Your basket is currently empty!

The world is in flux regulations, technologies, and economic strategies are reshaping how we live, work, and interact. From Europe’s controversial privacy battles to the resurgence of hard money in the United States, 2025 is proving to be a defining year. This blog unpacks nine pivotal developments in finance, technology, retail, and healthcare and explores why they matter to you.

EU’s Controversial Chat Control Law: Privacy vs. Protection

What the Chat Control law proposes

The European Union’s proposed Chat Control law would give authorities unprecedented power to scan private digital messages emails, texts, and encrypted chats to detect child sexual abuse material (CSAM). On the surface, it’s positioned as a child protection measure.

Why some governments and digital rights groups oppose it

Critics argue that the law fundamentally undermines encryption and online privacy, opening the door to state surveillance at a scale Europe hasn’t seen before. Tech companies, privacy advocates, and even some EU member states warn that once the door is open, it may be impossible to close.

Possible outcomes of the October EU vote

If passed, this legislation could set a precedent for other regions grappling with the balance between child protection and digital freedom. If blocked, it may signal a reaffirmation of Europe’s commitment to privacy as a human right.

Tupperware’s Paradox: Durability Doomed the Icon

Rise of Tupperware: innovation and household dominance

Founded in 1946, Tupperware revolutionized food storage with its airtight, long-lasting plastic containers. For decades, it thrived through home parties and direct sales.

The paradox of product durability in business sustainability

But Tupperware’s greatest strength its durability became its downfall. Consumers didn’t need replacements often enough, undercutting repeat sales. Coupled with a lack of e-commerce strategy, the company’s rigid model couldn’t survive changing shopping habits.

Lessons for modern brands in adapting to e-commerce

Tupperware’s decline is a stark reminder: innovation must evolve. Even iconic brands risk obsolescence if they fail to adapt to consumer trends, sustainability demands, and digital-first sales channels.

Iceland’s £1 Anti-Shoplifting Reward

The shoplifting crisis in the UK

Retail theft in the UK has surged, costing businesses an estimated £2.2 billion annually. Supermarkets like Iceland are particularly vulnerable.

Why Iceland’s community-based solution matters

In a bold move, Iceland will reward shoppers £1 for reporting theft, essentially deputizing the public. This “crowdsourced security” approach reflects the creative measures retailers are trying to survive.

Risks and rewards of incentivizing vigilance

Critics worry this could create tension among shoppers or even false accusations. Still, Iceland is betting that small cash incentives will deter thieves and build stronger store community ties.

Meta Bets Big on AI Talent

The $1.25 billion researcher deal explained

Meta recently made headlines by offering $1.25 billion over four years to secure one AI researcher one of the largest individual contracts in tech history.

The broader talent war in AI

This staggering offer underscores the cutthroat competition for AI talent. With AI at the heart of future tech, companies like Google, Microsoft, and Meta are investing billions to attract top researchers.

Implications for the future of Meta’s AI ambitions

Meta’s massive gamble reflects its vision of being a dominant player in AI-driven products. If successful, this move could cement its position alongside global leaders in artificial intelligence.

