Your basket is currently empty!

The world of 2025 is moving at a dizzying pace. Industries are being disrupted overnight, fortunes are being made and lost, and policies from regulators and corporations are shaping the way markets operate. If you are a builder, investor, or simply someone curious about how these shifts affect everyday life, you need a guide that brings clarity to the chaos. This is that guide. You’ll see the Global Business & Tech Shifts 2025 through a practical lens, with a breakdown of what happened, why it matters, and how to act.

1. The $91M Bitcoin Scam That Exposed the Dark Side of Crypto in 2025

One of the most dramatic heists of the year involved a victim losing 783 Bitcoin, worth over $91 million, in a single transaction. This wasn’t the result of complex code-breaking or blockchain flaws, but rather a highly polished social engineering scam. Attackers pretended to be customer support agents from a crypto exchange and hardware wallet provider. They pressured the victim with urgency, convincing them to authorize a massive “temporary transfer” to a so-called safe account.

The reality is that most crypto thefts do not begin with hacking at all; they begin with psychology. Scammers exploit trust, imitate official branding, and create panic through urgency. Once funds are transferred, they are laundered through mixers like Wasabi Wallet, leaving victims with no recourse because blockchain transactions are irreversible.

So how do you protect yourself? The best defense is to establish a strict verification ritual. Only trust communication that you initiate yourself, through official apps or websites. Use out-of-band confirmation methods if contacted, such as starting a fresh ticket rather than clicking a link. Lock your wallet by whitelisting trusted addresses, setting spending caps, and using two approvals from different devices for large transfers. Hardware wallets, passkeys, and kill-switch plans for sweeping funds in emergencies are no longer optional but essential.

2. From Stoner Legends to CEOs: How Cheech & Chong Built a $100M Cannabis Empire

Cheech & Chong have moved far beyond the realm of stoner comedy into the world of serious business. Their cannabis empire, valued at more than $100 million, proves how cultural icons can translate credibility into commercial success. They did not just lend their faces to a product line; they built an ecosystem of cannabis-infused edibles and beverages that aligned perfectly with their brand identity.

The economics of their business reveal why it works. Edibles and beverages offer strong profit margins and predictable dosing, making them ideal for both consumers and producers. Retail strategy blends owned dispensaries with wholesale distribution, ensuring visibility on shelves. Compliance, a major obstacle for many cannabis startups, has been turned into an asset for Cheech & Chong’s business. Their rigorous testing, labeling, and retail procedures have reassured both regulators and customers.

Their next growth stage lies in licensing, category expansions like CBD wellness products, and partnerships with chefs and beverage brands. The takeaway is clear: celebrity-backed brands do not succeed on hype alone. They succeed when authenticity, compliance, and disciplined operations align.

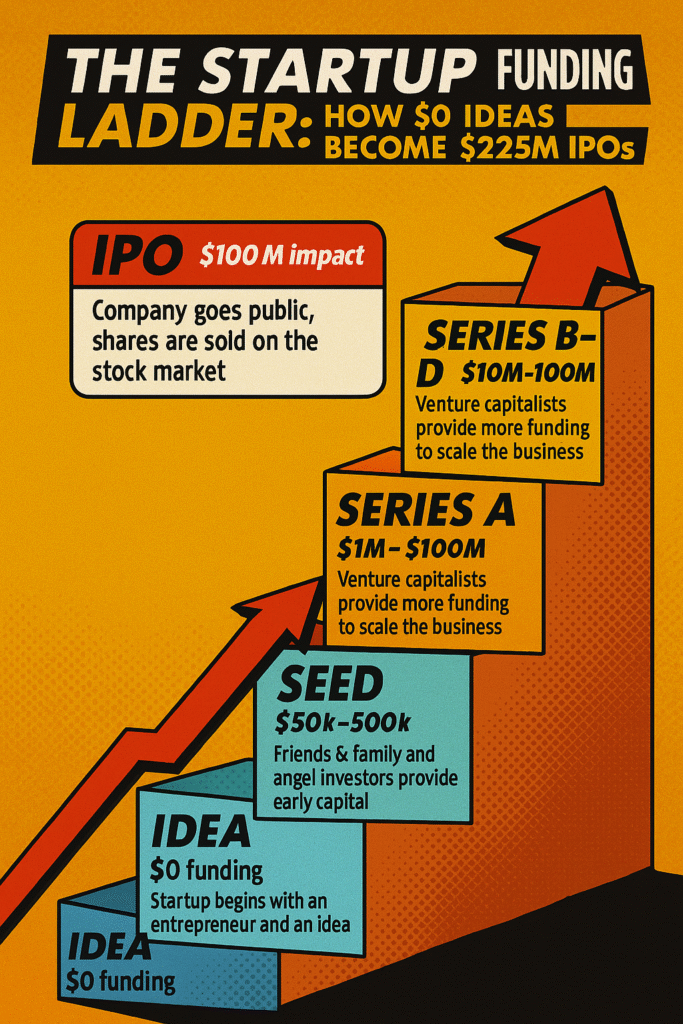

3. The Startup Funding Ladder: How $0 Ideas Become $225M IPOs

Every billion-dollar company begins the same way, with an idea and a founder’s determination. At the earliest stage, entrepreneurs often self-fund with whatever savings they can muster. Friends and family may contribute anywhere between $15,000 and $200,000, which helps create a minimum viable product.

