you through options strategies with specific examples, or have Grok explain how different economic indicators affect various market sectors. This personalized tutoring was once available only through expensive one-on-one coaching.

AI assistants can also help you understand the terminology used in financial media and research reports. Instead of feeling lost when reading analyst reports or financial news, you can paste confusing passages into ChatGPT and get clear explanations in everyday language.

GitHub Copilot can assist technically-minded traders in writing scripts to analyze data, backtest simple strategies, or automate basic portfolio tracking tasks – capabilities that once required expensive software or hiring programmers.

3. 24/7 Educational Support and Learning Acceleration

Traditional trading education was limited by class schedules, book availability, and access to knowledgeable mentors. AI assistants provide unlimited access to patient, knowledgeable tutoring that adapts to your schedule and learning style.

How AI Transforms Learning: You can have in-depth conversations about trading concepts at any time of day, whether you’re curious about something at 2 AM or have a quick question during your lunch break. Claude can explain why certain chart patterns might be significant, while ChatGPT can walk you through the logic behind different portfolio allocation strategies.

These AI tools can provide immediate feedback on your understanding by asking follow-up questions, suggesting related concepts to explore, and helping you work through practical examples. They can simulate conversations with experienced traders, helping you think through scenarios and potential challenges before risking real money.

AI assistants excel at breaking down complex topics into manageable pieces. If you’re trying to understand options trading, for example, you can start with basic concepts and gradually build complexity through ongoing conversations, with the AI adjusting its explanations based on your responses and questions.

You can also use these tools to create personalized study materials, practice quizzes, and learning schedules tailored to your available time and current knowledge level.

4. Flexible Research and Analysis Support

Retail trading offers lifestyle flexibility, and AI assistants enhance this by providing research and analysis support whenever and wherever you need it. Whether you’re commuting, traveling, or have just a few minutes between other activities, you can conduct meaningful market research using your smartphone.

How AI Enhances Trading Flexibility: Instead of being tied to expensive research platforms or specific software, you can use ChatGPT or Copilot on any device to analyze potential investments, understand market trends, or explore new trading strategies. These tools work equally well on mobile devices, making research possible during commutes, breaks, or while traveling.

You can have Copilot help you create watchlists by explaining what criteria to use for different investment goals, or ask ChatGPT to help you understand why certain stocks are moving in pre-market trading. This real-time educational support helps you stay informed without requiring dedicated research time.

AI assistants can help you prepare for trading sessions by reviewing relevant news, explaining potential market catalysts, and helping you think through your trading plan for the day. This preparation can be done efficiently through conversation rather than spending hours reading multiple sources.

5. Enhanced Decision-Making Through Better Understanding

While AI assistants can’t exactly predict market movements or guarantee returns, they can significantly improve your decision-making process by helping you understand the factors that drive market behavior and the logic behind different investment strategies.

How AI Improves Decision Quality: ChatGPT can help you work through the pros and cons of different investment approaches, explain the reasoning behind various valuation methods, and help you understand how different economic conditions might affect your portfolio. This isn’t about getting predictions, but about building better analytical frameworks.

You can use Claude to analyze your own trading ideas by having it help you identify potential risks, consider alternative scenarios, and think through the logic of your investment thesis. This process helps you develop more thorough, well-reasoned approaches to market decisions.

AI assistants can help you understand historical market behavior, explain why certain patterns tend to repeat, and help you learn from both successful and unsuccessful investment examples. This educational approach can lead to better pattern recognition and improved judgment over time.

Grok can help you understand market sentiment by explaining what different news events typically mean for various sectors, helping you develop better intuition about market reactions to current events.

Check out this article from Cointelegraph.com to see how to combine Grok and Crypto very easily!

6. Personal Financial Education and Planning Support

AI assistants can provide personalized financial education that helps you understand how trading fits into your broader financial picture, something that was once available only through expensive financial advisors.

How AI Enhances Financial Understanding: You can have detailed conversations with Perplexity about portfolio construction principles, risk management strategies, and how to balance trading activities with long-term financial goals. These discussions can help you develop a more sophisticated understanding of personal finance and investment strategy.

ChatGPT can help you understand different account types (taxable vs. retirement accounts), explain tax implications of various trading strategies, and help you think through asset allocation decisions based on your age, risk tolerance, and financial goals.