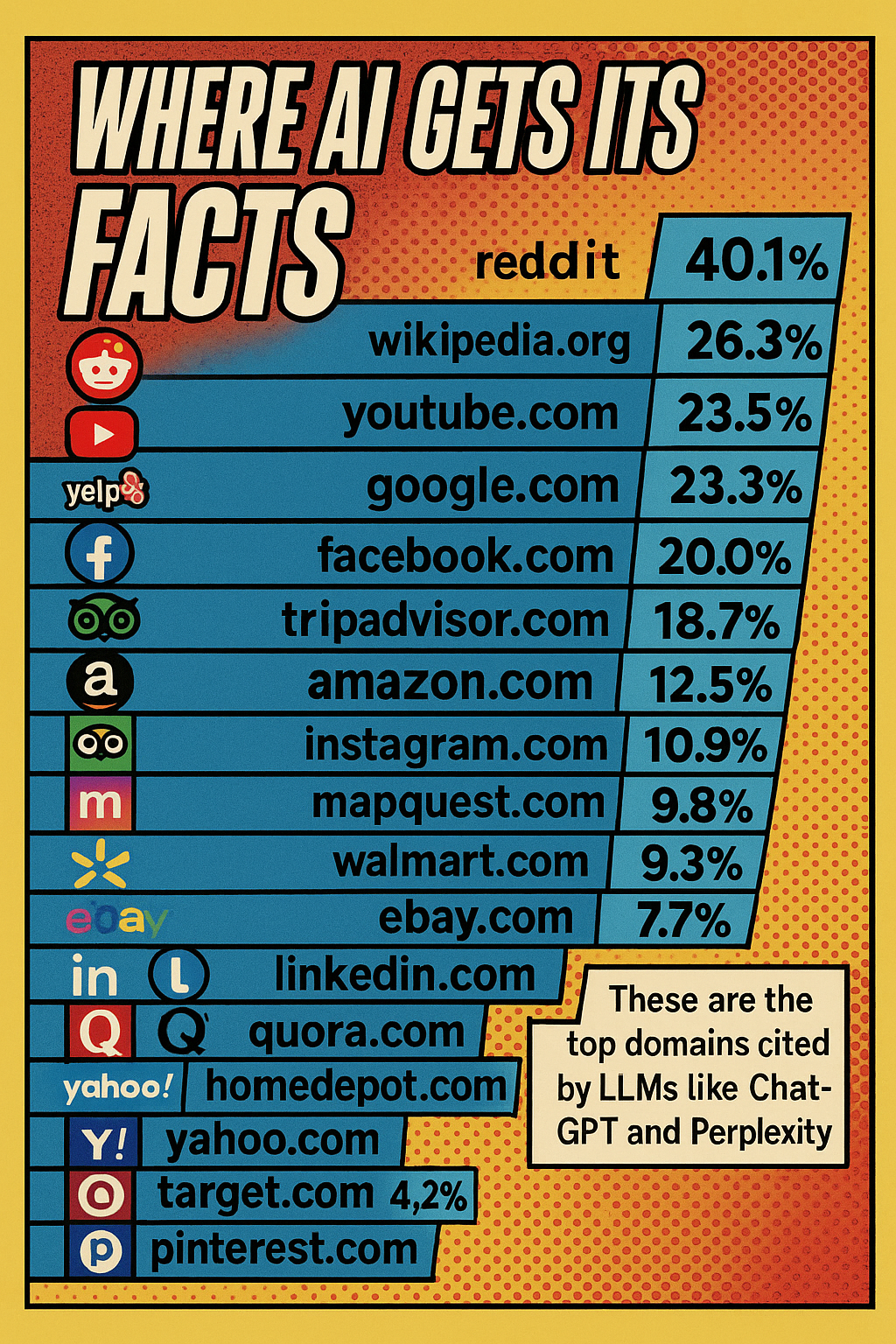

Where AI Gets Its Facts

How large AI models collect and process information

AI systems are trained on vast datasets: books, academic journals, news, and social media. These models synthesize patterns to generate answers and insights.

The challenge of misinformation and bias

Yet AI isn’t flawless. Biased or low-quality sources can introduce misinformation. This is why transparency in data sourcing is crucial for building public trust.

Why transparency in AI fact-sourcing matters

As AI becomes embedded in education, healthcare, and finance, users demand to know where facts come from. Trust in AI hinges on openness and accountability.

Meta’s New Smart Glasses: Hypernova on the Horizon

Features and affordability of Hypernova glasses

Meta is preparing to launch its latest wearable tech: Hypernova smart glasses. Unlike earlier prototypes, these feature a discreet display in the lower right-hand corner, allowing users to check apps, notifications, or even photos without breaking eye contact.

Strategic importance of pricing in consumer adoption

What makes Hypernova stand out is its price tag of $800, significantly lower than the initially rumored $1,400. By cutting costs nearly in half, Meta is positioning these glasses as a mass-market product perfectly timed for the holiday shopping season.