If the product shows promise, the company moves into the seed round, often raising half a million to a few million dollars. At this point, traction is measured through engagement, retention, and customer enthusiasm. A Series A, usually between $5 and $20 million, allows for scalable growth once product–market fit has been established. Later-stage funding fuels expansion, and if the company maintains efficient economics, it may ultimately debut on public markets, raising hundreds of millions at IPO.

The metrics investors look at can be summarized by four key concepts: product–market fit, CAC-to-LTV ratio, burn multiple, and the Rule of 40. Retention is the clearest signal of product–market fit. A healthy ratio between customer acquisition costs and lifetime value ensures growth is sustainable. Burn multiple tells investors how much new revenue is being generated per dollar burned, while the Rule of 40 blends profitability and growth into a single sanity check.

Fundraising is about process discipline. Successful founders prepare concise one-pagers, decks, and data rooms while focusing on retention rather than vanity metrics. Many fail because they overvalue high valuations, underestimate the importance of clean legal structures, or scale hiring too quickly after raising money.

4. Google’s War on Crypto: Why Unlicensed Wallets Are Being Wiped Out

Google has decided that any crypto wallet operating without a banking license will be banned from its platforms. This decision marks a shift in the balance of power, with platforms acting as de facto regulators for the digital economy.

The winners in this crackdown will be large custodial services and non-custodial wallets that already follow strict security and compliance protocols. The losers will be small developers who cannot afford compliance teams, audits, and regulatory filings.

For crypto founders, survival means hiring legal counsel, publishing risk disclosures, conducting security audits, and limiting data collection to the bare minimum. Wallet apps that integrate user protections like spending caps, whitelists, and region-specific compliance flows will be the ones left standing. For investors, the message is clear: consolidation is coming, CAC will rise, and infrastructure firms with regulatory approval will command premium valuations.

5. How the World’s Richest Added $33 Billion in a Single Day

One speech from Jerome Powell was all it took for billionaires to get richer by a combined $33 billion. The U.S. Federal Reserve Chair hinted at possible interest rate cuts during his Jackson Hole speech, sparking a rally in growth stocks.

The mechanics are simple. When central banks signal lower rates, discounted cash-flow models reprice growth assets, boosting the valuations of tech and consumer companies. Billionaires, whose wealth is heavily concentrated in equity, see their net worth jump instantly. Mark Zuckerberg gained $3.6 billion, Jeff Bezos gained $4.4 billion, and others in the billionaire class enjoyed similar windfalls.

For everyday investors, chasing these spikes is rarely a winning strategy. Instead, the focus should be on disciplined portfolio management. Maintain target allocations, rebalance periodically, and use safe-haven assets as buffers. If you choose to take macro-driven positions, set explicit loss limits and time boundaries. Wealth concentration is accelerating, and the Global Business & Tech Shifts 2025 make clear how quickly policy decisions ripple through to the ultra-rich.

6. The Cheese King: The Billionaire Who Controls Every Slice of Pizza You Eat

James Leprino, founder of Leprino Foods, quietly controls the cheese supply for the world’s biggest pizza chains: Domino’s, Pizza Hut, Papa John’s, and Little Caesars. His company produces over a billion pounds of cheese annually, making him one of the most powerful figures in the global food industry.

Leprino’s power lies in the supply chain. Pizza chains calibrate their ovens and recipes to the specific melt and stretch profiles of his cheese, which makes switching suppliers costly. Long-term contracts provide predictable demand, allowing Leprino Foods to invest in scale and logistics. Even seemingly small improvements in texture or moisture at the factory level translate into millions saved across the industry.

For operators in other industries, the lesson is clear. You don’t always need to own the brand to own the market. By becoming the invisible standard that everyone else builds around, you can dominate without ever being on the billboard.

7. AI Superagents Are Here: Will DeepSky Change the Way Investors Work Forever?

DeepSky’s new AI superagent is changing how investors do research. Unlike traditional platforms, this system doesn’t just aggregate data; it interprets it. By connecting with premium feeds like FactSet, Crunchbase, and SEC filings, it can deliver real-time diligence, competitor analysis, and sentiment tracking in minutes.

Use cases include rapid due diligence for new investments, automated benchmarking against peer groups, transcript analysis across multiple earnings calls, and live alerts for insider trades or material announcements. What once took an analyst days can now be done in hours.