AI assistants can help you create and understand financial models, such as calculating compound growth, understanding the impact of fees on long-term returns, or modeling different retirement scenarios. While they can’t provide personalized financial advice, they can help you understand the tools and concepts professional advisors use.

You can also use these tools to better understand financial statements, economic reports, and market research, helping you become more sophisticated in evaluating investment opportunities and understanding market dynamics.

7. Accelerated Learning and Skill Development

The intellectual challenge of trading is enhanced by AI assistants that can help you rapidly develop new skills, understand complex concepts, and explore advanced strategies that might otherwise take years to master.

How AI Accelerates Skill Development: Instead of struggling through dense financial textbooks alone, you can have interactive conversations with AI assistants that adapt to your learning style and current knowledge level. Perplexity can provide examples, analogies, and explanations that make complex concepts more accessible.

You can use Claude to help you understand academic research on market behavior, explain statistical concepts used in finance, and help you work through mathematical calculations involved in options pricing or portfolio optimization. This makes advanced concepts more approachable for self-directed learners.

AI assistants can help you develop coding skills that are increasingly valuable in modern trading. GitHub Copilot can assist in writing Python scripts for data analysis, while ChatGPT can explain programming concepts and help you automate basic portfolio tracking or analysis tasks.

These tools can also help you understand different schools of thought in investing and trading, from fundamental analysis to technical analysis to quantitative approaches, helping you develop a broader perspective on market analysis.

8. Access to Advanced Concepts and Tools

While retail traders don’t have access to institutional-grade AI trading systems, they can use readily available AI assistants to understand and implement more sophisticated approaches to market analysis and portfolio management.

How Available AI Tools Level the Playing Field: ChatGPT and Claude can help you understand complex trading strategies that were once the domain of professional traders. They can explain multi-leg options strategies, help you understand statistical arbitrage concepts, and walk you through portfolio optimization techniques.

You can use AI assistants to help you understand and implement basic quantitative analysis. While you won’t have access to institutional algorithms, you can use ChatGPT to help you understand statistical concepts, create simple backtesting frameworks, and analyze historical performance data.

GitHub Copilot can assist in creating tools for portfolio tracking, basic technical analysis, or data visualization. While these won’t compete with professional systems, they can provide valuable insights and help you better understand your own trading performance.

AI assistants can help you understand academic research on market behavior, explain the logic behind various market anomalies, and help you think critically about different investment approaches. This educational support can lead to more sophisticated investment strategies over time.

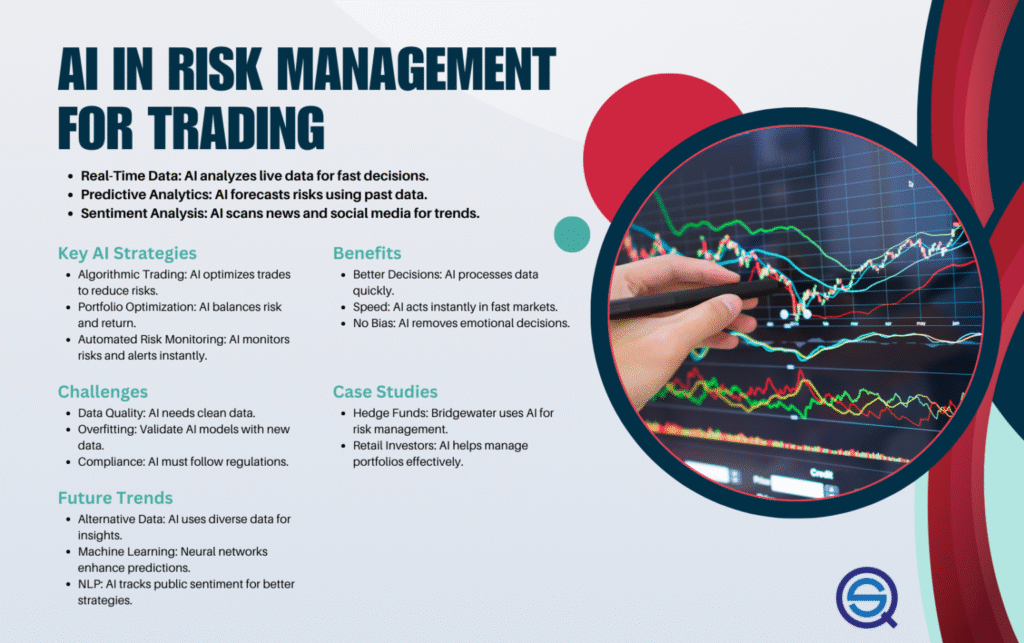

9. Improved Risk Management Through Better Understanding

Risk management is crucial for trading success, and AI assistants can help you develop more sophisticated approaches to protecting your capital while pursuing growth opportunities.