Market implications if Meta dominates smart eyewear

If Hypernova gains traction, it could redefine consumer tech the way smartphones did. With Meta’s market cap nearing $2 trillion, success here would not only solidify its hardware dominance but also accelerate the integration of AR into daily life.

Gold’s Meteoric Rise? Goldman Forecasts $4,000/oz by 2026

Why gold demand is increasing globally

Gold has long been a safe haven for investors, and Goldman Sachs’ prediction of $4,000 per ounce by 2026 highlights intensifying demand. Economic uncertainty, inflation concerns, and geopolitical instability are pushing more people toward tangible assets.

Safe-haven assets during uncertain economies

With fiat currencies under pressure, gold represents stability. Central banks, particularly in Asia, have ramped up gold reserves, signaling a broader shift toward asset-backed security in global markets.

How investors are preparing for Goldman’s prediction

If gold truly doubles in value, the impact will ripple across investment strategies, from retirement funds to sovereign wealth portfolios. Many analysts suggest diversifying now, before prices surge further.

GoodRx’s GLP-1 Breakthrough: $499/Month Access

Why GLP-1 drugs matter for diabetes and obesity care

Drugs like Ozempic and Wegovy GLP-1 therapies have transformed care for diabetes and weight management. Their effectiveness has created enormous demand, but affordability remains a challenge.

GoodRx’s pricing strategy and telehealth expansion

GoodRx’s new offering $499/month flat pricing aims to make these therapies more accessible. By partnering with telehealth services, the company is streamlining prescriptions, consultations, and delivery.

The future of digital healthcare affordability

This move signals a larger shift: healthcare is increasingly digitized, transparent, and consumer-driven. As more patients access cutting-edge drugs online, we may see a revolution in affordability and health outcomes.

Florida Legalizes Gold and Silver Coins A Return to Hard Money?

What the new Florida law entails

Florida has become the first U.S. state to legalize gold and silver coins as currency. Residents can now use these precious metals to pay debts and conduct transactions alongside traditional cash.

Implications for fiat currency vs. precious metals

This law rekindles debate over the stability of fiat currency. Supporters argue that tangible assets like gold and silver provide security against inflation and central banking policies, while critics see it as impractical in a digital-first economy.

Could other US states follow Florida’s lead?

If successful, Florida’s experiment may inspire other states to adopt “hard money” policies, potentially reshaping America’s relationship with currency and federal monetary authority.

FAQs

1. What is the EU Chat Control law and why is it controversial?

It’s a proposed EU regulation to scan private digital messages for child abuse material. Critics fear it undermines privacy and weakens encryption.

2. Why did Tupperware struggle despite being a household name?

Its products were too durable, reducing repeat sales. Combined with poor adaptation to e-commerce, this led to financial decline.

3. How does Iceland’s £1 anti-shoplifting scheme work?

Shoppers reporting theft receive £1, incentivizing community involvement in reducing retail losses.

4. Why is Meta spending billions on AI talent?

AI is the future of tech. Meta’s $1.25 billion offer reflects its ambition to dominate AI-driven products and services.

5. How reliable are AI facts?

AI pulls from vast sources, but misinformation and bias remain issues. Transparency in data sourcing is critical for public trust.

6. Why is Florida legalizing gold and silver as money?

The move reflects growing skepticism of fiat currency and a return to tangible, stable assets for financial transactions.

Wrap Up: What These 9 Global Shifts Mean for the Future

From AI breakthroughs and wearable tech to currency revolutions and privacy debates, these nine developments highlight how rapidly our world is changing. They show us the tension between innovation and tradition, freedom and security, digital and physical assets.

As we move through 2025, one thing is clear: success whether for governments, businesses, or individuals will depend on the ability to adapt, innovate, and stay informed.

0 responses to “9 Shocking Global Shifts in Tech, Finance & Policy You Need to Know!”