The risk lies in automation bias. Humans must remain in the loop to challenge assumptions, validate sources, and double-check scenario ranges. The best way to integrate AI superagents is to start small, automate one workflow, and measure the savings in time and insight quality.

8. Kanye’s $YZY Coin Collapse: How Traders Lost Millions in Hours

Kanye West’s $YZY token is a reminder that not every celebrity-backed project is built to last. Within 12 hours of its launch, insiders dumped massive holdings, leaving retail traders holding the bag. Millions were lost almost instantly.

51,0000 People lost $74 Million while Only 11 made $1 Million!

The cycle is predictable. Hype creates liquidity, liquidity drives a price spike, and insiders use the moment to exit. Once the dump occurs, new buyers are left with worthless tokens.

The red flags are visible. Unclear tokenomics, centralized liquidity control, and influencer-driven marketing campaigns without disclosures almost always spell disaster. Retail traders would do better to support creator economies through transparent revenue shares, audited contracts, and regulated platforms.

9. Rivals Join Forces: Why Mercedes-Benz Will Run on BMW Engines by 2027

Mercedes-Benz and BMW are supposed rivals, but in 2027 Mercedes will begin using BMW’s B48 2.0L turbo engine in certain vehicles. The reason is practical. BMW’s modular internal combustion engines are already emissions-compliant, reliable, and cost-effective. By sharing components, both companies can free up capital for electric vehicle development.

This type of coopetition is not new. Automakers have shared transmissions, platforms, and even factories before. What makes 2025 different is that regulatory pressures, supply constraints, and the rapid EV transition are pushing these collaborations into the spotlight.

Expect more cross-licensing agreements in software, ADAS systems, and batteries in the years ahead. For consumers, it may mean better reliability and pricing, even if purists lament the loss of unique drivetrains.

10. Tesla’s Pi Phone vs. iPhone: The Tech Earthquake No One Saw Coming

Tesla is rumored to be developing a Pi Phone that could shake up the smartphone industry. With features like satellite internet and solar charging, the Pi Phone could be the first serious challenger to Apple in years.

Tesla already has distribution advantages. Millions of Tesla car owners and the company’s global Supercharger network could act as retail touchpoints. The phone would integrate vertically with Tesla’s ecosystem, controlling vehicles, energy products, and even financial services.

The obstacles are significant. Apple and Google have deep moats in operating systems, security, and app ecosystems. Tesla would need to overcome regulatory hurdles for satellite bandwidth, build an entirely new app ecosystem, and prove the reliability of solar charging.

If Tesla succeeds, the Pi Phone could begin as a niche pro tool for off-grid workers and adventurers before evolving into a mainstream disruption. If it fails, it may still push Apple and Google to innovate faster, changing the smartphone market indirectly.

FAQs

What’s the single best defense against crypto scams?

Always initiate communication yourself and never rely on links sent by others. Combine that with whitelisting trusted addresses and requiring two approvals for large transactions.

Are celebrity tokens always scams?

Not always, but many lack transparency and governance. Look for audited contracts, vesting schedules, and multisignature wallets before investing.

What metric best proves product–market fit?

Retention is the strongest proof. If customers come back without paid incentives and usage deepens over time, the product is on track.

How can small crypto apps survive Google’s crackdown?

Operate as non-custodial wallets, minimize data collection, publish transparent disclosures, and undergo security audits.

Why did billionaires gain $33 billion from Powell’s speech?

Their wealth is concentrated in high-growth equities, which respond dramatically to interest rate signals.

What lesson does the pizza cheese empire teach?

Owning the supply chain, even in an unglamorous product category, can create more power than being a household brand.

Will AI superagents replace analysts?

They will replace tasks, not judgment. Analysts will still be needed to challenge assumptions and approve critical insights.

Is the Tesla Pi Phone confirmed?

Not officially. Treat it as a scenario worth monitoring rather than a certainty.

Key Takeaways

The Global Business & Tech Shifts 2025 teach us that the biggest risks are often human, not technical, as shown in crypto scams. Authenticity, combined with compliance, turns cultural credibility into thriving businesses, as Cheech & Chong have proven. For startups, metrics and discipline matter more than hype, while Google’s crackdown reminds us that platforms are increasingly acting as regulators. Billionaire wealth will continue to concentrate with every macro signal, and hidden supply chains can quietly control entire industries.

AI superagents are reshaping workflows, but human oversight remains essential. Celebrity coins are mostly traps, while auto rivals are finding strength in cooperation. Finally, Tesla’s Pi Phone, whether it succeeds or not, signals that disruption is alive and well.

The future belongs to those who adapt fastest to these shifts, whether you are an entrepreneur, investor, or simply a consumer trying to stay ahead.

0 responses to “10 Unmissable Global Business & Tech Shifts This Week!”