How AI Enhances Risk Management: Claude can help you understand different types of risk (market risk, sector concentration, currency risk, etc.) and explain various strategies for managing each type. While the AI can’t manage risk for you, it can help you understand the tools and concepts professionals use.

You can have ChatGPT walk you through position sizing calculations, help you understand the mathematics behind stop-loss strategies, and explain how correlation affects portfolio risk. This educational support can lead to more thoughtful risk management decisions.

AI assistants can help you understand options strategies that can be used for portfolio protection, such as protective puts or collar strategies. They can explain how these work, when they might be appropriate, and help you understand the trade-offs involved.

You can also use these tools to better understand historical market volatility, learn from past market crises, and develop contingency plans for different market scenarios. This preparation can help you respond more effectively to market stress.

Check this article out from QuantifiedStrategies.

10. Building Long-term Wealth Through Enhanced Financial Literacy

AI assistants can help you develop the financial literacy and analytical skills needed to build wealth through trading and investing, providing educational support that was once available only through expensive professional guidance.

How AI Supports Wealth Building: ChatGPT and Perplexity can help you understand the mathematics of compound growth, explain how to optimize tax efficiency in different account types, and help you develop long-term investment strategies that align with your goals and timeline.

These tools can help you understand how successful investors and traders approach the markets, explain different investment philosophies, and help you develop your own coherent approach to wealth building through market participation.

AI assistants can help you understand estate planning concepts, explain how different investment strategies might affect your tax situation, and help you think through the long-term implications of various financial decisions.

You can also use these tools to stay educated about changing market conditions, new investment opportunities, and evolving financial regulations that might affect your trading and investment strategies.

Getting Started: Practical AI Implementation for New Traders

The key to successfully using AI assistants in your trading journey is understanding their strengths and limitations. These tools excel at education, explanation, and helping you think through complex problems, but they cannot predict market movements, provide personalized investment advice, or replace your own judgment and research.

Effective Ways to Use AI Assistants: Start by using ChatGPT or Claude to understand basic investing concepts before risking real money. Ask them to explain fundamental analysis, technical analysis basics, and risk management principles. Use these conversations to build a solid educational foundation.

Create a routine of using AI assistants to help you understand news events, earnings reports, and market developments. Instead of just reading headlines, ask these tools to help you understand the implications and context of market-moving events.

Use GitHub Copilot to help you create simple tools for tracking your portfolio performance, calculating position sizes, or analyzing your trading results. These technical skills can provide valuable insights into your own performance and help you make more informed decisions.

Practice using AI assistants to work through hypothetical trading scenarios. Discuss potential investments, explore different strategies, and have them help you identify potential risks and opportunities. This mental practice can improve your real-world decision-making.

The Future of AI-Assisted Retail Trading

The integration of AI assistants into retail trading education and analysis is still in its early stages, but the potential for enhancing individual trader capabilities is significant. As these tools continue to improve, they’re likely to provide even more sophisticated educational support and analytical capabilities.

The key advantage for retail traders is not in trying to compete with institutional algorithms, but in leveraging AI to become more educated, analytical, and systematic in their approach to the markets. This educational enhancement can lead to better decision-making and improved long-term results.

Future developments may include more specialized financial AI assistants, better integration with trading platforms, and enhanced capabilities for analyzing market data and trends. However, the fundamental principles of education, risk management, and sound judgment will remain essential for trading success.

Ready to Transform Your Trading Journey with AI?

While AI assistants provide incredible support, most traders waste months using them incorrectly.

That’s why I created The AF Blitz Suite – a Hybrid training solution combining AI and Trading.

You’ll get Ongoing Training, Trading Algorithms, AI prompts and your very own Trading Coach guiding you through each step – SuperCharging your Trading!

0 responses to “10 Reasons to Become a Trader in 2025 With These 5 Easy To Use AI Assistants That Are FREE!”